Solana (SOL) Crashes 15% After Massive Profit-Taking Spike

On-chain data shows that investors on the Solana network participated in significant profit-taking ahead of the asset’s latest retrace.

Solana Realized Profit Registered A Sharp Spike Yesterday

According to data from the on-chain analytics firm Glassnode, the Realized Profit observed a huge spike for Solana recently. The “Realized Profit” here refers to an indicator that, as its name suggests, keeps track of the total amount of profit that the investors are ‘realizing’ through their selling.

The metric works by going through the transfer history of each coin being sold on the blockchain to see what price it was transacted at prior to this. If this previous selling price for any coin was more than the current spot price, then that particular token’s sale is leading to profit realization.

The Realized Profit takes the difference between the two prices to calculate the exact amount of profit involved in the transaction and sums it up for sales across the network.

In the context of the current topic, the usual Realized Profit isn’t the metric of interest, but rather a derivative form known as the Realized Profit by Age. This indicator basically tells us about how the SOL profit-taking is distributed among the various coin age bands.

An “age band” is a time-range within which coins part of the band were last moved. The 1-week to 1-month age band, for instance, refers to the part of the supply that was last involved in a transfer between one week and one month ago.

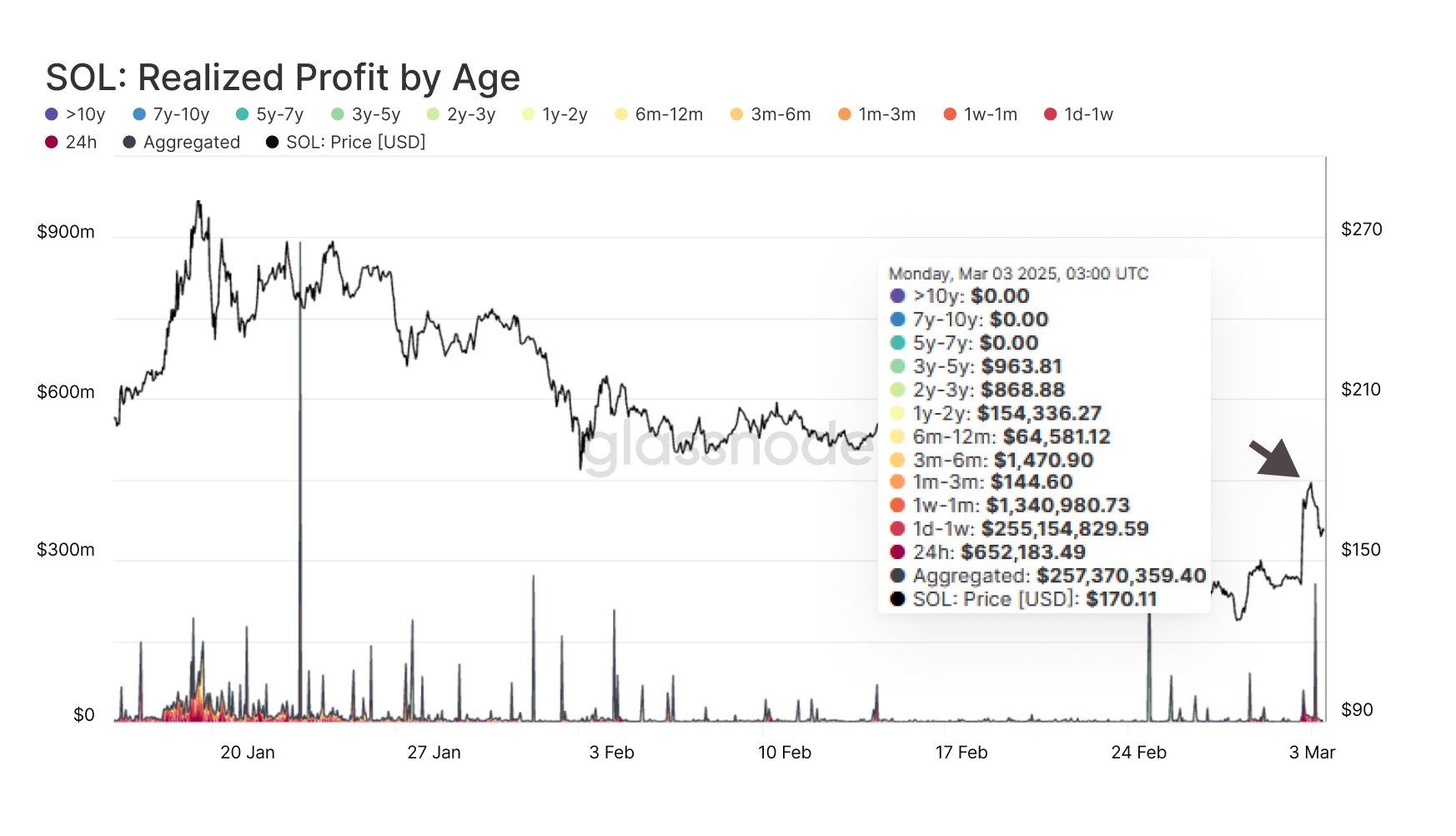

Now, here is the chart shared by the analytics firm that shows the trend in the Solana Realized Profit by Age over the last few months:

As is visible in the above graph, the aggregated Solana Realized Profit observed a huge spike on Monday following the recovery in the cryptocurrency’s price toward the $180 mark.

The sharp rally in the coin came after United States President Donald Trump announced a Crypto Strategic Reserve that is going to include five digital assets, one of which is SOL.

It would appear the investors were keen to cash in on this opportunity, as the SOL Realized Profit shot up to an hourly value of over $257 million, making the profit-taking event one of the largest in the last couple of months.

Interestingly, as the chart displays, 99% of the aggregated profit realization (around $255 million) came from the 1-day to 1-week age band alone. This would suggest that the profit-taking spree was almost entirely due to investors who bought during last week’s dip, capitalizing on their quick gains.

SOL Price

Solana has crashed following the profit-taking selloff as its price has returned back to $136.