Pi Network (PI) Distributes Record Airdrop But Indicators Show Weak Momentum

Pi Network (PI) was finally launched and became the biggest airdrop in crypto history, surpassing Uniswap, but its price action has been volatile since its launch. Despite the massive hype, Pi’s ADX has dropped from 60.2 to 15, indicating a lack of clear trends and diminishing market momentum.

Its RSI also fell dramatically from over 90 to 45.2, reflecting a shift from extreme buying pressure to a more cautious sentiment. If selling pressure continues, Pi could test support at $0.71. A reversal could push it to test resistance at $1.02 and possibly rise to $1.26.

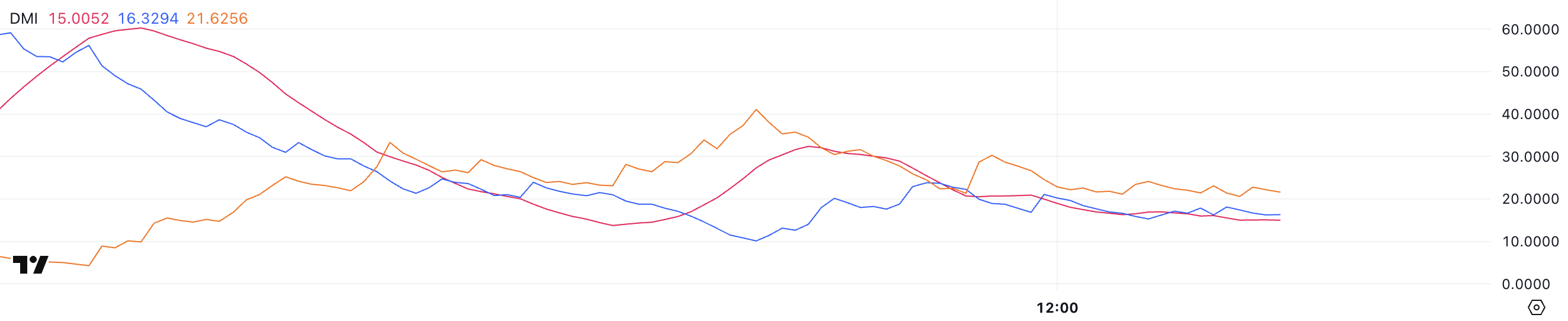

Pi Network DMI Shows the Lack of a Clear Trend

Pi Network’s DMI chart shows its ADX at 15, a significant drop from 60.2 just a few hours ago when the token was officially launched. It became the biggest airdrop in crypto history, surpassing Uniswap. This rapid decline in ADX suggests a loss of momentum and a weakening trend, indicating that the initial hype surrounding the launch has faded.

An ADX of 15 reflects a very weak trend, suggesting that the market is currently indecisive and lacks clear direction.

The drop in ADX highlights diminishing volatility, implying that Pi Network price could consolidate or remain range-bound until a new trend is established.

PI DMI. Source: TradingView.

PI DMI. Source: TradingView.

The Average Directional Index (ADX) is a momentum indicator that measures the strength of a trend without indicating its direction. Typically, an ADX below 20 suggests a weak or non-existent trend, between 20 and 40 indicates a developing trend, and above 40 signals a strong trend.

Alongside this, the +DI and -DI lines provide insights into buying and selling pressure. Currently, Pi Network’s +DI is at 16.3, down from over 60 a few hours ago, indicating a significant reduction in PI buying pressure. Conversely, the -DI is at 21.6, up from 4.2 at launch, showing increasing selling pressure.

This shift suggests that the initial bullish momentum has reversed, and sellers are gaining control. With the ADX so low and the price declining, the next trend is uncertain, and traders should watch for either a breakdown or a potential reversal as the market seeks direction.

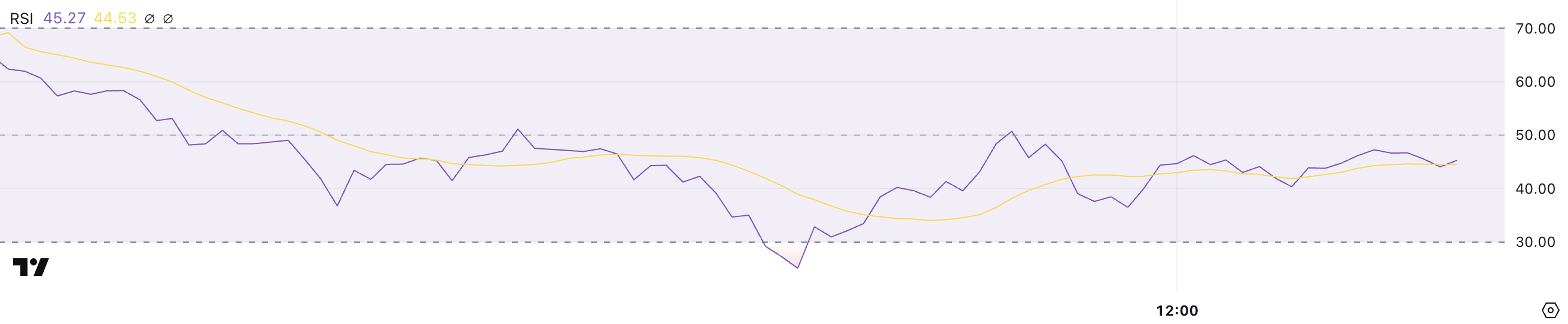

PI RSI Dramatically Fell Since Its Launch

Pi Network’s RSI is currently at 45.2, showing a dramatic shift from its peak of over 90 when the token was launched. This initial spike above 90 indicated extremely overbought conditions, driven by intense buying pressure and market excitement.

However, the rapid decline to 25.1 a few hours ago reflects a swift reversal in sentiment as selling pressure took over.

The recovery to 45.2 suggests that the extreme selling has eased, but the RSI remaining below 50 indicates that bearish sentiment still prevails.

PI RSI. Source: TradingView.

PI RSI. Source: TradingView.

The Relative Strength Index (RSI) is a momentum oscillator that measures the speed and change of price movements, ranging from 0 to 100.

Typically, an RSI above 70 signals overbought conditions, suggesting a potential price correction. Meanwhile, an RSI below 30 indicates oversold conditions, which could lead to a price rebound. With Pi’s RSI currently at 45.2, the market is neutral to slightly bearish. This reflects a cautious sentiment as traders wait for a clearer direction.

This level suggests that the selling pressure has subsided, but buying interest remains weak. If the RSI can climb above 50, it could signal a bullish reversal, potentially leading to a price recovery.

However, if it drops back towards 30, it could indicate renewed selling pressure and further downside for Pi Network.

Will Pi Network Fall Below $0.70 Soon?

If selling pressure continues, Pi could test the support level around $0.71, where its longest EMA line is positioned. This is a critical zone for maintaining the current price range.

If this support is lost, the bearish trend could accelerate. It could lead to further declines and continued downward momentum.

PI Price Analysis. Source: TradingView.

PI Price Analysis. Source: TradingView.

On the other hand, if the trend reverses and Pi gains bullish momentum, it could test the resistance at $1.02. A breakout above this level would indicate renewed buying interest and could lead to a bullish trend reversal.

If this resistance is successfully breached, Pi could rise to $1.26, representing a potential 41% upside from current levels. This would confirm the end of the bearish phase and could attract more buying activity.