President Trump’s announcements: Bullish one day, bearish the next. What to trade?

- Bitcoin, Ethereum and altcoins have observed major price swings in less than 50 days of Trump’s administration.

- James Toledano of Unity Wallet attributes 90% of crypto volatility to Trump’s announcements impacting trader sentiment.

- Cronos, Near and Aptos have shown resilience amid Bitcoin's flash crash and market-wide crypto corrections.

- CRO, NEAR and APT recently ended their multi-month downtrends this week.

United States (US) President Donald Trump’s announcements have influenced crypto prices in the past month and a half. From tariff announcements to developments in the Artificial Intelligence (AI) sector, Securities and Exchange Commission’s (SEC) meme coin guidance to lawsuits dropped against crypto firms, traders have reacted from headline to headline.

James Toledano, Chief Operating Officer at Unity Wallet, believes Trump’s announcements have emerged as a key factor influencing the sentiment-driven crypto market and token prices.

Amidst the Bitcoin flashcrashes and market-wide bloodbath, three tokens ended their multi-month downward trends and are gearing for recovery: Cronos (CRO), Near (NEAR) and Aptos (APT).

Crypto’s wild price swings and top market movers

When former SEC Chair Gary Gensler referred to crypto as the Wild Wild West, he may have had a mental image of unpredictable and frequent price swings, such as the ones we noted in the less than 50 days of the Trump administration.

Trump’s strategic crypto reserve announcement, key appointments to top administrative and regulatory offices and Trump-backed World Liberty Financial’s moves have kept traders on their toes for the forty-three days he has spent in office.

Bitcoin price has crashed under the $80,000 level a few times and market liquidation in the 24-hour timeframe has exceeded the $1 billion mark, leaving traders fearful as they digest the headline daily.

“Typically, I’d attribute such a wild ride to a mix of macroeconomic pressures, security concerns, and market-driven reactions. While those factors still play a role, the past two to three months have been overwhelmingly sentiment-driven. Geopolitical tensions, particularly the ongoing Russia-Ukraine conflict, are certainly contributing, but at this point, 90% or more of the volatility stems from President Trump and his unpredictable announcements—one day bullish, the next day bearish,” said Toledano to FXStreet.

The shifting policies of the Trump administration have proven a key driver fueling a risk-off sentiment among traders. With Bitcoin’s increasing correlation with US equities and tech stocks, there has been a decline in institutional interest as traders move away from risky assets to tackle the volatile market conditions.

The largest crypto hack, the $1.4 billion Bybit attack, further hit trader confidence and exacerbated the sell-off, explains Toledano.

The Unity Wallet COO says, “While a correction was warranted, the market’s reaction seems exaggerated—though it’s hard to blame investors for overreacting when policy decisions feel like knee-jerk responses.”

These three tokens offer buying opportunity to traders

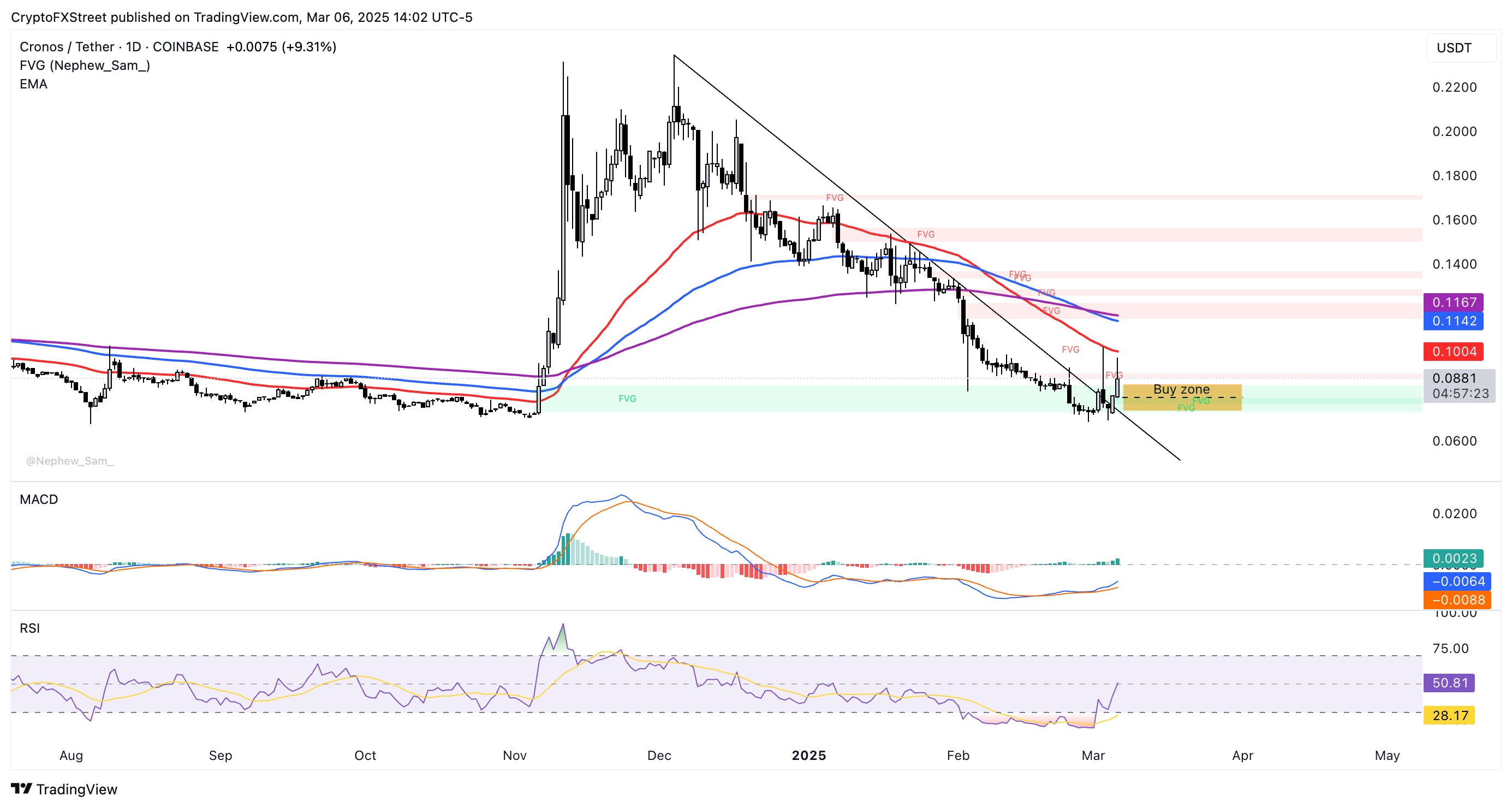

Cronos price added nearly 10% to its value on Thursday. The token traded within its buy zone early in the day, between $0.0731 and $0.0830, as seen on the daily price chart below. The two key momentum indicators, the Relative Strength Index (RSI) and Moving Average Convergence Divergence (MACD), support a bullish thesis for CRO.

RSI reads 50 and is sloping upwards, MACD is flashing green histogram bars above the neutral line. CRO could gain nearly 14% and test resistance at the 50-day Exponential Moving Average (EMA) at $0.1004.

CRO/USDT daily price chart

CRO could find support at $0.0793, within the buy zone on the daily timeframe, if there is a correction in the token’s price.

NEAR price attempted a break out of its downward trend early on Thursday as crypto traders brace for volatility on Friday with the upcoming White House Crypto Summit. NEAR is trading within the buying zone.

NEAR could test its closest resistance at $3.565, Monday’s high for the AI token. This would mark nearly 14% gains for the token. Both RSI and MACD support the narrative, and there is an underlying positive momentum in the NEAR price trend.

NEAR/USDT daily price chart

Aptos is in the buy zone, consolidating after a clean break from its multi-month downward trend. APT trades at $5.946 at the time of writing. For sidelined buyers, APT is between $5.040 and $6.038.

Technical indicators RSI and MACD indicate a positive underlying momentum in APT price trend, as seen in the daily price chart.

APT/USDT price chart

If there is a correction, APT could find support at $5.040, the lower boundary of the Fair Value Gap (FVG) on the daily price chart.