What will become of Berkshire Hathaway now that Warren Buffett is stepping down?

Warren Buffett is losing control of Berkshire Hathaway, and hedge fund manager Bill Ackman says it’s time for a new era. The 94-year-old “Oracle of Omaha” has led Berkshire for decades, but Bill believes his investment style is outdated. He says Berkshire would be better off under Greg Abel, Warren’s handpicked successor.

The greatest investor of all time is Warren —no debate. If you Google “who is the greatest investor ever?” right now, the results will show you Warren Buffett. This guy turned a struggling textile company, Berkshire Hathaway, into a financial empire worth hundreds of billions of dollars.

He’s been compounding money at an annual rate of around 20% for over six decades, which is literally unheard of. Warren’s investing philosophy is just buy great companies at fair prices and hold them forever. No gimmicks, no chasing trends (sorry Bitcoin)—just fundamental analysis and a ton of patience.

If you’re looking for other contenders though, Benjamin Graham (Warren’s mentor) literally wrote the book on value investing. Peter Lynch turned Fidelity’s Magellan Fund into a money-printing machine. John Templeton was a pioneer in global investing, and Ray Dalio built one of the most powerful hedge funds ever.

But if we’re talking consistency, longevity, and sheer impact, Warren wins every single time. No one else has matched his track record over such a long period while keeping it simple and transparent. The author of this article has and will forever remain in absolute awe of him.

Bill exposes Warren’s missed opportunities

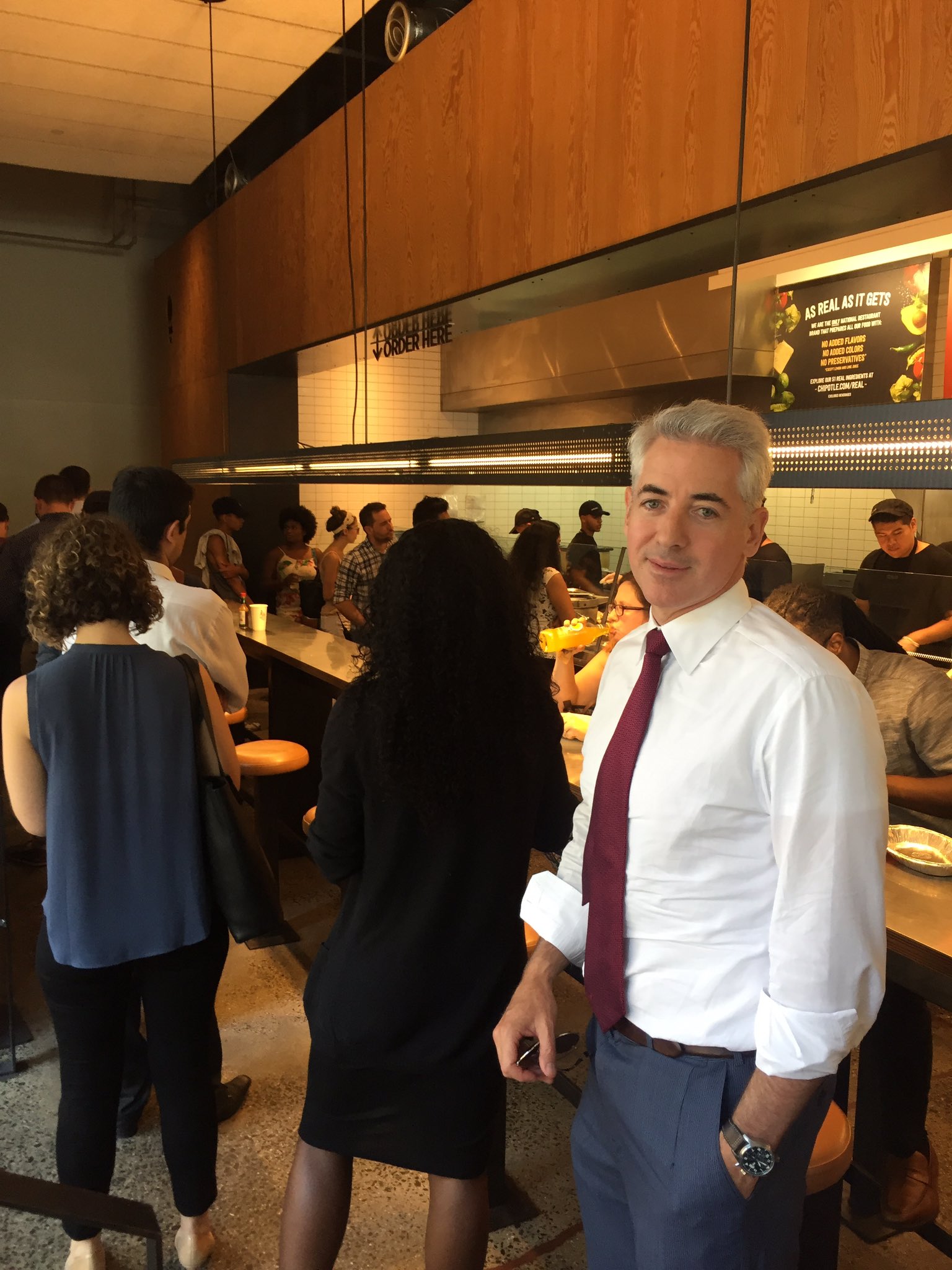

Now let’s get back to Bill, who by the way runs Pershing Square Capital Management. Speaking on the World According to Boyar podcast on Monday, he said Warren’s cautious investment approach has caused missed opportunities and slowed down Berkshire’s growth.

Bill pointed to Burlington Northern Railroad, which Warren bought in 2009, calling it “the least efficiently operated” among major railroads. He also criticized Warren for failing to capitalize on market downturns, especially the one in 2020 during the global pandemic, when Bill himself made billions by betting against the market.

Bill then revealed that he personally called Warren in February 2020 to warn him about the pandemic’s impact on financial markets, and Warren allegedly dismissed his concerns and then froze when stocks crashed. “I thought Warren would be taking advantage of this amazing opportunity to buy stocks, and he was frozen,” Bill said.

He also tried to get Warren to buy Hilton Hotels in 2007, before Blackstone acquired it for $26 billion. The deal turned into a massive win for Blackstone, but Warren passed on it. “It would have been an incredible home run for Berkshire,” Bill said, blaming Warren’s price discipline for the missed opportunity.

Bill said Warren refuses to buy businesses that trade for more than 10 times operating income, even if they have strong growth potential. “That’s worked really well for him for 60, 70 years, [so] why should he change?” Bill said.

“But we’re in a world where there’s some amazing businesses that have very long-term growth trajectories, where you have to pay more than 10 times operating income to succeed in buying a stock or buying a business,” said Bill.

Warren’s approach, he argued, is too rigid for today’s market. He believes Abel will take a more hands-on approach, making Berkshire’s businesses run more efficiently. “Now you’re going to have more of an operator in charge of Berkshire, and I think there’s a lot of value that can be created at Berkshire with better operations,” Bill said.

Berkshire’s board isn’t all Warren loyalists

While Warren still commands unparalleled respect, Berkshire’s board of directors is not just a group of loyalists. Some members are longtime allies, but others are independent thinkers who agree with Bill that Warren’s got to go.

The closest to Warren are Greg Abel and Ajit Jain, the company’s top executives. Greg, who as I’ve said has been chosen as Warren’s successor, is expected to be fully loyal to Warren’s vision.

Warren’s children, Howard and Susan, are also on the board, so that’s cleared. Ronald Olson, Warren’s longtime attorney, has been a trusted legal advisor for years, and would likely never vote against Warren.

But board member Kenneth Chenault, the former CEO of American Express, is known for being highly independent, and he’s been politely critical of some of Warren’s actions. Then we have Susan Decker, the former Yahoo! president, who brings tech industry expertise but isn’t at all close to Warren.

Meryl Witmer and Christopher Davis, both investment professionals, have no deep history with Berkshire and are on the board mainly to bring outside perspectives, so they no doubt agree with Bill. Warren is running out of time.

Berkshire acknowledged the risk of Warren leaving in its annual report, warning that the loss of “key personnel, particularly Mr. Warren,” could have a material adverse effect on the company. Warren himself admitted in his latest shareholder letter that his time is almost up.

“At 94, it won’t be long before Greg Abel replaces me as CEO,” Warren wrote. But while Abel is trusted internally, shareholders are uncertain about his investment abilities. He is an operator, not an investing icon like Warren. This author genuinely believes that Berkshire’s success under Greg Abel is far from guaranteed.

Bill is building his own version of Berkshire

Alright, we’re back to Bill once again. See, this guy is not just criticizing Warren, he is actively working on making himself the next greatest investor. He has long been a Warren admirer, even attending Berkshire’s annual meetings and publicly asking him questions. But now, he is creating his own modern-day Berkshire Hathaway with Howard Hughes Holdings.

Pershing Square has increased its stake in Howard Hughes to 48%, wanting to turn it into a diversified holding company. In the podcast, Bill said his goal is to replicate Warren’s strategy while adapting it for today’s market conditions.

Bill’s track record shows strong performance. Since launching Pershing Square in 2004, his funds have compounded at 19.8% annually after fees—almost identical to Warren’s 19.9% average over 60 years, though after performance fees, that number drops to 16.4%.

Bill also has more personal skin in the game than Warren. 21% of his wealth is tied up in his own fund, compared to Warren’s 14% stake in Berkshire. He has built a powerful network, saying, “I pretty much know every CEO in America or am one step removed.”

Despite his success, Bill still manages only $16.2 billion in assets, compared to Berkshire’s $1.03 trillion market cap. He sees the Howard Hughes acquisition as a way to close that gap and establish himself as Warren’s true successor.

Bill’s strategy is different from Warren’s. While Warren used cash from his textile business acquisition to build an empire, Bill is relying on Howard Hughes, which won’t generate free cash flow for at least three years.

Unlike Warren, who made Berkshire his sole focus, Bill is still managing a hedge fund, a UK-listed investment trust, and a special purpose acquisition vehicle.

Bill actually owned some of Berkshire for a very short period of time via the fund before selling fast. When asked about it, Bill responded that:

“We bought Berkshire because we thought it was very cheap and we’re Warren Buffett fans and even after Buffett passes and I hope he continues to live forever and he’s doing a pretty good job on the forever, Bart, I think the next generation of leadership is very good and I think there’ll be that much more disciplined. There’s a lot of value to be extracted in running the businesses that Berkshire owns better. So that itself was a pretty good story.”

Some critics argue Bill’s structure is too complicated. Warren runs Berkshire Hathaway with a clean and simple ownership model, while Bill has to juggle multiple investment entities. He has even proposed Howard Hughes paying Pershing Square a 1.5% market cap fee, which Warren never did with Berkshire.

But when the critics point this out, Bill defends himself by noting that Greg Abel gets paid $20 million per year, while Warren’s salary is only $100,000.

At 58 years old, Bill has time to build his version of Berkshire. Interestingly, Warren listed Berkshire on the New York Stock Exchange at the same age, in November 1988, when its market cap was only $5.8 billion. Bill believes he can follow a similar path, despite the differences in their business models.

But no matter how hard Bill tries, Warren’s legacy will forever be unmatched. No one else is cut out for this. And when Warren steps down, everything’s gonna change at Berkshire, and Wall Street will never be the same again.

Though it’d be interesting to see how stock bros will find their way without the man that has guided them for a very, very long time.