Binance Net Inflow Notably Increased After the Bybit Hack

Binance saw $3.9 billion in net inflows in the week after the Bybit hack. Overall, in February, the exchange saw $5.323 billion in net inflows, showing strong demand and investor confidence during a period of market uncertainty.

Bybit was formerly the second-largest exchange by 24-hour trade volume, but it fell to eleventh place.

More Users are Shifting to Binance

The Bybit hack on February 21 was the largest theft in crypto history, and its fallout is reverberating in unexpected ways. The North Korean Lazarus Group perpetrated the attack, and the organization has already laundered all $1.5 billion in stolen funds.

Bybit sustained a serious loss, but Binance emerged as an unexpected winner as the dust cleared.

According to trading data, the firm saw over $3.9 billion in inflows in the week after the Bybit hack, while the latter exchange saw huge outflows. Before the attack, Binance was already the world’s largest crypto exchange in terms of 24-hour trading volume, but Bybit was a close second.

Since the hack, however, Bybit has fallen to eleventh place.

“Since the hack, Bybit has experienced the most number of withdraws that we have ever seen, We have had a total number of more than 350,000 withdraws requests, and so far, around 2,100 withdraw requests [still need] to be processed. Overall 99.994% withdraws have been completed,” CEO Ben Zhou said on the day of the security breach.

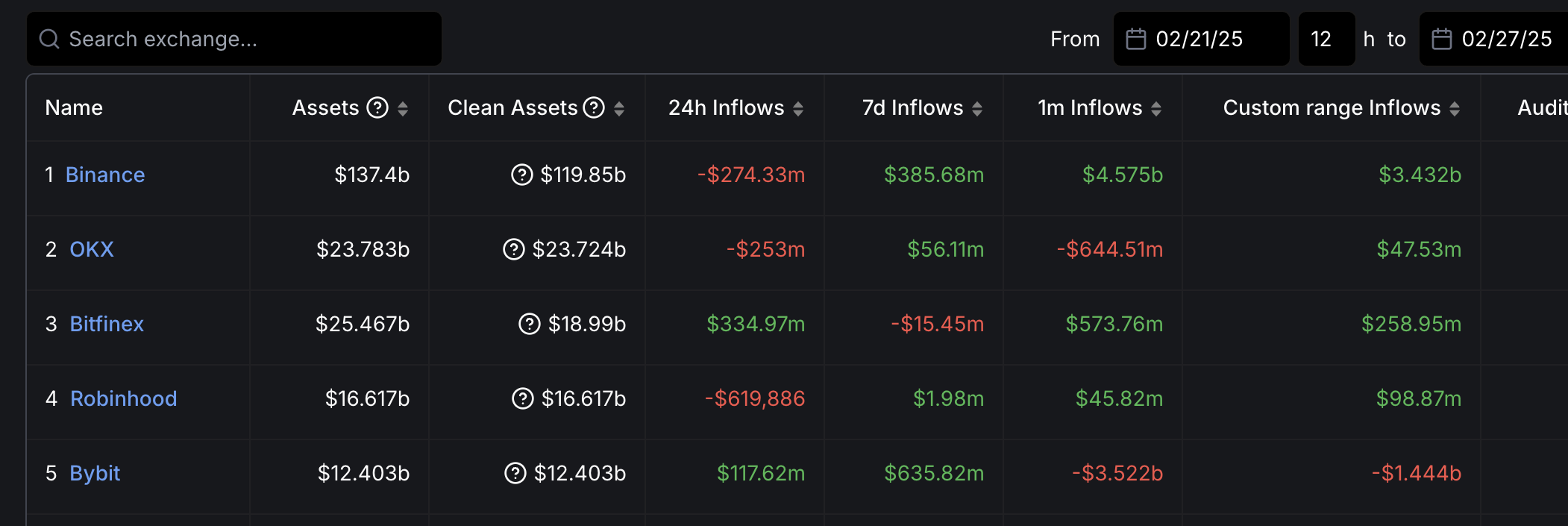

Binance Inflows After Bybit Hack. Source: DeFi Llama

Binance Inflows After Bybit Hack. Source: DeFi Llama

In the entire month of February, it had $5.32 billion in net inflows. The biggest chunk of its inflows, however, came in the immediate aftermath of the hack.

Binance 12-Month Inflows. Source: DeFi Llama

Binance 12-Month Inflows. Source: DeFi Llama

In other words, it seems like Bybit is losing its customers, and many are moving to Binance. The latter exchange has been on a winning streak, with inflows peaking at just under $9.3 billion last November.

Overall, Binance has been extending its lead as the largest centralized exchange. In the last two years, the exchange has faced significant regulatory scrutiny and legal challenges. However, it’s now seemingly making progress towards more proactive compliance.

Most recently, Binance delisted Tether’s USDT and non-MICA-compliant stablecoins in Europe. Its American wing, Binance.US, also restarted USD deposits nearly 2 years after the DOJ charges.

The Bybit hack shocked the entire industry, and the exchange’s resilience was applauded by all. Regardless, it seems like user interest in Binance continues to grow, with no close competition.