Dogecoin Price Could Shoot Up To $2.74 – Here’s The Support Level To Watch

After what seemed like a resurgence at the start of the week, the Dogecoin price has again dropped beneath the psychological $0.2 level. This has pretty much been the theme for DOGE so far in 2025, with the meme coin struggling to capitalize on any bit of momentum.

Fortunately, the future appears to not be all doom and gloom for the Dogecoin price, as the altcoin approaches a critical support level. Below is the future trajectory of the DOGE price if this major level holds strong over the coming weeks.

Is A 1,450% Rally On The Cards For DOGE?

In a new post on the X platform, prominent crypto trader Ali Martinez shared fresh insights into the current setup of the Dogecoin price. According to Martinez, the meme coin seems to be at a juncture that could prove pivotal to its long-term health and trajectory.

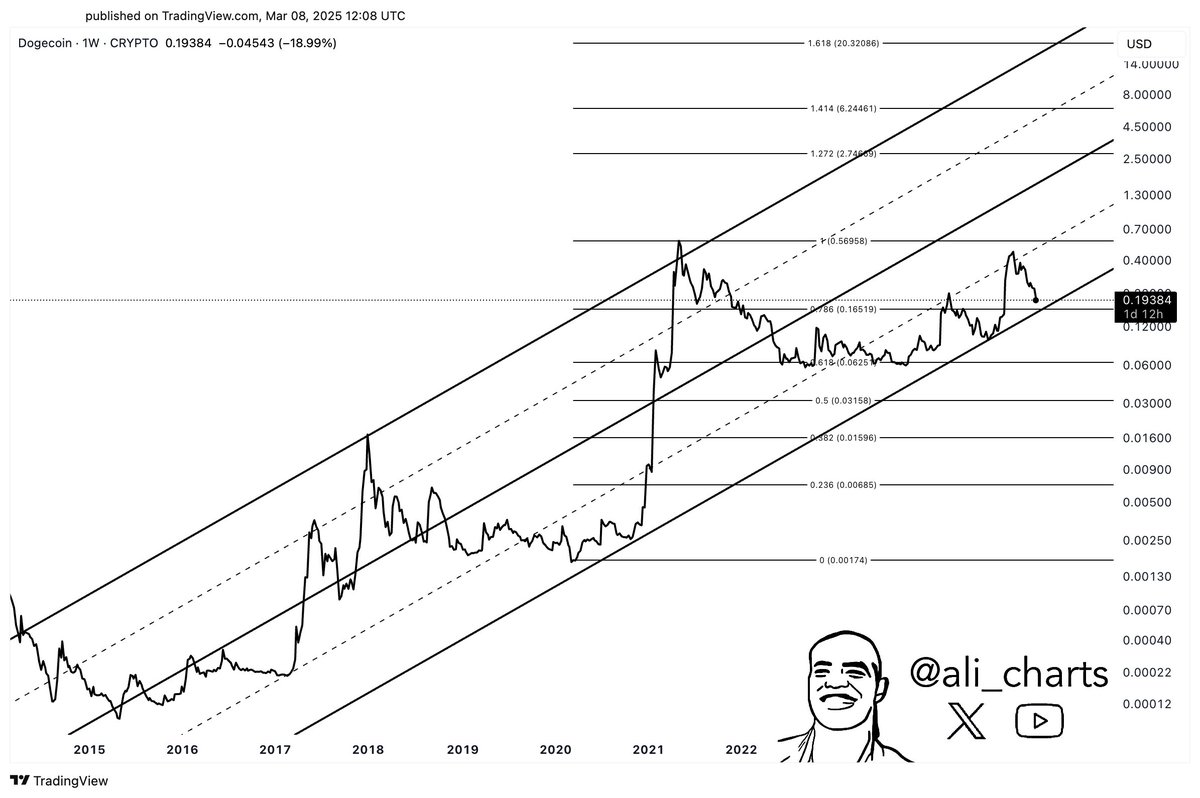

This analysis is based on the formation of an ascending channel pattern on the Dogecoin price chart on the weekly timeframe. An ascending channel is a technical analysis pattern marked by two primary (upward-sloping) trendlines; the upper channel line connecting the swing highs and the lower boundary line connecting the swing lows.

As shown in the chart above, the asset’s price usually persists within the channel; with the upper boundary line often considered a resistance zone and the lower channel line serving as a support cushion. Investors can trade as price swings between the pattern’s support and resistance levels or enter a position following a breakout or breakdown.

The ascending channel pattern suggests the persistence of an upward price trend. Nonetheless, a breakout or breakdown of this channel can be used to pinpoint a trend continuation or reversal, respectively. A break above the upper trendline typically indicates the continuation of an upward trend. On the flip side, when the price breaks down below the lower channel line, it signals a possible transition from an uptrend to a downtrend.

For this Dogecoin scenario, the price of DOGE has been in an ascending channel since 2015, bouncing back each time it reaches the lower boundary line. With the meme coin currently around this trendline, historical precedence suggests that the Dogecoin price might find support and rebound.

“If DOGE maintains support at the channel’s lower boundary at $0.17, it could trigger a strong rebound toward $2.74,” Martinez postulates. This potential move would represent an astounding 1,450% surge from the current price point. Contrarily, if this support level of around $0.17 is breached, investors could see the Dogecoin price fall to $0.06 Fibonacci level.

Dogecoin Price At A Glance

Dogecoin has struggled to hold above $0.2 after falling beneath the level at the end of February. As of this writing, the price of DOGE stands at about $0.195, reflecting an over 3% decline in the past 24 hours.