Will Michael Saylor’s Strategy be forced to sell off its Bitcoin as prices tumble further?

Michael Saylor’s Strategy, formerly known as MicroStrategy, is facing one of its biggest tests yet has tumbled by more than 55% since the year started in the stock market, per data from Google Finance.

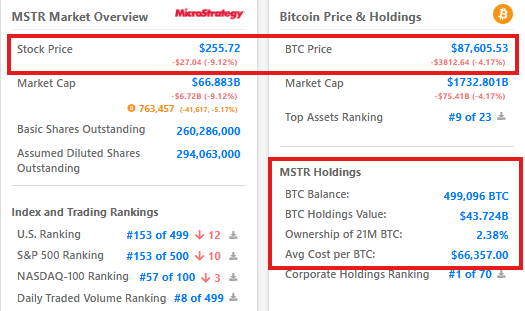

With 499,096 BTC sitting on its balance sheet—worth about $44 billion—many are asking one question: Will Strategy be forced to liquidate its Bitcoin?

At press time, Bitcoin has slipped far below Strategy’s average purchase price of $66,350 per BTC, meaning the company is now staring at billions in unrealized losses. If the downturn continues, it’d put Strategy’s entire financial structure at risk.

This is the first real test of Strategy’s model since it became a Bitcoin-first company in 2020.

How much trouble is Strategy really in?

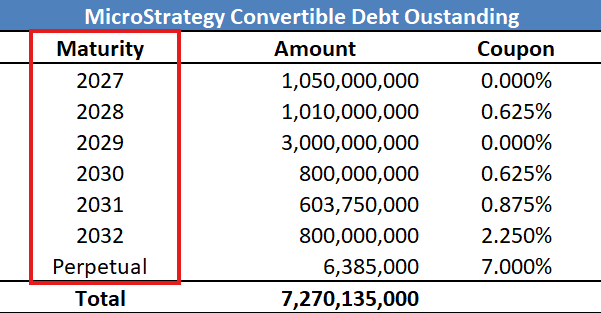

Strategy has built its entire business model around Bitcoin accumulation, funding purchases with a mix of debt and equity raises. The company holds $8.2 billion in debt, against its $44 billion Bitcoin holdings—a leverage ratio of about 19%.

Most of this debt is tied up in convertible notes, financial instruments that allow creditors to convert their loans into $MSTR shares if the stock trades above a certain price. Just about the only way a “forced liquidation” occurs if there is a “fundamental change” at the company.

Asked about the risks of forced selling, Saylor dismissed the idea outright. “Even if Bitcoin went to $1, we would not be liquidated,” he said. “We would just buy all of the Bitcoin.”

That might sound confident, but according to data from EpochVC, a forced liquidation could happen under one key condition: a “fundamental change” in the company’s structure, which would need a stockholder vote or a corporate bankruptcy. Per its own bylaws, both of these options will likely force Strategy to sell off its Bitcoin reserves.

While bankruptcy might seem unlikely, Strategy’s biggest risk is in 2027 and beyond when the first batch of convertible notes matures. Goldman Sachs analysts said in a note on Tuesday that if Bitcoin prices crash by 50% more and remains consolidated, creditors could refuse to roll over debt, leaving Strategy scrambling for cash.

Saylor holds 46.8% of the voting power, which gives him a ton of control over any liquidation decisions. In spite of Saylor, shareholders now face a choice. Do they keep betting on Michael’s vision, doubling down on $MSTR despite its losses? Or do they walk away, forcing the company into a financial corner? At press time, Bitcoin was worth $88,756, according to data from CoinGecko.

Cryptopolitan Academy: Coming Soon - A New Way to Earn Passive Income with DeFi in 2025. Learn More