Shiba Inu Price Prediction: SHIB hits seven-month low as Ethereum TVL drops $14B after Pectra upgrade

- Shiba Inu price hit $0.00001 on Tuesday, trading at its lowest since August 2024.

- Since the Pectra upgrade testnet launch on March 5, Ethereum total value locked has witnessed $14 billion in outflows.

- Technical indicators on the SHIBUSDT 12-hour chart are shaping up for more downsizing.

Shiba Inu (SHIB) price hit $0.00001 on Tuesday, testing seven-month lows before rebounding 6%. On-chain data shows investors withdrawing funds from the Ethereum ecosystem after the Pectra upgrade could spark further losses.

Shiba Inu (SHIB) price test seven-month lows as memecoin traders panic

Shiba Inu prices plunged to record lows on Tuesday as memecoin traders intensified sell-offs under multiple bearish catalysts.

The first post-US Nonarm Payrolls (NFP) sell-off on Friday set the ball rolling for a bearish weekend.

However, after more tariff spats between the US and Canada on Monday, cascading liquidations sent SHIB prices spiraling to new lows as investors moved to shift funds out of high-risk and low-liquidity meme tokens.

Shiba Inu Price Action, March 11

SHIB price had plunged 28.88% in the last four days, trading as low as $0.000010 on Tuesday before bulls battled back to reclaim territory around $0.000012 at press time. However, the low volumes accompanying the recovery suggest weak conviction.

Ethereum TVL withdrawals signal weakened ecosystem activity since Pectra upgrade

In addition to bearish macro pressure from US trade policy tweaks, SHIB’s weak performance in the past week has coincided with investors pulling funds out of the Ethereum ecosystem.

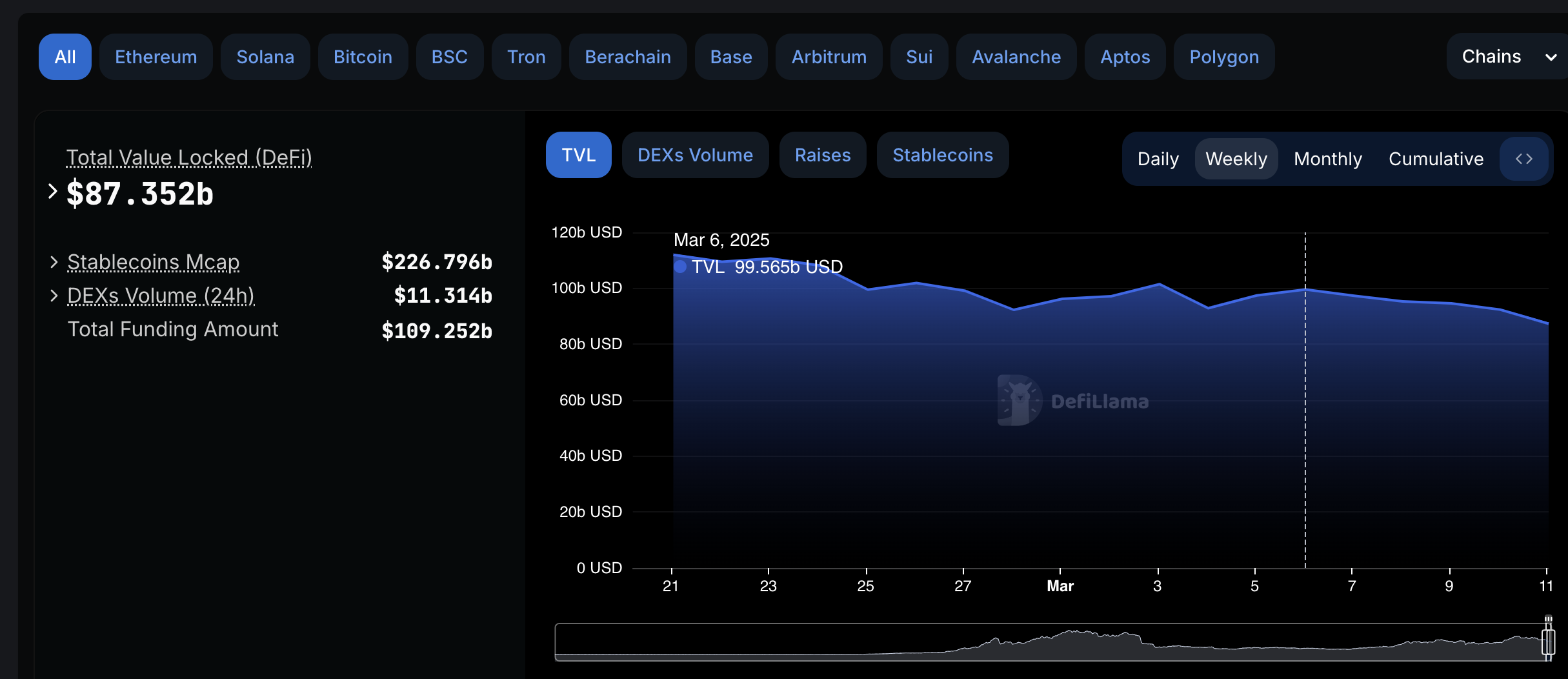

DeFiLlama’s Total Value Locked (TVL) tracks the value of capital invested within a blockchain ecosystem and serves as a key indicator of investor sentiment.

Since the Pectra upgrade testnet launch on March 5, Ethereum’s TVL has suffered $14 billion in outflows, declining from $101 billion to $87 billion as of Tuesday.

This coincided with a 17% decline in Shiba Inu’s price within the same period.

Ethereum Total Value Locked (TVL) | DeFiLlama

Ethereum Total Value Locked (TVL) | DeFiLlama

The downturn suggests that the highly anticipated Pectra upgrade has so far failed to attract new liquidity into the Ethereum ecosystem.

While the upgrade was expected to improve efficiency and scalability, investor sentiment has leaned bearish, reflecting concerns about implementation delays and broader crypto market headwinds.

Adding to the uncertainty, growing doubts over Donald Trump’s ability to secure congressional approval for his crypto strategic reserve proposal have likely dampened investor confidence.

Trump’s proposal had previously fueled speculative optimism for Ethereum-based assets like SHIB, but legislative hurdles now present additional downside risks.

If Ethereum’s TVL outflows persist, SHIB price could face further declines. A sustained drop in ecosystem-wide liquidity often leads to lower on-chain activity, shrinking trading volumes, and weaker price support for Ethereum-hosted assets such as Shiba Inu.

Shiba Inu Price Forecast: Bears could target $0.00001 breakdown

Despite mild intra-day recovery on Tuesday, Shiba Inu price remains under pressure. The 12-hour chart shows SHIB trading at $0.00001188 after briefly touching a seven-month low of $0.00001000. Bollinger Bands are widening, with price action hovering near the lower band, indicating heightened volatility and persistent selling pressure.

The Volume-Weighted Average Price (VWAP) at $0.00001156 signals that bulls are struggling to reclaim lost ground, reinforcing the dominance of bearish momentum.

-638773230900970529.png)

Shiba Inu Price Forecast

BM-X indicator reflects weakening bullish strength, with green peaks losing momentum while red zones dominate, signaling that market sentiment remains fragile.

A breakdown below $0.00001124, the lower Bollinger Band support, could expose SHIB to another retest of the critical $0.00001000 floor.

If bearish pressure accelerates, cascading liquidations from overleveraged positions may drive the price lower, with $0.00000950 emerging as the next significant support.

On the upside, SHIB needs a decisive close above $0.00001297, the upper Bollinger Band resistance, to regain bullish footing.

A successful breakout past this level could open the door to a short-term recovery toward $0.00001470. Until then, the risk of further downside persists, with traders closely watching liquidity levels and leverage unwinding in the broader market.