Bitcoin Struggles to Find Footing After Massive $540 Million Whale Dump

Bitcoin has experienced a sharp decline in price this week, dropping from $95,700 to below $80,000. The crypto king’s recovery seems uncertain, as large wallet holders, known as whales, have capitalized on the price dip, selling a substantial amount of their BTC holdings.

This selling pressure further worsens the situation for investors who are already reeling from the downtrend.

Bitcoin Holders Are Cashing Out

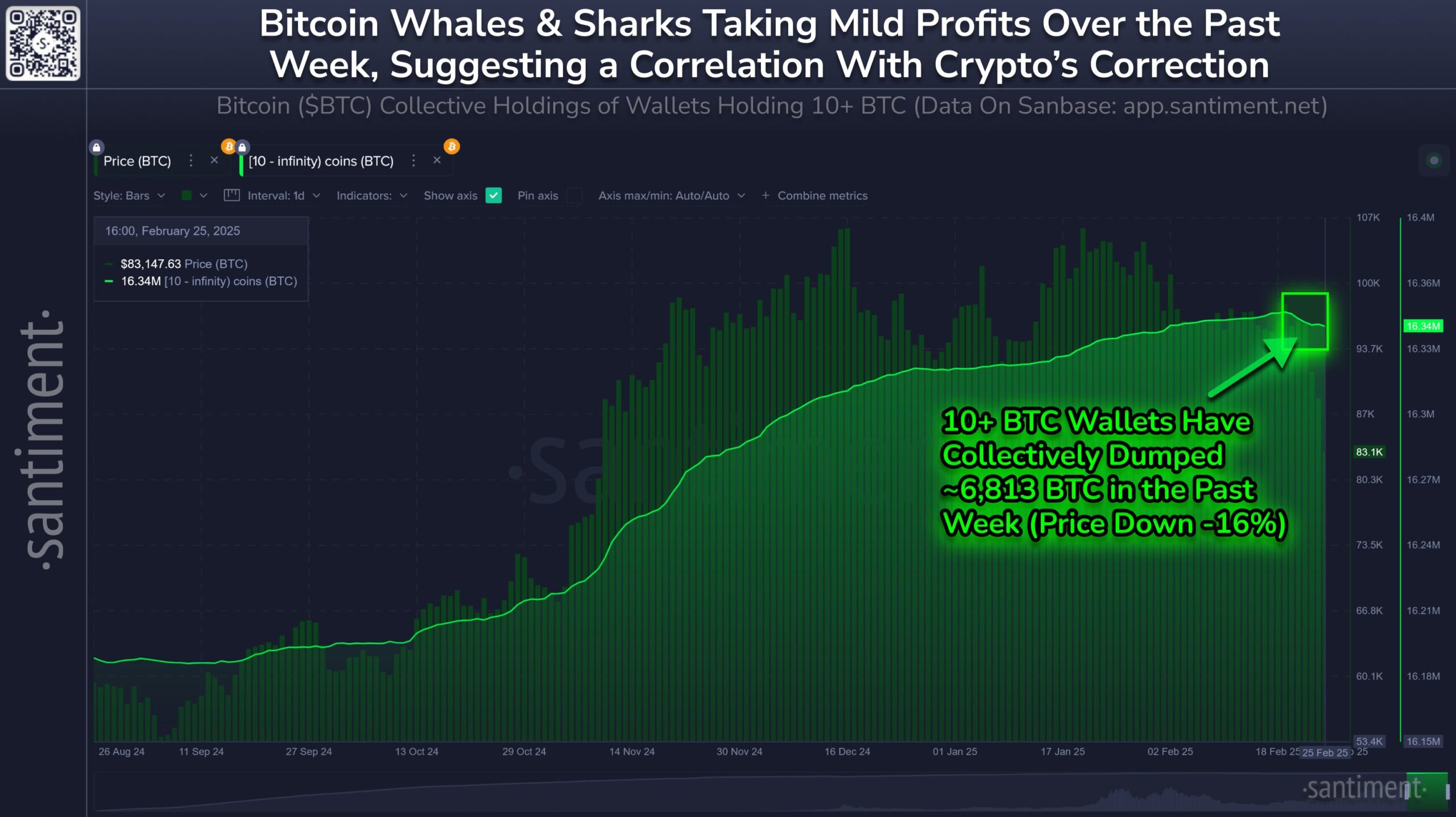

Whales and sharks, specifically wallets holding 10 or more BTC, have been active in the market, dumping around 6,813 coins, approximately worth $540 million, since last week. This is the largest drop since last July and serves as a bearish indicator, suggesting that further price declines could be in store.

Despite the selling pressure, the possibility of accumulation from these large holders could signal a potential market reversal. Historically, these whales tend to influence the market significantly, so their actions should not be overlooked, as they may also begin accumulating at lower levels once the market stabilizes.

The overall sentiment is still negative, but it is important to consider that this behavior could also suggest a shift in strategy. If these large investors begin accumulating BTC again, it may indicate confidence in the long-term potential of Bitcoin.

Bitcoin Sharks and Whales Holdings. Source: Santiment

Bitcoin Sharks and Whales Holdings. Source: Santiment

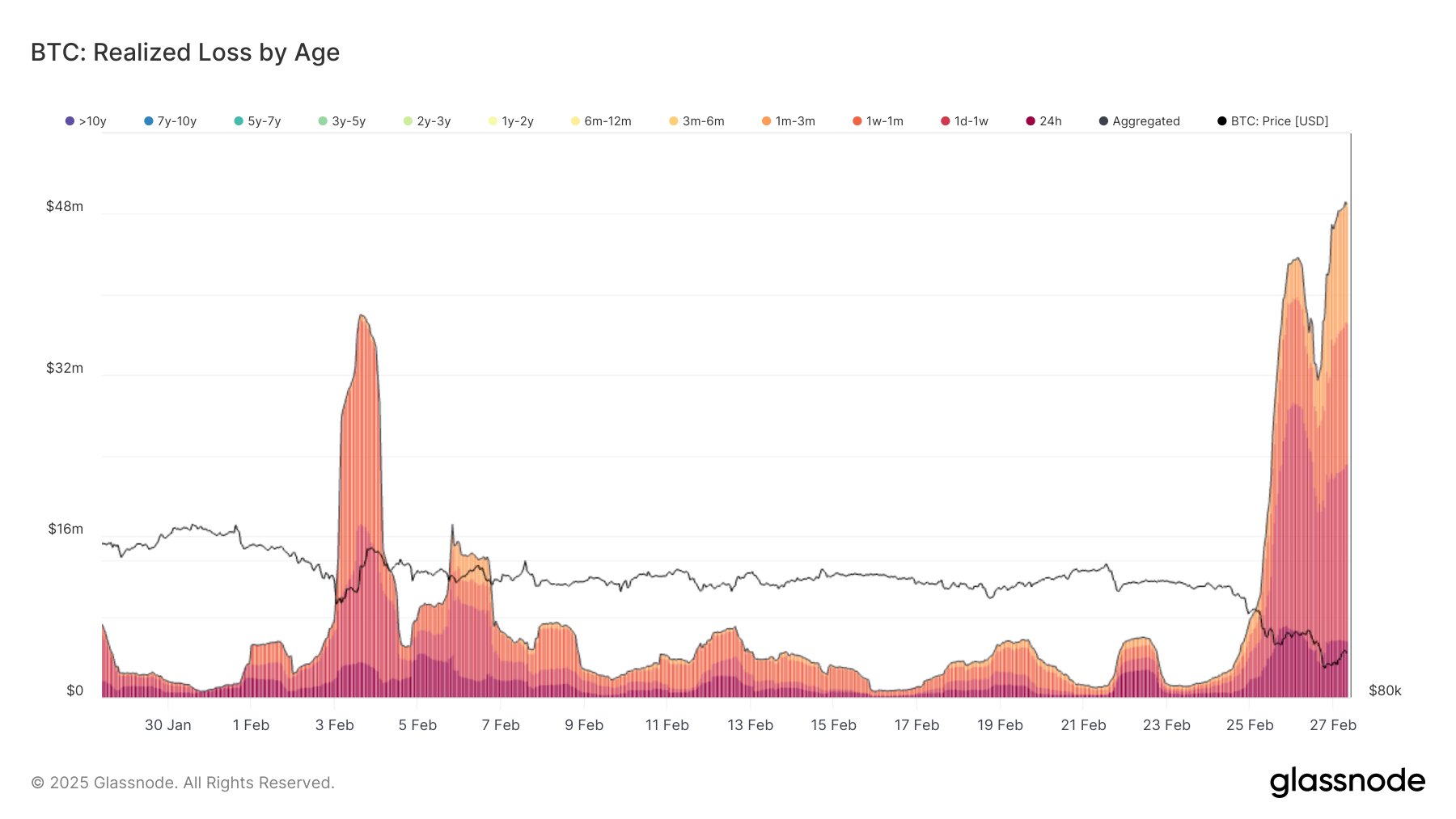

Looking at the broader market, Bitcoin’s recent downturn has also been accompanied by significant realized losses. Between February 25 and 27, over $2.16 billion in losses were realized, primarily coming from recent market entrants.

Of these losses, approximately $927 million—42.85% of the young cohort’s total—occurred in just one day. The losses ended up marking the largest single-day loss since August 2024. This substantial sell-off from newer investors is a concerning sign, as it could deter further participation in the market.

These losses reflect the harsh reality that newer market participants are facing significant setbacks, which could reduce overall investor confidence. As long as this trend persists, it may weigh heavily on Bitcoin’s price recovery. This could further exacerbate the bearish sentiment in the market.

Bitcoin Realized Losses. Source: Glassnode

Bitcoin Realized Losses. Source: Glassnode

BTC Price Is Struggling

Bitcoin is currently trading at $79,539, having already lost the support of $80,313. Given the recent developments, BTC is likely to test the next support level at $76,741. This level has historically acted as a key bounce point, offering some hope for a price rebound.

However, if the selling pressure continues and investor confidence weakens further, Bitcoin could fall below $76,741 and approach the support of $71,529. A drop to this level would significantly extend the losses and deepen the bearish outlook for the cryptocurrency.

Bitcoin Price Analysis. Source: TradingView

Bitcoin Price Analysis. Source: TradingView

To invalidate the bearish thesis and spark a potential recovery, Bitcoin must reclaim the support of $80,313 and make its way back to $85,000. If this happens, it could signal the beginning of a reversal and the possibility of recovery.