XRP Price Faces Pressure as Active Addresses Plunge 53% in a Month

XRP price has dropped nearly 4% in the last 24 hours and is down 21% over the past 30 days, bringing its market cap to $144 billion. The decline comes as key technical indicators flash warning signs, with the Chaikin Money Flow (CMF) hitting its lowest level since June 2022 and active addresses dropping by 53% in the past month.

Additionally, XRP’s EMA lines are forming a death cross, signaling the potential for further downside if the trend continues. With momentum weakening, XRP now faces a critical moment, as traders watch whether the price stabilizes or risks a deeper correction.

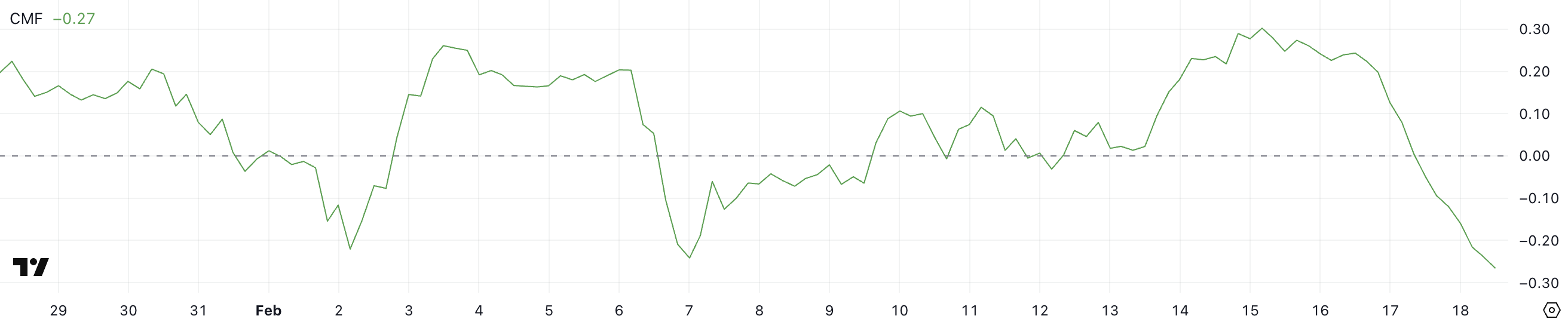

XRP CMF Is Breaking Negative Records

XRP Chaikin Money Flow (CMF) has dropped to -0.27, continuing a steady decline from 0.30 three days ago.

The CMF indicator measures buying and selling pressure by analyzing both price and volume. Values above zero indicate accumulation, and below zero signal distribution.

A sustained decline in CMF suggests that selling pressure is increasing, with more capital flowing out of XRP than into it. This downward trend reflects weakening bullish momentum and could indicate that investors are offloading their positions.

XRP CMF. Source: TradingView.

XRP CMF. Source: TradingView.

This is XRP lowest CMF reading since June 2022, a concerning signal for price action. Historically, prolonged negative CMF levels have preceded extended downtrends, as they indicate persistent capital outflows.

If the indicator remains in negative territory or continues to decline, XRP could face further selling pressure, increasing the risk of deeper price losses.

However, if CMF starts recovering and moves closer to zero, it could suggest stabilization, giving bulls a chance to regain control. For now, XRP remains in a vulnerable position, with traders closely watching whether selling pressure will intensify or ease in the coming days.

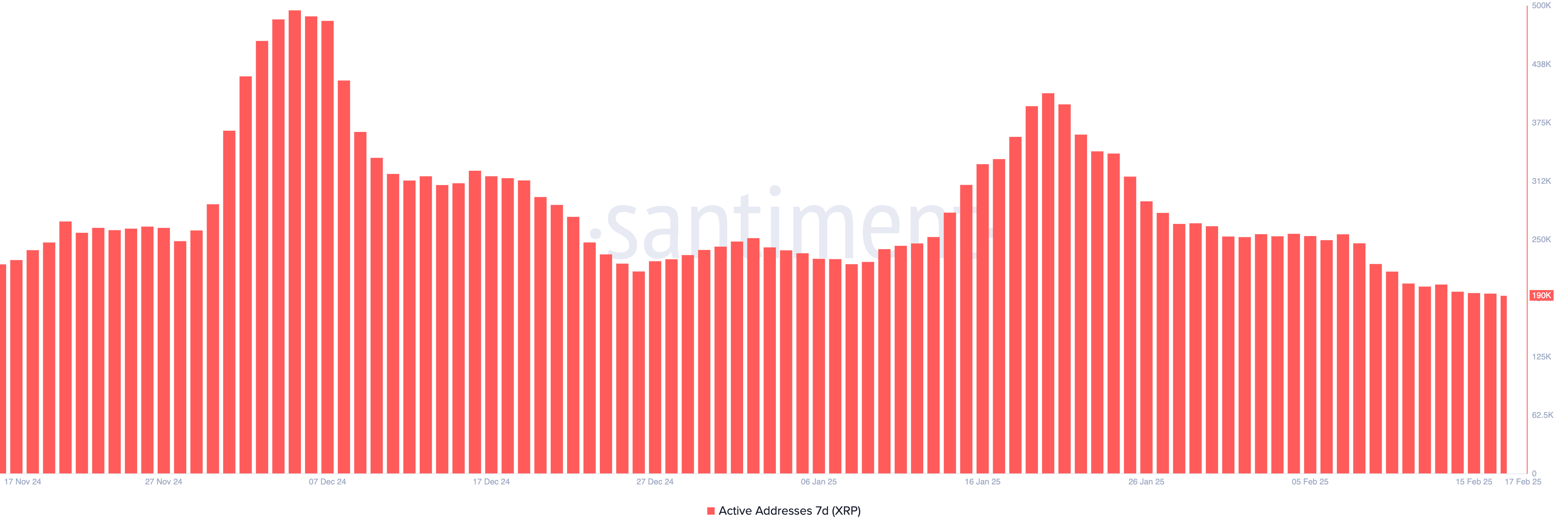

XRP Active Addresses Corrected By 53% In the Last Month

XRP 7-day active addresses have plummeted to 190,470, marking a sharp 53% decline from the 407,000 recorded on January 20. This metric tracks the number of unique addresses involved in transactions over a seven-day period, serving as a key indicator of network activity and overall user engagement.

A drop of this magnitude suggests reduced participation from traders and investors, potentially signaling waning interest or lower transaction demand.

Such a decline can often coincide with weaker price action, as fewer active addresses generally mean lower liquidity and less on-chain activity driving market movements.

7-Day XRP Active Addresses. Source: Santiment.

7-Day XRP Active Addresses. Source: Santiment.

This is XRP’s lowest 7-day active address count since November 14, 2024, reinforcing concerns about declining user engagement. Historically, prolonged declines in this metric have preceded periods of price stagnation or downside pressure, as reduced network activity often reflects fading momentum.

If active addresses continue falling, it could indicate weakening investor confidence, making it harder for XRP to sustain any significant bullish moves.

However, if this metric stabilizes or starts rebounding, it could suggest a renewed interest in the asset, potentially supporting price recovery efforts. For now, XRP remains in a cautious phase, with traders monitoring whether activity will pick up or continue declining.

XRP Price Prediction: Will XRP Face a 29% Further Correction?

XRP’s EMA lines are forming a death cross, with short-term moving averages crossing below long-term ones, signaling a potential bearish trend.

A confirmed death cross often suggests that downside momentum is strengthening, increasing the likelihood of further XRP price declines.

XRP Price Analysis. Source: TradingView.

XRP Price Analysis. Source: TradingView.

If the sell-off intensifies, XRP price could test support at $2.33, and a breakdown below that level could trigger a 29% correction down to $1.77. Such a move would reinforce bearish sentiment and could lead to extended weakness unless buyers step in to defend key levels.

However, if XRP can reverse this trend and regain bullish momentum, it could challenge the $2.83 resistance level.

A successful breakout above this zone could pave the way for a rally toward $3.15. If momentum persists, XRP could push as high as $3.28, marking its first move above $3 in February 2025.