Top 3 Crypto Narratives to Watch For the Third Week of February

Crypto narratives continue to shift, with Automated Market Makers (AMMs), trading bots, and perpetuals emerging as key trends this week. AMM protocols like UNI, CAKE, and PENDLE are gaining momentum, fueled by Uniswap’s Unichain launch and BNB’s strength.

Trading bots remain highly profitable, with Photon and BullX generating more fees than Ethereum in the last seven days. Meanwhile, perpetuals platforms are seeing renewed interest, with HYPE leading the category and Hyperliquid maintaining its dominance in revenue generation.

Automated Market Makers (AMMs)

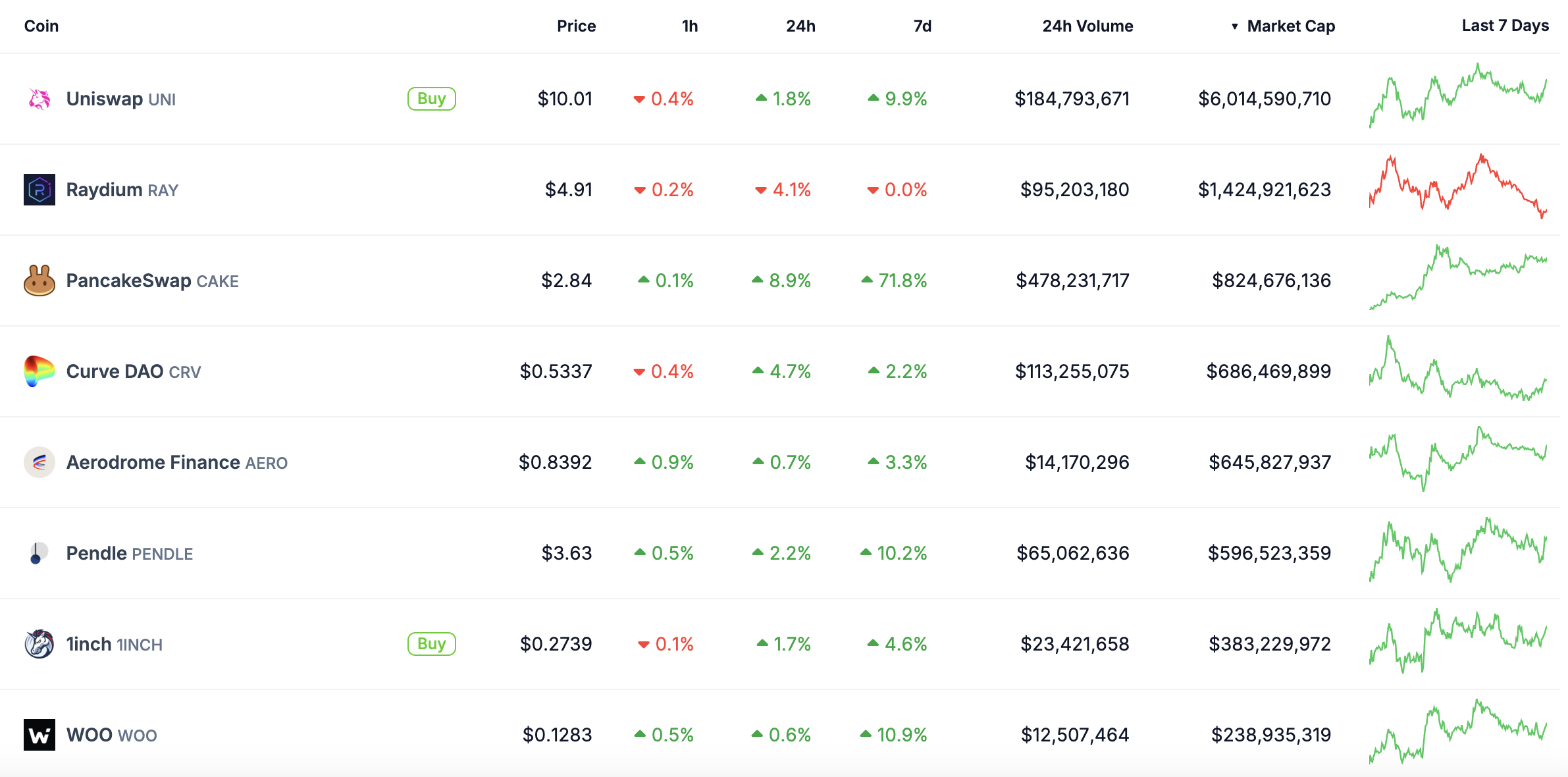

UNI, CAKE, PENDLE, and WOO have all risen in the past week making it one of the hottest crypto narratives at the moment. Uniswap’s launch of Unichain strengthens its ecosystem, while BNB’s momentum has fueled CAKE’s 70% surge.

If these catalysts persist, AMM protocols could see further gains.

Biggest AMM Coins by Market Cap. Source: CoinGecko.

Biggest AMM Coins by Market Cap. Source: CoinGecko.

Automated Market Makers (AMMs) are decentralized protocols that allow trading without order books, using liquidity pools instead. Traders swap assets against these pools, while liquidity providers earn fees.

RAY has moved sideways but remains highly profitable, generating $270 million in fees in 30 days. Despite Solana’s downtrend, a resurgence in Solana meme coins could drive renewed interest in RAY. Its strong fundamentals keep it positioned for a potential breakout.

Trading Bots

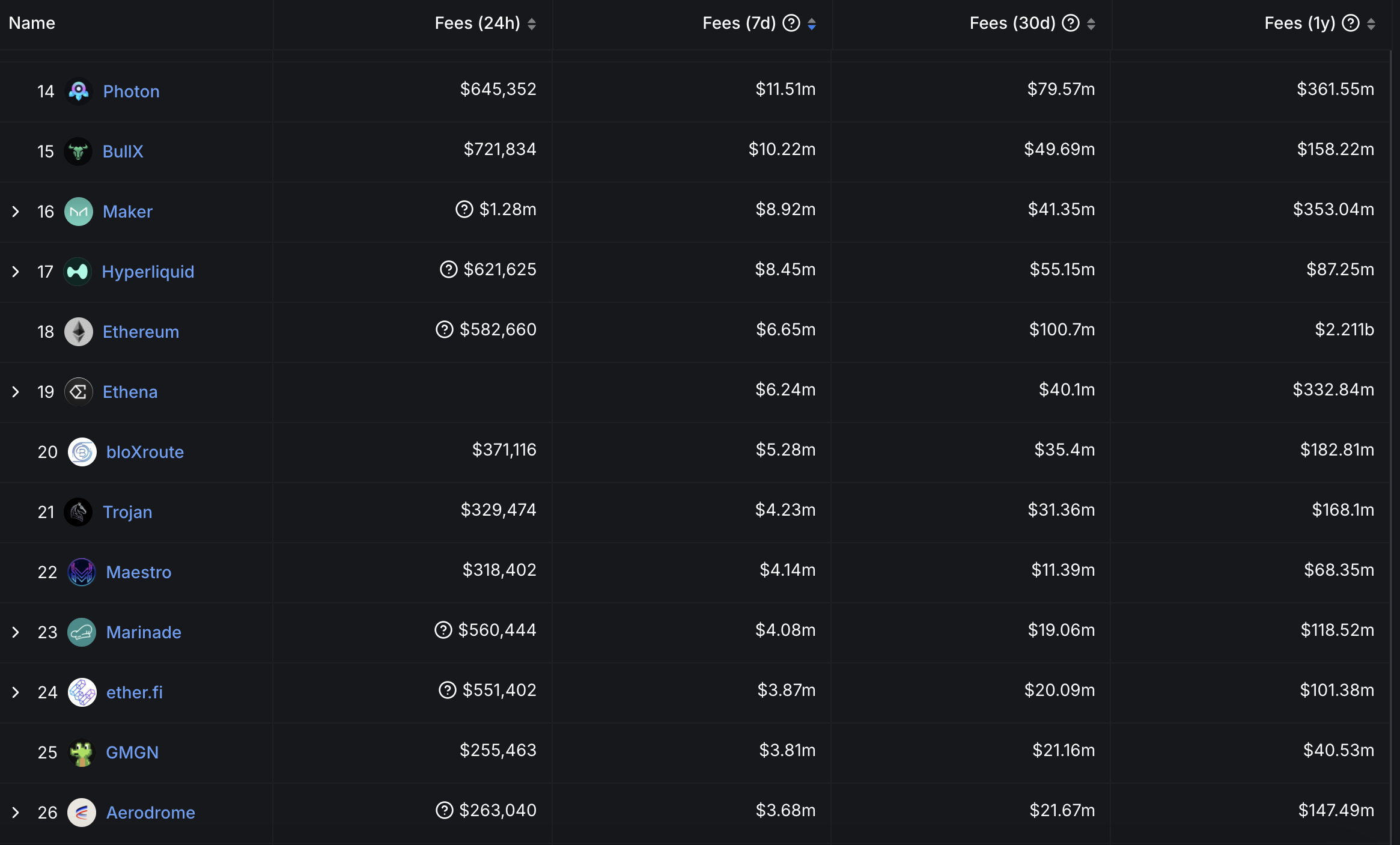

Trading bots have been one of the biggest crypto narratives since the end of 2023, as these applications continue to generate a lot of revenue and attract hundreds of thousands of users per day. Five of them rank in the top 25 for revenue among all crypto protocols.

Crypto Trading Bots are automated programs that execute buy and sell orders based on predefined strategies, eliminating the need for manual trading. Almost all of them are based on Telegram, although some also have desktop options.

In the last seven days, Photon and BullX generated over $10 million in fees, surpassing Ethereum, which made $6.6 million.

Fees/Revenue for Selected Protocols and Chains. Source: DeFiLlama.

Fees/Revenue for Selected Protocols and Chains. Source: DeFiLlama.

Other bots, such as Trojan, Maestro, and GMGN, are also thriving. Each generated over $3 million in fees in the past week.

Despite Solana’s price decline, trading bots continue to attract users. With more coins being created daily and some analysts predicting 1 billion coins by 2030, these bots are unlikely to slow down, which could benefit coins like BONK and BANANA, which are related to BonkBot and BananaGun trading bots.

Perpetuals

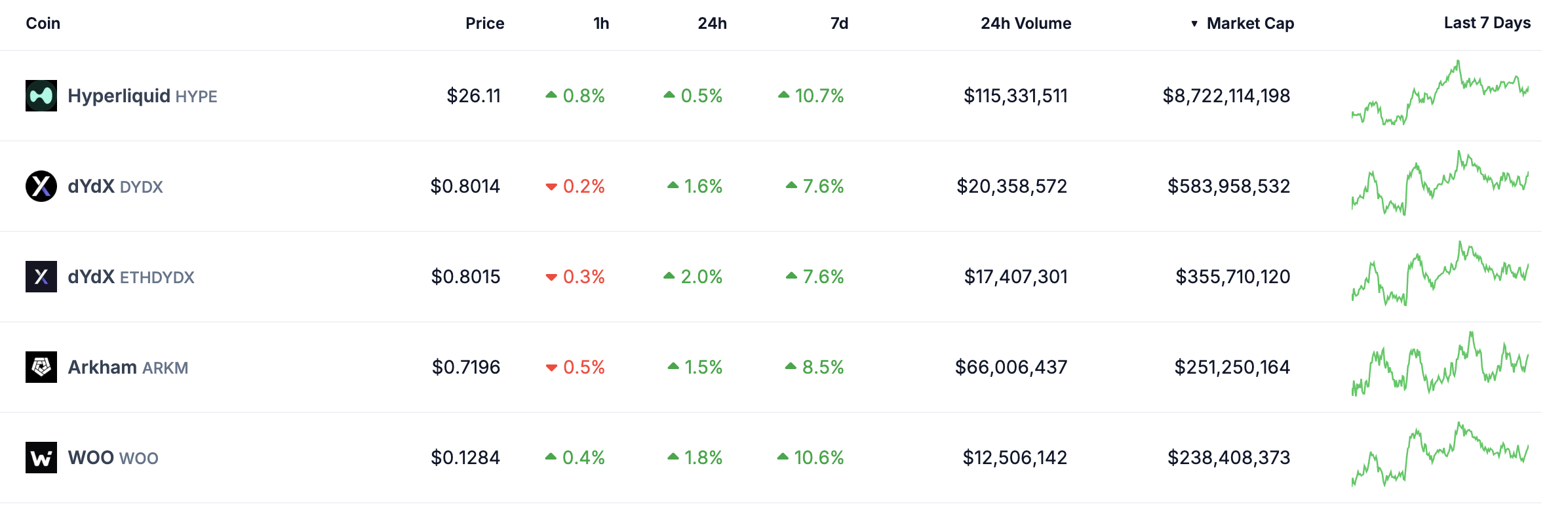

Perpetuals coins seem poised for a rebound, with the top five all gaining in the past week. HYPE leads the pack, up more than 10% in seven days. This momentum signals growing interest in the sector after HYPE struggled for some weeks.

Perpetuals platforms exchanges that allow traders to trade perpetual futures contracts without an expiration date. These platforms enable users to take long or short positions with leverage, using a funding mechanism to keep contract prices aligned with the spot market.

Biggest Perpetuals Coins by Market Cap. Source: CoinGecko.

Biggest Perpetuals Coins by Market Cap. Source: CoinGecko.

Hyperliquid remains the dominant force in perpetuals, generating $8.45 million in fees in just the last week.

HYPE is the clear leader, with a market cap and revenue bigger than all other players combined. However, this dominance suggests room for competitors to emerge, just as happened with trading bots. Once controlled by BONK, BANANA, and Maestro, the market later saw Trojan, BullX, and Photon gain significant ground.