Pi Network’s PI Token Eyes $2 Comeback Following Post-Launch Price Slump

Pi Network’s PI token officially launched on February 20, marking a major milestone for the crypto project. However, the long-awaited launch triggered a wave of sell-offs as early adopters rushed to cash in on their holdings.

The selling pressure triggered a decline in PI’s value, which fell to a low of $0.60 by February 21. Despite the initial crash, PI has rebounded, showing renewed bullish momentum.

PI Soars 173% from Post-Launch Low

PI currently trades at $1.64, noting a 173% hike from its post-launch low. This triple-digit rally has been fueled by the resurgence in demand for the altcoin over the past few days.

A potential Binance listing partly drives this demand. As of February 22, 212,000 votes had been cast on whether PI should be launched on the exchange, with more than 86% in favor. As the voting process nears its conclusion, investors anticipate Binance will list the altcoin, potentially driving its price higher.

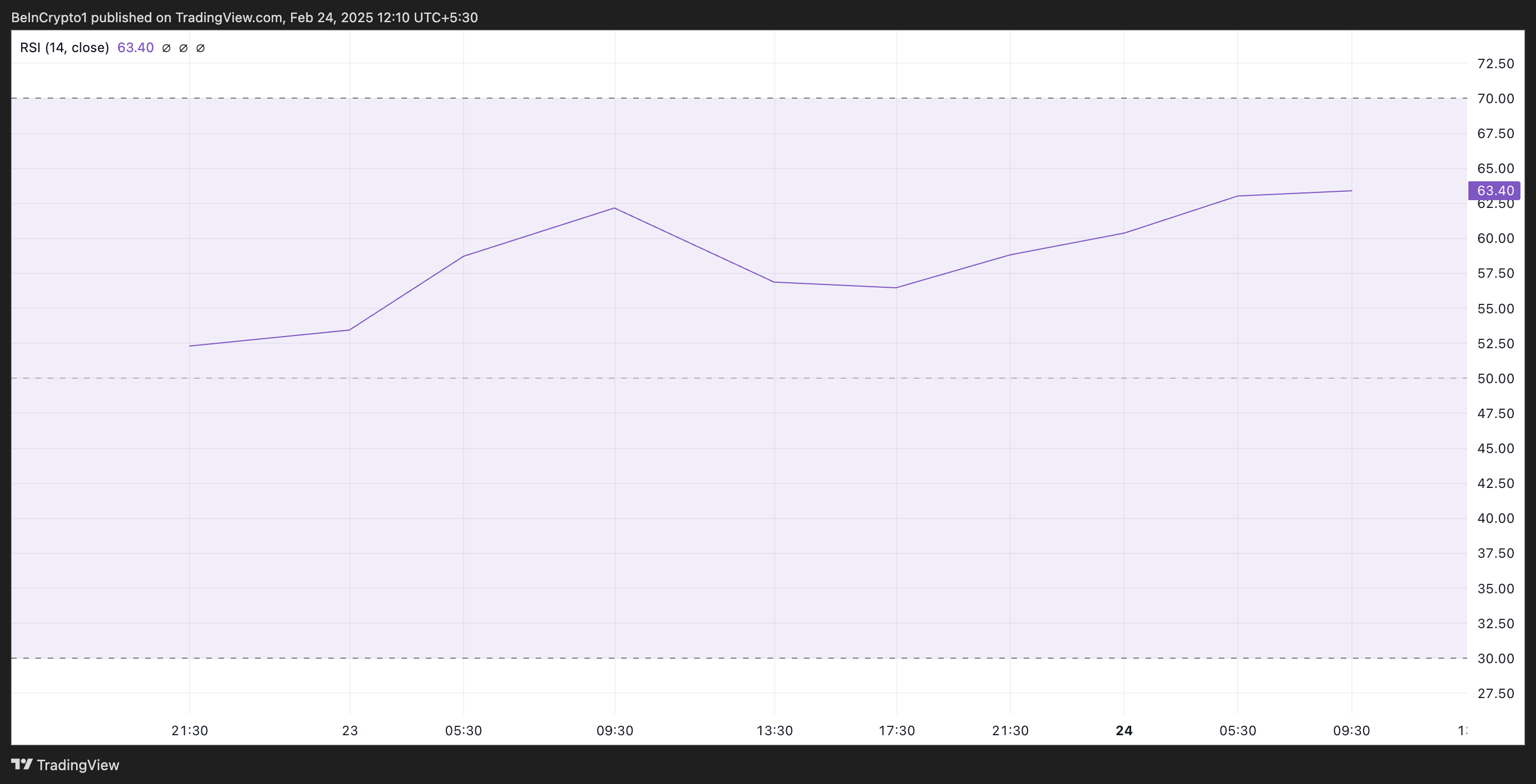

PI’s high demand is reflected by its rising Relative Strength Index (RSI). As of this writing, this key momentum indicator, assessed on a four-hour chart, is in an upward trend at 63.40.

PI RSI. Source: TradingView

PI RSI. Source: TradingView

An asset’s RSI measures its overbought and oversold market conditions. It ranges between 0 and 100, with values above 70 indicating that the asset is overbought and due for a correction. On the other hand, values under 30 suggest that the asset is oversold and may witness a rebound.

PI’s RSI reading of 63.40 signals strong bullish momentum. This means that buying pressure outweighs selling activity among market participants, and if the trend continues, the altcoin’s price will continue to grow.

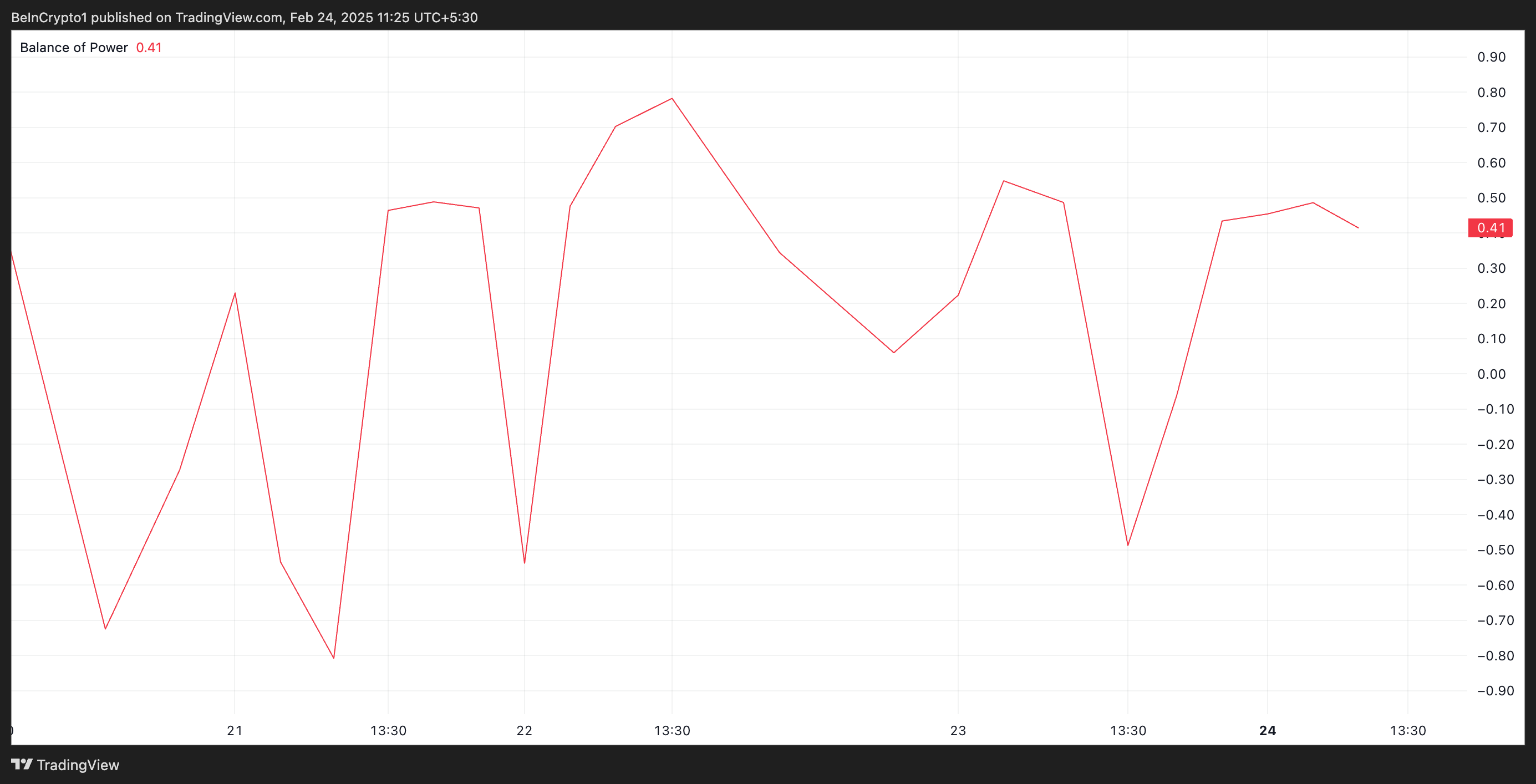

Moreover, readings from PI’s Balance of Power (BoP) support this bullish outlook. As of this writing, it returns a positive value of 0.41.

PI BoP. Source: TradingView

PI BoP. Source: TradingView

The BoP measures the strength of buyers against sellers by analyzing price movements within a given period. As with PI, when the indicator’s value is positive, buyers have more control. This indicates strong upward momentum and hints at the potential for further price gains.

PI Holds Strong Above Trendline: Can It Reach a New High?

PI has traded above an ascending trend line since February 20, confirming the resurgence in the bullish activity around the altcoin.

When an asset trades above this pattern, it indicates a strong uptrend, with buyers consistently supporting higher prices. If the uptrend persists, PI could breach the $2 price mark to trade at its all-time high of $2.20.

PI Price Analysis. Source: TradingView

PI Price Analysis. Source: TradingView

On the other hand, if demand plummets amid a rise in profit-taking activity, this bullish projection will be invalidated. In that scenario, PI’s value could break below $1.60 and fall to $1.34.