Bitcoin Weekly Forecast: Will Trump's Strategic Bitcoin Reserve and White House Crypto Summit support BTC recovery?

- Bitcoin price extends its decline on Friday, falling over 5% so far this week.

- BTC uncertainty and volatility spikes liquidated $1.67 billion as the first-ever White House Crypto Summit takes place on Friday.

- AI and Crypto Czar David Sacks announced President Trump signed an executive order on Thursday to establish a strategic Bitcoin reserve.

Bitcoin (BTC) remains under pressure and continues its decline, trading around $88,900 at the time of writing on Friday and falling over 5% this week. BTC uncertainty and volatility spikes liquidated $1.67 billion this week as the first-ever White House Crypto Summit takes place on Friday. AI and Crypto Czar David Sacks announced President Trump signed an executive order on Thursday to establish a strategic Bitcoin reserve.

Bitcoin volatility spikes liquidate $1.67 billion from the market

Bitcoin price soared nearly 10% on Sunday, reaching a high of $95,000 due to US President Donald Trump's surprising announcement of a US Crypto Strategic Reserve.

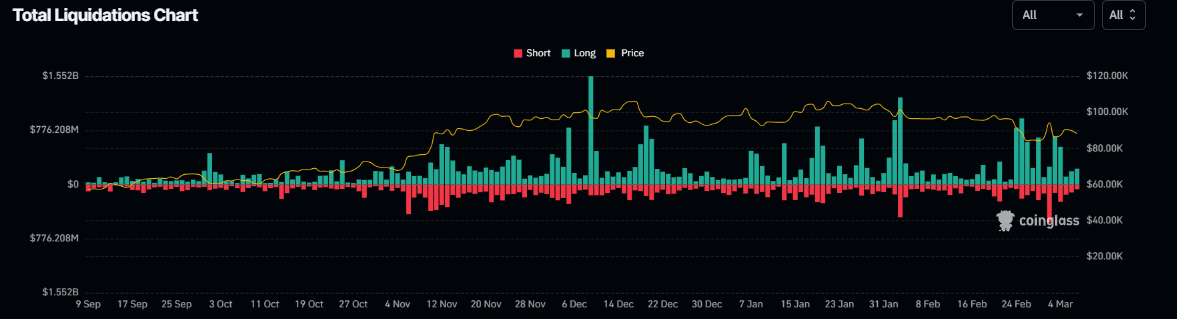

However, the brief crypto rally following Trump's announcement was swiftly erased as it became nothing more than a short-term "buy the rumor, sell the news" event. This market volatility triggered a wave of liquidation, wiping over $812.5 million on Monday and a total of $1.67 billion until Friday, according to Coinglass data.

Total Liquidation Chart. Source: Coinglass

Beyond the surprise announcement, global tensions and stock market volatility have added even more uncertainty this week. BTC hit a low of $81,500 on Tuesday before rebounding, closely mirroring geopolitical events, most notably Trump's heated Oval Office exchange with Ukrainian President Zelenskyy and the potential for new US tariffs.

QCP Capital's report this week states, "Adding to the uncertainty, the Atlanta Fed's GDP forecast turned negative at -2.8% just two days ago, fueling concerns over stagflation. Markets are now laser-focused on key economic data releases: The NFP report will be released this Friday, and the CPI release will be released next Wednesday. These will be crucial in shaping market direction and providing much-needed clarity on the macro outlook."

Bitcoin investors await the first-ever White House Crypto Summit

Apart from these volatility spikes, Bitcoin investors await the first-ever White House Crypto Summit, which will take place on Friday and will discuss regulation and innovation in the cryptocurrency sector.

This Summit indicates a significant milestone in US digital asset policy, highlighting the government's supportive crypto approach and commitment to establishing clear regulations, which President Trump promised during his campaign.

The event will unite key industry leaders — founders, CEOs, investors, and the US President's Working Group on Digital Assets — to explore how regulation and innovation can shape the cryptocurrency market's future.

The Summit will be chaired by White House AI and Crypto Czar David Sacks and administrated by Working Group's Executive Director Bo Hines. The Summit's goals remain unconfirmed, as do its potential impacts on the crypto market. With high speculation, traders should exercise caution, as such events often trigger volatility and potential liquidations.

As in the previous article, FXStreet interviewed some experts in the crypto markets regarding the upcoming Summit, which could be helpful for crypto investors.

In an exclusive interview, Ryan Lee, Chief Analyst at Bitget Research, told Fxstreet, “A successful summit could see Bitcoin reclaim $100K and crypto assets like ETH, XRP, and Solana soar, cementing U.S. leadership in global crypto markets. Conversely, a lack of actionable steps might disappoint investors, underscoring the high stakes of this event.”

Bitcoin's institutional weakness continues

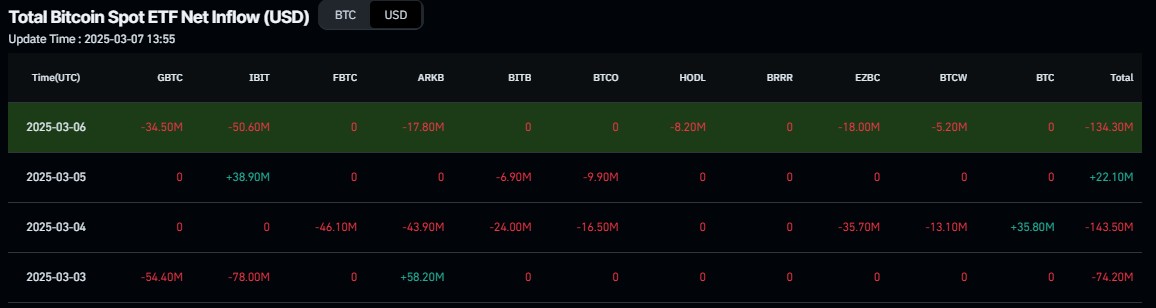

This week's falling institutional demand and rising selling pressure supported the 5% price drop in Bitcoin. According to Coinglass data, Bitcoin spot Exchange Traded Funds (ETFs) recorded net outflows of $329.90 million until Thursday, continuing its ongoing sell-off from over the past weeks. If the magnitude of the outflow continues and intensifies, the Bitcoin price could see further corrections.

Total Bitcoin Spot ETF net inflow chart. Source: Coinglass

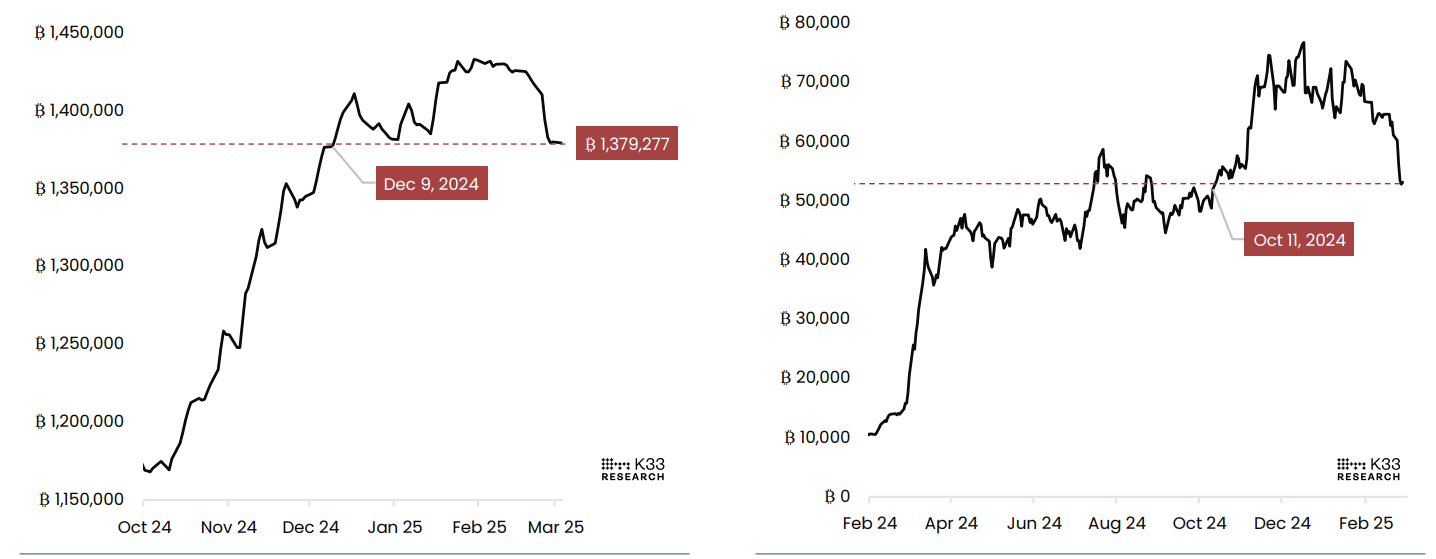

Additionally, a K33 Research 'Ahead of the curve' report explains that the Bitcoin Exchange Traded Products (ETPs) globally held an exposure of 1,379,277 BTC as of March 3, the lowest net exposure since December 9, 2024.

The report further explains that the entirety of the 2025 pre-Trump inauguration run-up has thus been sold off back into the market by BTC ETP holders. The most aggressive outflows were seen in February, and the current BITX exposure sits at lows that have not been seen since October 2024, following the considerable sell-off seen in BTC throughout the month.

Global BTC ETP Exposure (Left) and BITX, BTC Equivalent Exposure (Right) chart. Source: K33 Research

Trump signs executive order to create US Strategic Bitcoin Reserve

AI and Crypto Czar David Sacks confirmed on Thursday that President Trump signed an Executive Order to establish a Strategic Bitcoin Reserve. This announcement came through Sack's social media platform X.

Sacks explains that the Reserve will be capitalized with Bitcoin owned by the federal government, which was forfeited as part of criminal or civil asset forfeiture proceedings. 'This means it will not cost taxpayers a dime.' Moreover, the US government is estimated to own about 200,000 Bitcoins; however, there has never been a complete audit. The executive order directs a full accounting of the federal government's digital asset holdings.

"The US will not sell any bitcoin deposited into the Reserve. It will be kept as a store of value. The Reserve is like a digital Fort Knox for the cryptocurrency often called "digital gold," says Sacks in his X post.

He continued, "This Executive Order underscores President Trump's commitment to making the US the "crypto capital of the world."

In addition, the executive order establishes a “US Digital Asset Stockpile, consisting of digital assets other than bitcoin forfeited in criminal or civil proceedings. “

In an exclusive interview with FXStreet, Joe Burnett, Head of Market Research at Unchained, said, "The executive order makes clear; Bitcoin is no longer an outsider."

Burnett continued as the seventh most valuable asset on earth; it is now positioned alongside traditional reserves, signaling a shift in how governments and institutions approach financial security, inflation protection, and global liquidity.

"Institutions will deepen their exposure, and sovereign wealth strategies will evolve to account for Bitcoin's unique properties. As more nations take notice, some will follow, others will resist—but the trajectory is set," Burnett said.

BTC's technical outlook reflects a weakness in momentum indicator

Bitcoin price faced rejection around the $95,000 level on Sunday and declined 8.54% the next day. On Tuesday, BTC dipped below the daily support level at $85,000 but bounced and closed above it. This daily level roughly coincides with the 200-day Exponential Moving Average (EMA) at $85,843, making it a key support zone. At the time of writing on Friday, it trades down, finding support around the 200-day EMA at $85,843.

If BTC breaks below the 200-day EMA and closes below $85,000, it could extend the decline to retest its next support level at $73,000.

The Relative Strength Index (RSI) on the daily chart reads 44, pointing downwards after being rejected from its neutral level of 50 earlier this week, indicating bearish momentum. The Moving Average Convergence Divergence (MACD) indicator coils, suggesting indecisiveness among traders.

BTC/USDT daily chart

However, if the $85,000 level holds as support, BTC could extend the recovery to retest its Sunday high of $95,000.

Bitcoin, altcoins, stablecoins FAQs

Bitcoin is the largest cryptocurrency by market capitalization, a virtual currency designed to serve as money. This form of payment cannot be controlled by any one person, group, or entity, which eliminates the need for third-party participation during financial transactions.

Altcoins are any cryptocurrency apart from Bitcoin, but some also regard Ethereum as a non-altcoin because it is from these two cryptocurrencies that forking happens. If this is true, then Litecoin is the first altcoin, forked from the Bitcoin protocol and, therefore, an “improved” version of it.

Stablecoins are cryptocurrencies designed to have a stable price, with their value backed by a reserve of the asset it represents. To achieve this, the value of any one stablecoin is pegged to a commodity or financial instrument, such as the US Dollar (USD), with its supply regulated by an algorithm or demand. The main goal of stablecoins is to provide an on/off-ramp for investors willing to trade and invest in cryptocurrencies. Stablecoins also allow investors to store value since cryptocurrencies, in general, are subject to volatility.

Bitcoin dominance is the ratio of Bitcoin's market capitalization to the total market capitalization of all cryptocurrencies combined. It provides a clear picture of Bitcoin’s interest among investors. A high BTC dominance typically happens before and during a bull run, in which investors resort to investing in relatively stable and high market capitalization cryptocurrency like Bitcoin. A drop in BTC dominance usually means that investors are moving their capital and/or profits to altcoins in a quest for higher returns, which usually triggers an explosion of altcoin rallies.