Bitcoin Mega Whales The Primary Sellers During Price Crash, Analytics Firm Reveals

The market intelligence platform IntoTheBlock has revealed how the largest of Bitcoin holders have been the ones applying selling pressure amid the price decline.

Bitcoin Mega Whales Have Been Reducing Their Supply Recently

In a new post on X, IntoTheBlock has discussed the latest trend in the Bitcoin supply held by the whales. The ‘whales‘ broadly refer to the entities who own more than 1,000 tokens of the cryptocurrency.

At the current exchange rate, this amount converts to a whopping $88.9 million, so the only investors who would qualify for the cohort would be the big-money ones.

In the context of the current topic, the holders of focus aren’t just any ordinary whales, but in fact the largest among them: those carrying more than 10,000 BTC ($889 million) in their balance. This group may be termed as the ‘mega whales.’

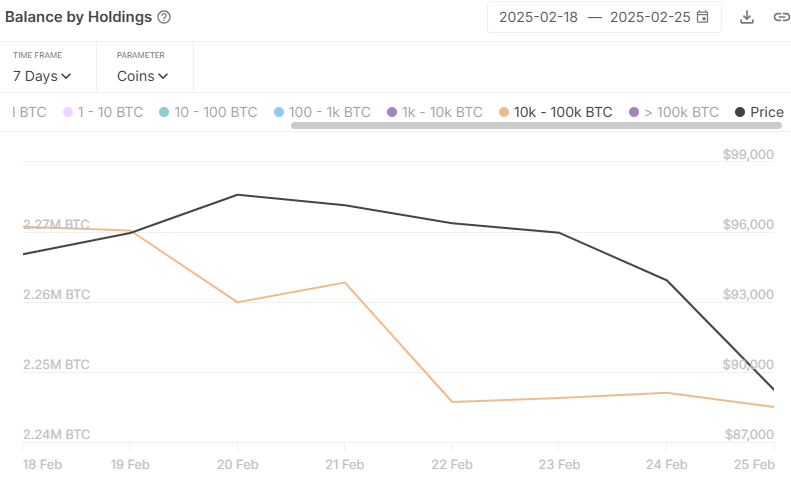

Now, here is the chart shared by the analytics firm that shows the trend in the holdings of the Bitcoin mega whales over the past week:

As displayed in the above graph, the Bitcoin mega whales sold some of their supply during the price crash. More interesting, though, is the detail that these investors already began their selloff a few days back, a potential indication that they saw the price plunge coming.

According to IntoTheBlock, this cohort was the primary seller in this window. In fact, the analytics firm has pointed out that the rest of the groups have shown combined accumulation at the same time, meaning the smaller entities are looking at the plummet as an opportunity to buy.

In total, the mega whales have sold 25,740 BTC (almost $2.3 billion) over the last seven days. The behavior of the cohort could now be to keep an eye on in the coming days, as with the rest of the market buying, what these humongous investors do could tip the balance one way or the other for Bitcoin.

Holder balance is just one way to classify BTC cohorts. Another is through exchanges, as different platforms can host a different demographic of investors. Two exchanges in particular are generally of relevance in this type of analysis: Coinbase and Binance.

Coinbase is mainly used by entities from the US, especially large institutional traders, while Binance serves global investors. An indicator that can be used for tracking the difference in behavior between the two user bases is the Coinbase Premium Index.

This metric measures the percentage difference between the Bitcoin price listed on Coinbase (USD pair) and that on Binance (USDT pair). As CryptoQuant founder and CEO Ki Young Ju pointed out in an X post, the Coinbase Premium Index has been negative recently.

This trend, alongside the fact that Coinbase’s spot volume dominance has shot up recently (left chart), would suggest the American whales have been the main drivers during the crash.

BTC Price

Bitcoin approached the $86,000 mark during yesterday’s dip, but the coin has since seen a rebound as its price is now trading around $88,700.