Ethereum Grabs Social Media Attention: Is A Rebound Coming?

Data shows social media discussions related to Ethereum have spiked recently, something that may be positive for the struggling ETH price.

Ethereum Social Dominance Has Shot Up Over The Past Day

According to data from the analytics firm Santiment, the Ethereum Social Dominance has just seen a significant increase. The “Social Dominance” here refers to an indicator that’s based on another metric known as the Social Volume.

The Social Volume basically tells us about the amount of discussion that a given topic or term is receiving on the major social media platforms. The metric calculates its value by counting up the unique total number of posts/messages/threads on these platforms making mentions of the term.

It might seem odd that the metric doesn’t just count up the mentions themselves, but the reason behind it is that the other methodology can sometimes paint an inaccurate picture of the situation on social media.

This can happen when there isn’t much activity present on the platforms, but there are a few posts from enthusiasts up. Such posts can contain a notable number of mentions, enough to skew the Social Volume by themselves.

By tracking only the posts themselves, the indicator only spikes when the discussion is more spread out across social media (that is, there are a high number of users participating in talks).

Now, the actual indicator of relevance here, the Social Dominance, determines what part of cryptocurrency-related discussions that any given token is accounting for. The metric makes use of the Social Volume of the asset and that of the top 100 coins by market cap to make the comparison.

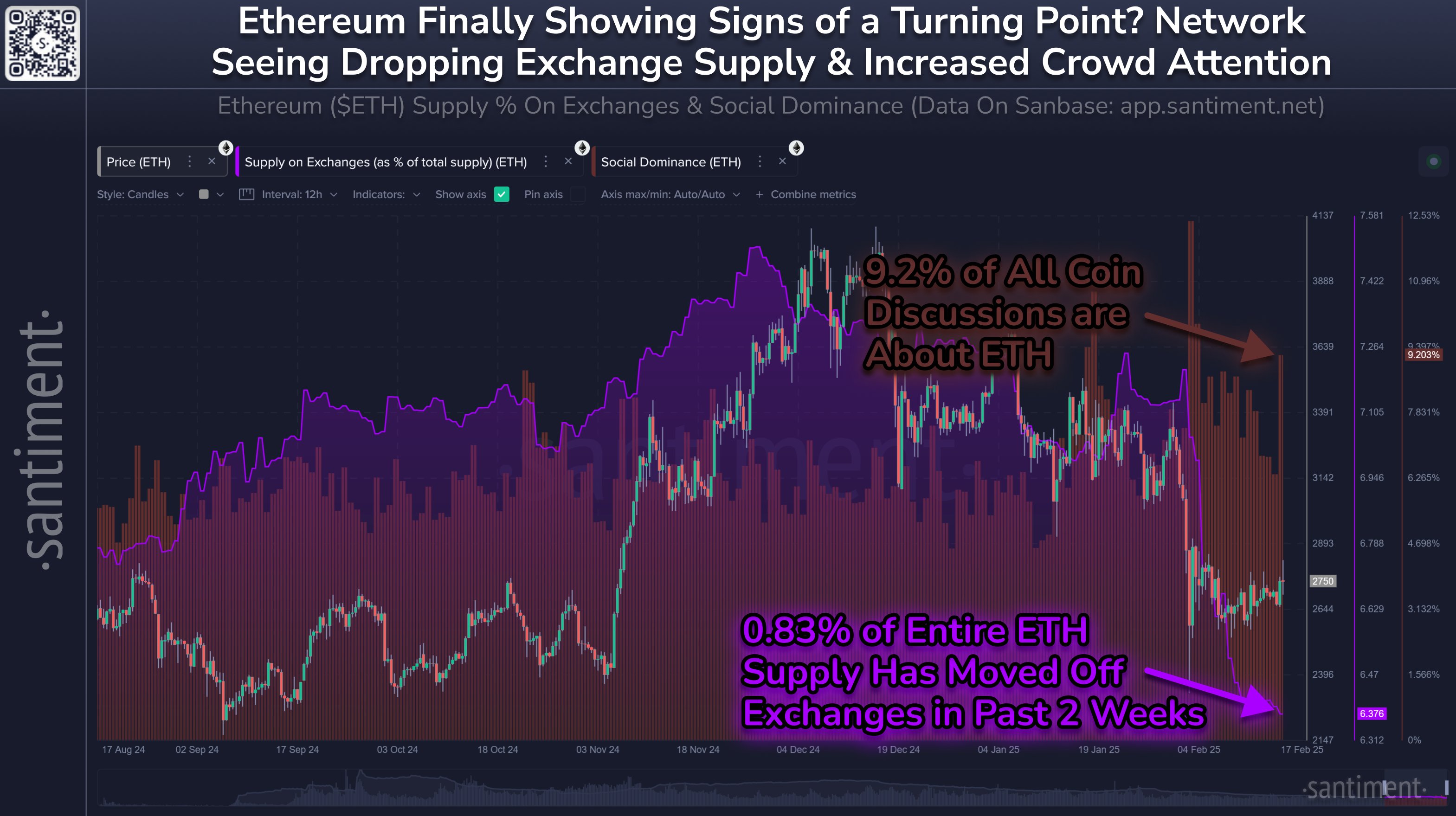

Below is the chart shared by Santiment, which shows the trend in the Social Dominance for Ethereum over the last few months:

As is visible in the graph, the Ethereum Social Dominance has just observed a spike, meaning that the share of social media discussions occupied by the asset has shot up.

Following this increase, the indicator is now sitting at 9.2%, which means almost a tenth of the discussions related to the cryptocurrency sector involve ETH in some form. The asset’s price has been struggling recently, so this renewed interest from social media users may be a positive sign for things to come in the week.

The trend in Social Dominance isn’t the only bullish development that Ethereum has seen, as the data of the other indicator attached in the chart by the analytics firm shows.

It appears that the Supply On Exchanges have plunged during the last couple of weeks, which suggests the investors have been making net withdrawals of the coin from the centralized exchanges. In total, 0.83% of the ETH supply has left exchanges in this period, leaving just 6.38% still sitting on these platforms.

ETH Price

At the time of writing, Ethereum is trading at around $2,700, up 1% in the last week.