CryptoQuant CEO Ki Young Ju Challenges Traditional Altcoin Season with New Insights

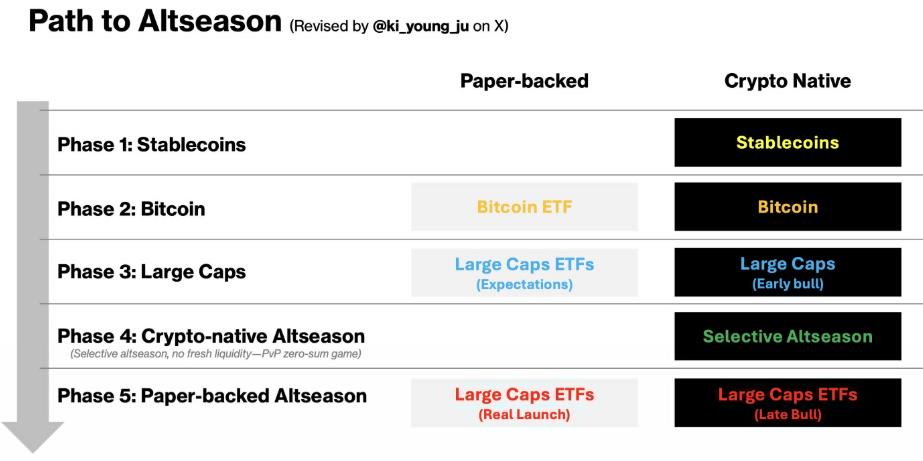

Ki Young Ju, the founder and CEO of CryptoQuant, has challenged the traditional notion of Altcoin Season.

He suggests that the old capital flow cycle leading to altcoin surges has become obsolete.

CryptoQuant CEO Discusses Changing Altcoin Season

According to Ju, changing crypto regulations and institutional adoption have altered how capital moves in the crypto market. These changes, he says, prevent the typical explosion of smaller altcoins that historically defined Altcoin Season.

In a recent post on X (formerly Twitter), Ki compared the old altcoin season cycle to a disappearing rainy season.

“Redefining Altseason. The old altseason capital flow cycle is obsolete. What I meant was that due to climate change, the rainy season has completely disappeared, leaving only a season of occasional drizzles,” Ki explained.

CryptoQuant CEO on Redefining Altcoin Season. Source: Ki Young Ju/X

CryptoQuant CEO on Redefining Altcoin Season. Source: Ki Young Ju/X

He explained that Bitcoin-driven capital rotations no longer function as they once did due to institutional involvement and regulatory changes. Instead, new capital primarily flows into stablecoins or widely accepted altcoins rather than speculative smaller tokens.

Despite declaring an altcoin season amid liquidity struggles, Ki quickly clarified that the era of indiscriminate altcoin surges is over. Instead, he predicts a “selective altseason,” where only a few altcoins will benefit from new market trends. Based on this, he highlighted three key factors that could drive altcoin performance in 2025.

The CryptoQuant executive cited the potential approval of exchange-traded funds (ETFs) for altcoins, sustainable attention drivers, and revenue-generating projects.

He emphasized that “most altcoins won’t make it,” marking a stark contrast to previous cycles where nearly all altcoins experienced substantial price increases.

“The era of everything pumping is over. It’s a selective altseason—most altcoins won’t make it,” Ki added.

Meanwhile, recent market trends support Ki’s assessment of a selective altcoin season. As BeInCrypto reported, altcoins outperformed Bitcoin regarding crypto inflows last week. Citing a CoinShares report, BeInCrypto highlighted Bitcoin’s outflows of $571 million. Meanwhile, certain altcoins, including XRP, led inflows with $38.3 million, largely due to speculation around potential ETF approvals.

Other altcoins, such as Solana (SOL) and Ethereum (ETH), also registered positive performance. This trend suggests that investors prioritize established altcoins with strong fundamentals rather than smaller, more speculative tokens.

Recently, Ki addressed the ongoing liquidity struggles in the crypto market. He described the situation as a “PvP fight,” where capital is redistributed among assets rather than new liquidity entering the market.

This aligns with the notion that institutional capital progressively shapes the sector, favoring stability over speculative altcoin booms. With institutional investors exerting greater influence, the days of indiscriminate altcoin surges driven by retail traders may end.