Bitcoin Tumbles as Trump’s Remarks Stoke US Recession Fears

Bitcoin (BTC) and the broader crypto market are facing mounting pressure as recession fears escalate following comments from US President Donald Trump.

His recent remarks on Fox News about the possibility of an economic downturn have rattled investors, triggering a sharp sell-off across risk assets, including Bitcoin.

Bitcoin Drops As Recession Fears Trigger Panic Selling

In a March 10 interview, Fox News asked President Trump about the likelihood of a recession. While he avoided making a definitive prediction, Trump acknowledged that “disruption” was inevitable as the country rebuilds its economic foundation.

Trump Does Not Rule Out A Recession in 2025His comments signaled a shift in sentiment, suggesting that the US economy could face short-term challenges before achieving long-term stability.

Trump’s stance appeared to suggest a willingness to weather a recession if it meant implementing necessary economic reforms.

“So, why did the decline accelerate today? We think markets are reacting to President Trump’s willingness to weather an economic downturn to “fix” issues the US faces,” The Kobeissi Letter observed.

While potentially beneficial in the long run, this perspective has heightened near-term anxieties, especially among Wall Street investors and cryptocurrency traders.

BTC Price Performance. Source: BeInCrypto

BTC Price Performance. Source: BeInCrypto

In the immediate aftermath, Bitcoin prices dropped below the psychological level of $80,000. As of this writing, BTC was trading for $79,856, down by almost 3% since Tuesday’s session opened.

Notably, Trump’s allusion aligns with recent remarks from the Federal Reserve, which warned about the possibility of a recession, further intensifying market jitters. The Fed’s cautious tone has fueled bearish sentiment across cryptocurrencies.

A potential economic slowdown could lead to lower interest rates to stimulate growth. However, investors appear to be preparing for more pain ahead in the short term.

Bitcoin and Stocks’ Correlation with Economic Anxiety

Like Bitcoin, the traditional financial markets responded swiftly. The S&P 500 has lost $5 trillion in market value over 13 trading days. Meanwhile, crypto markets have shed approximately $1.3 trillion since peaking in December 2024.

Bitcoin, widely regarded as a barometer for risk appetite, has fallen by 35% in just three months.

This, combined with lingering inflationary concerns and uncertainty over Federal Reserve policy, has fueled a risk-off sentiment among investors. The downturn in Bitcoin aligns with a broader shift in investment strategies. Institutional investors have been pulling out of high-risk assets, reducing their exposure to tech stocks at the fastest pace since July 2024.

The so-called “Magnificent Seven” stocks, which include major tech giants, have seen their lowest exposure levels since April 2023. Tesla, a stock historically associated with high-risk trades, experienced its seventh-largest single-day drop, falling 15.4%. This decline mirrors how investor confidence in speculative assets has diminished due to growing recession fears.

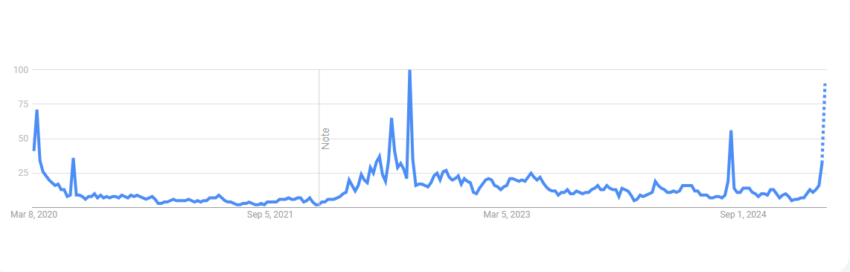

Meanwhile, Bitcoin’s price movements have often been closely tied to macroeconomic uncertainty. Google Trends data shows that searches for “US recession” have reached their highest levels since August 2024—historically a signal of impending market volatility. Similar spikes in searches in mid-2022 and late 2024 coincided with sharp Bitcoin price declines.

US Recession Fears Searches. Source: Google Trends

US Recession Fears Searches. Source: Google Trends

Adding to concerns, prediction markets like Kalshi have increased the probability of a US recession to 40%. These markets, which aggregate real-time investor sentiment, are often seen as more accurate than traditional economic models in forecasting downturns.

“The prediction markets can often be more accurate than traditional economic models, reflecting real-time sentiments and information from traders,” startup investor Rushabh Shah commented.

While some analysts believe a recession could lead to looser monetary policy, which might boost Bitcoin, the immediate outlook remains uncertain. For now, traders and investors should brace for continued volatility.