Bitcoin, XRP and Solana slump with US stock sell-off, Lummis eyes 1 million BTC purchase

- Bitcoin, XRP and Solana declined on Wednesday amidst US stock sell-off.

- Senator Cynthia Lummis reintroduced the BITCOIN Act in Congress and proposed a 1 million BTC purchase in five years.

- Trump’s executive orders, SEC’s pro-crypto moves, and Lummis’ proposal fail to catalyze recovery in the crypto market.

Bitcoin (BTC), XRP and Solana (SOL) prices struggle on Wednesday. The three tokens rank in the top 5 cryptocurrencies by market capitalization, and the risk-off sentiment in the crypto market has ushered in a cooling-off period.

Three strikes and a decline

Bitcoin attempted to close above the $100,000 milestone thrice in the first week of February. The largest cryptocurrency by market capitalization opened above that level each day and failed to close, slipping lower.

Now, more than thirty days have passed since Bitcoin traded above the $100,000 milestone.

BTC/USDT daily price chart

Key market movers like the United States (US) President Donald Trump’s executive orders, plan for a Strategic Crypto Reserve, and Senator Cynthia Lummis’ proposal for the US to buy 1 million BTC tokens over five years have failed to catalyze a recovery in the cryptocurrencies sector.

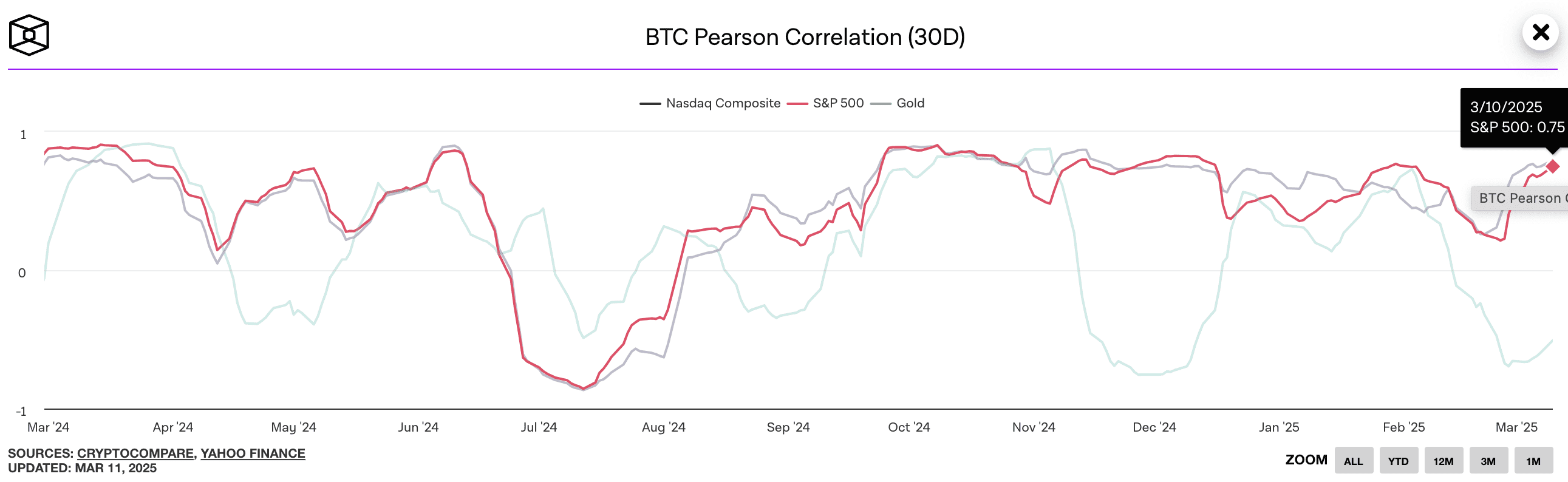

The 30-day Bitcoin Pearson Correlation chart on TheBlock analyzes the linear relationship between two variables, BTC and the S&P 500 in this case, to identify the strength and direction of the correlation. The value ranges between -1 and +1.

The metric shows a 0.75 correlation between Bitcoin and the S&P 500 as of March 10, meaning the two are highly correlated, and BTC’s price trend likely mirrors US stock performance.

Bitcoin Pearson correlation (30-day) | Source: TheBlock

With the correction in the S&P 500 and Nasdaq Composite, in light of the correlation, crypto traders can expect choppiness in BTC price to persist. While Trump’s executive orders and policies roll out, crypto could face further correction this week.

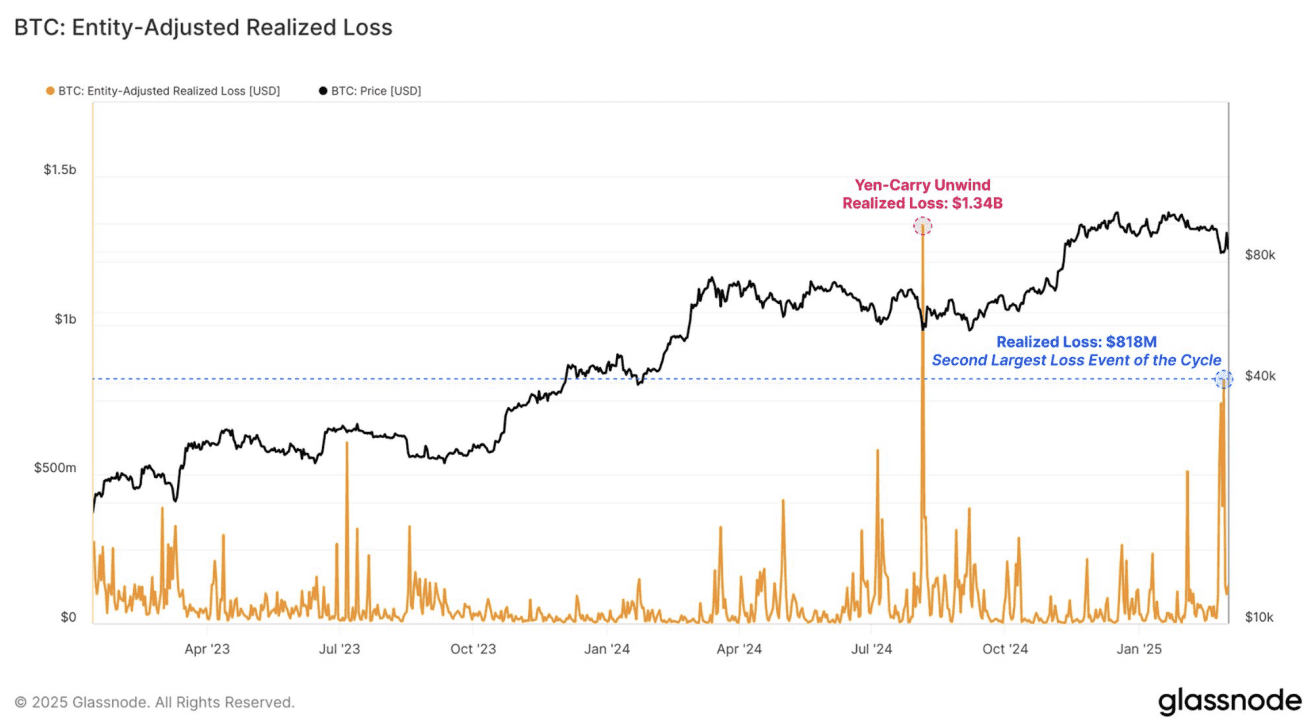

In its market report published on Monday, Bitfinex analysts note that Bitcoin price is facing a sell-off in response to recent macroeconomic events. A large portion of the recent sell-side pressure comes from BTC being sold at a loss, meaning traders are likely capitulating.

In the two weeks between February 28 and March 4, realized losses across all BTC traders surged to $818 million per day. This includes the two largest days for realized losses.

Capitulation phases are typically followed by a market stabilization. However, the macroeconomic headwinds and geopolitical uncertainties mean the market remains “highly reactive,” and traders need to monitor buy-side absorption and ETF flows before making trade decisions in the coming weeks.

Bitcoin entity-adjusted realized loss | Source: Glassnode, Bitfinex Alpha Report

Buy 1 million Bitcoin in 5 years: Senator Cynthia Lummis’ BITCOIN Act

US Senator Cynthia Lummis has reintroduced the “BITCOIN Act” in Congress. The Act proposes the purchase of up to 1 million BTC tokens over the next five years and calls for a holding period of at least 20 years.

Lummis aims to establish a Strategic Bitcoin Reserve, similar to President Trump’s call for a Strategic Crypto Reserve, echoing the intentions of crypto market participants in the US.

Bitcoin, XRP and Solana slip on Wednesday, traders remain fearful

The Crypto Fear & Greed Index reads 34 on a scale of 0 to 100, meaning traders remain fearful even with positive announcements in crypto from the Trump administration. Bitcoin slips 1.78%, trading at $81,450 at the time of writing on Wednesday. BTC has wiped out 6.67% of its value in the last seven days.

XRP trades at $2.1488, down 1.07% on the day, while Solana exchanges hands at $121.68, erasing nearly 3% of its value on Wednesday.

A similar period in Bitcoin was observed in 2017 – Expert commentary

Fakhul Miah, Director of GoMining Institutional, told FXStreet in an exclusive interview:

"Bitcoin’s recent drop below $80,000 for the second time this year reflects escalating market volatility, reinforcing its status as a high-risk asset.

Over $130 billion in market value has been erased, indicating a phase of negative capitulation where traders are offloading positions under mounting pressure from deteriorating sentiment. This volatility stems not only from internal crypto market weaknesses but also from broader macroeconomic headwinds, including persistent inflation and monetary tightening.

A similar period of liquidity strain tied to a stronger dollar was observed in 2017 during Trump’s presidency. However, the current environment presents additional complexities. Elevated consumer price index (CPI) readings have maintained the Federal Reserve’s hawkish stance, keeping borrowing costs high and reducing liquidity in the market. This dynamic continues to weigh on speculative assets like Bitcoin, which are highly sensitive to shifts in monetary policy.”