Donald Trump backed World Liberty Financial triples Ethereum holdings ahead White House Crypto Summit

- Donald Trump’s World Liberty Financial increased its Ethereum holdings nearly threefold on Thursday, buying the recent ETH price dip.

- Ethereum hovers around $2,200, up nearly 1.5% on Thursday.

- Ethereum could test resistance at $2,500 and rally nearly 10% if whale accumulation persists.

Crypto traders are closely watching Trump-backed World Liberty Financial’s wallet addresses ahead of the upcoming White House Crypto Summit on Friday. Data from on-chain intelligence tracker Arkham Intel shows that the wallet tracked by the tool increased its Ether holdings nearly threefold in the past 24 hours.

The firm has accumulated Ethereum through the dips in ETH price, fueling investor confidence in the altcoin. At the time of writing, ETH hovers around $2,200.

World Liberty Financial accumulates Ethereum, buys the dip

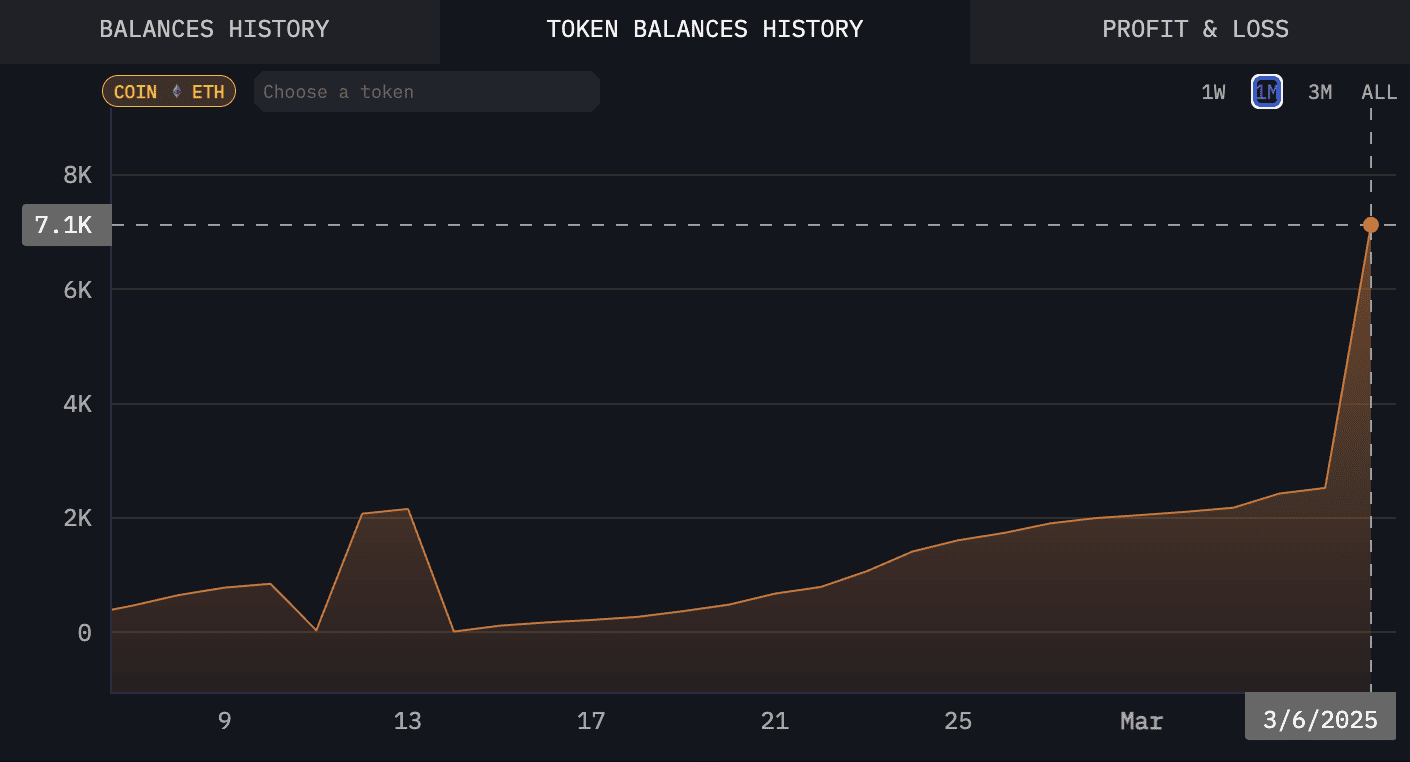

US President Donald Trump-backed World Liberty Financial (WLF) has consistently purchased cryptocurrency through recent declines in token prices and holds over $80 million in crypto, according to Arkham Intel’s wallet monitoring tool. The tool shows that WLF holds 7,100 Ethereum tokens on Thursday.

WLF’s Ethereum holdings climbed from 2,500 to 7,100 in the past 24 hours, as seen in the balances history chart on Arkham Intel. This marks a nearly three-fold increase in Ethereum holdings.

Typically, the accumulation of Ether by large wallet addresses is a positive sign as it suggests confidence in price gains in the medium to long term.

Token balances history | Source: Arkham Intel

Santiment’s data shows that 280,000 Ether tokens have been added to the holdings of whale wallets outside of exchanges between March 3 and the time of writing. Another key metric to watch is the supply of Ether held by top exchange wallets, which has declined by 90,000 tokens in the same period.

A drop in exchange supply and an increase in accumulation by non-exchange whale wallets supports a bullish thesis for Ether, which is in line with World Liberty Financial’s accumulation of Ethereum tokens.

[18.02.54, 06 Mar, 2025]-638768671069430660.png)

Ethereum supply held by exchange wallets and whales outside of exchanges | Source: Santiment

Ethereum gears for rally in light of crypto summit

Ethereum has been on a downward trend since its 2024 peak. The ETH/USDT daily price chart shows that Ether is currently hovering close to support at $2,221, the Tuesday peak for the altcoin.

The Relative Strength Index (RSI) key technical indicator reads 40 and slops upwards in the daily chart. Meanwhile, the Moving Average Convergence Divergence (MACD) momentum indicator flashes red histogram bars under the neutral line, meaning there is underlying negative momentum in ETH price trend. However, the bars are fading, signaling a reversal is likely.

Ethereum is trading below the 50, 100 and 200-day Exponential Moving Averages (EMAs).

The resistance at the $2,500 level is key for Ethereum’s recovery from the recent price crash. A 9.34% rally could push ETH to test this level. A daily candlestick close above this level could confirm a recovery in ETH in the short term.

ETH/USDT daily price chart

However, if Ethereum fails to sustain gains, the token could sweep liquidity at $2,221 before declining to the $2,000 psychological support.