Trump’s global trade war is now officially live and markets are crashing

President Donald Trump has officially launched a global trade war, sending markets into chaos and wiping out billions overnight. On Tuesday, the US slapped heavy tariffs on imports from Mexico, Canada, and China, with Trump confirming that no more negotiations will take place.

The numbers are brutal: 25% on all goods from Mexico, 25% on nearly everything from Canada except energy, 10% on Canadian energy imports, and 20% on many Chinese goods. Canada immediately hit back with 25% tariffs on $155 billion worth of US exports.

Global stock markets tumble as Trump’s tariffs officially go live

Data from CNBC shows that Asian tech stocks crashed right after the news. Nvidia took a 9% dive, while Japanese chip giant Advantest collapsed to its lowest level since October, dropping 9%. Renesas Electronics lost 6.35%.

South Korea’s SK Hynix dropped by 3.26%. Over in China, Alibaba fell 2.23%, Kingsoft Cloud dropped 8.46%, and electric vehicle stocks like BYD lost 6.60%, per the data.

SoftBank, the Japanese investment giant, plunged 6.25%. Masayoshi Son, its CEO, reportedly plans to borrow $16 billion for AI investments, but that news wasn’t enough to stop the freefall.

Taiwan Semiconductor Manufacturing Company (TSMC) also tumbled by 2% after Trump said the company would spend $100 billion in the US to boost chip production.

The S&P 500 is getting wrecked too, as it sees its worst fall since December 18 teetering on the 200-day moving average, a critical support level. If the index breaks lower, expect even more blood in the market.

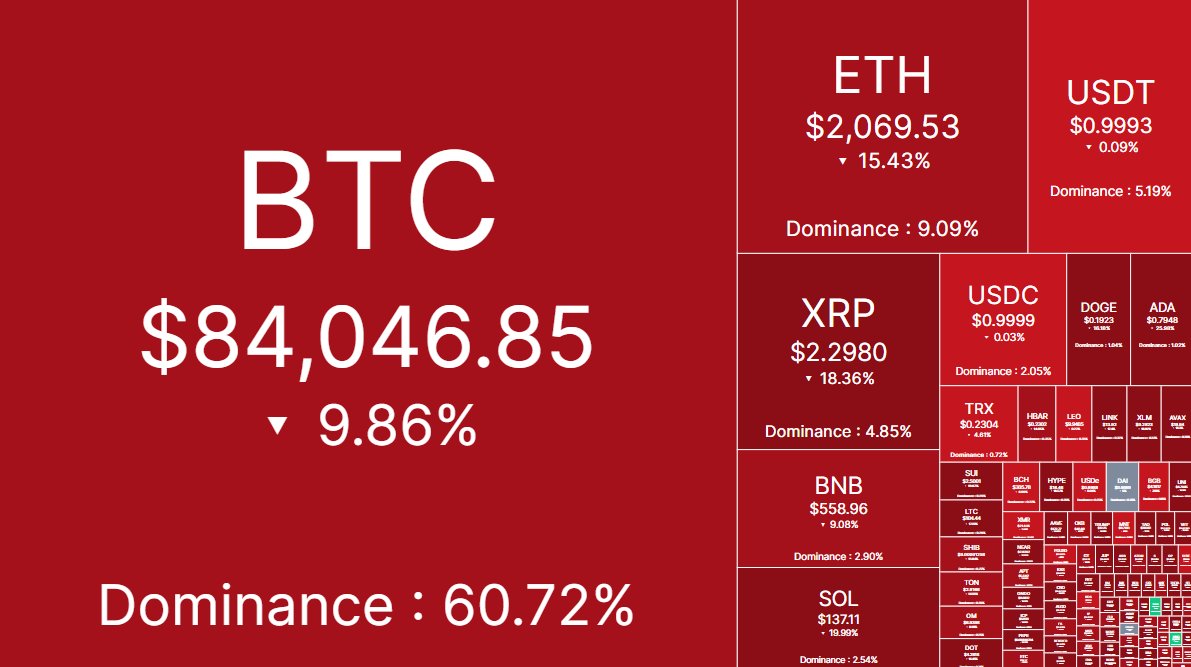

Bitcoin is feeling the heat, too. It tanked below $90,000, erasing the 10% gains it made after Trump announced the US Crypto Reserve.

Oil prices fell sharply as traders ran for safety. Gold, on the other hand, is thriving—up 10% since January, while Bitcoin has lost 10% YTD.

Oh but the European markets, though, are handling things a little differently. The Stoxx 600, which represents a broad look at European stocks, actually outperformed the S&P 500 in February, per CNBC.

The reason is that investors are pouring money into defense stocks, expecting Trump’s policies to continue pulling the rug out from under the markets.

Crypto crashes after wild 36-hour swing

Crypto investors are having it worse by the way. On Sunday afternoon, Trump announced that the US was launching a Crypto Reserve, AND That news sent crypto prices flying, with market cap surging from $2.7 trillion to $3.1 trillion in hours. But that party didn’t last.

By Monday night, reality hit. The market flipped, and in just 24 hours, crypto lost $500 billion. It’s now $100 billion below where it was before Trump’s announcement. Ethereum, which had bounced from $2,173 to $2,550, is now at $2,002—8% lower than its pre-announcement level.

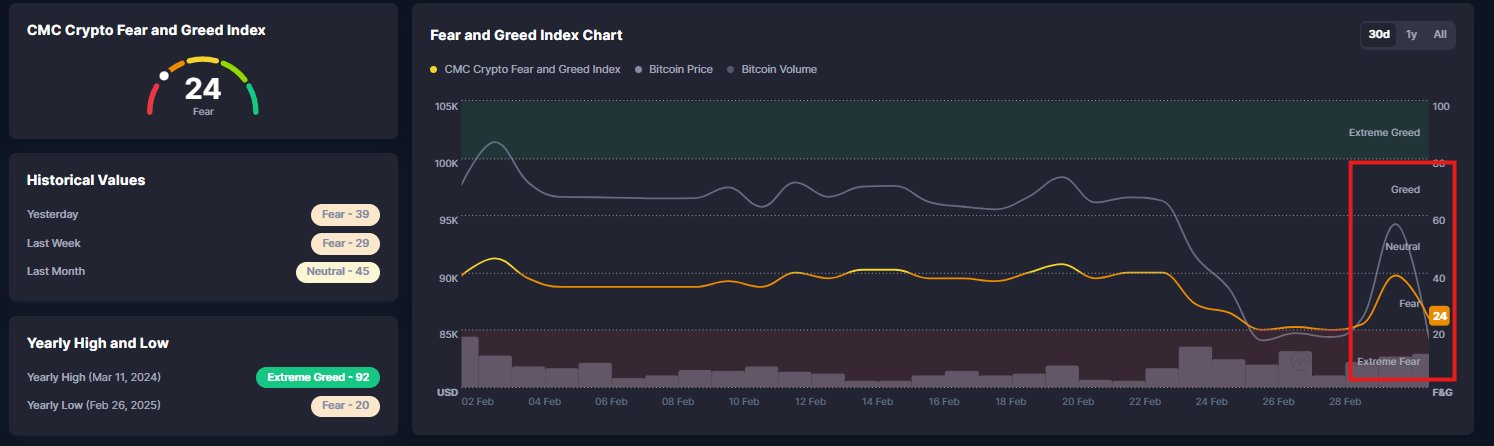

Before Trump’s Reserve news, the Crypto Fear & Greed Index sat at 20 (Extreme Fear). After the announcement, it shot up to 55 (Greed). Now? Back to 24, meaning fear is back in control.

Meanwhile, institutional investors have been pulling money out fast. In the last week of February, crypto funds saw a record $2.6 billion in outflows, the biggest ever, $500 million higher than the previous record in 2024. Bitcoin is down 3% from pre-reserve announcement levels, erasing $250 billion in market cap in just 12 hours.

A Bank of America survey found that 42% of investors now say the trade war is the biggest threat to risk assets in 2025, up from 30% in January. Only 3% of investors believe Bitcoin will be the best-performing asset in a full-blown trade war—way lower than the US dollar (15%) or gold (58%).

Meanwhile, Goldman Sachs’ volatility panic index, which was sitting at 1.4 in December, has spiked to 9.1 and is approaching 10 today. That means expect more violent price swings ahead.

The US effective tariff rate is now set to reach its highest level since the Great Depression. And it’s not over. Next up is a 25% tariff on the European Union.

Cryptopolitan Academy: Coming Soon - A New Way to Earn Passive Income with DeFi in 2025. Learn More