Bitcoin Price Outlook: Will BTC Rebound Or Drop To $76,000?

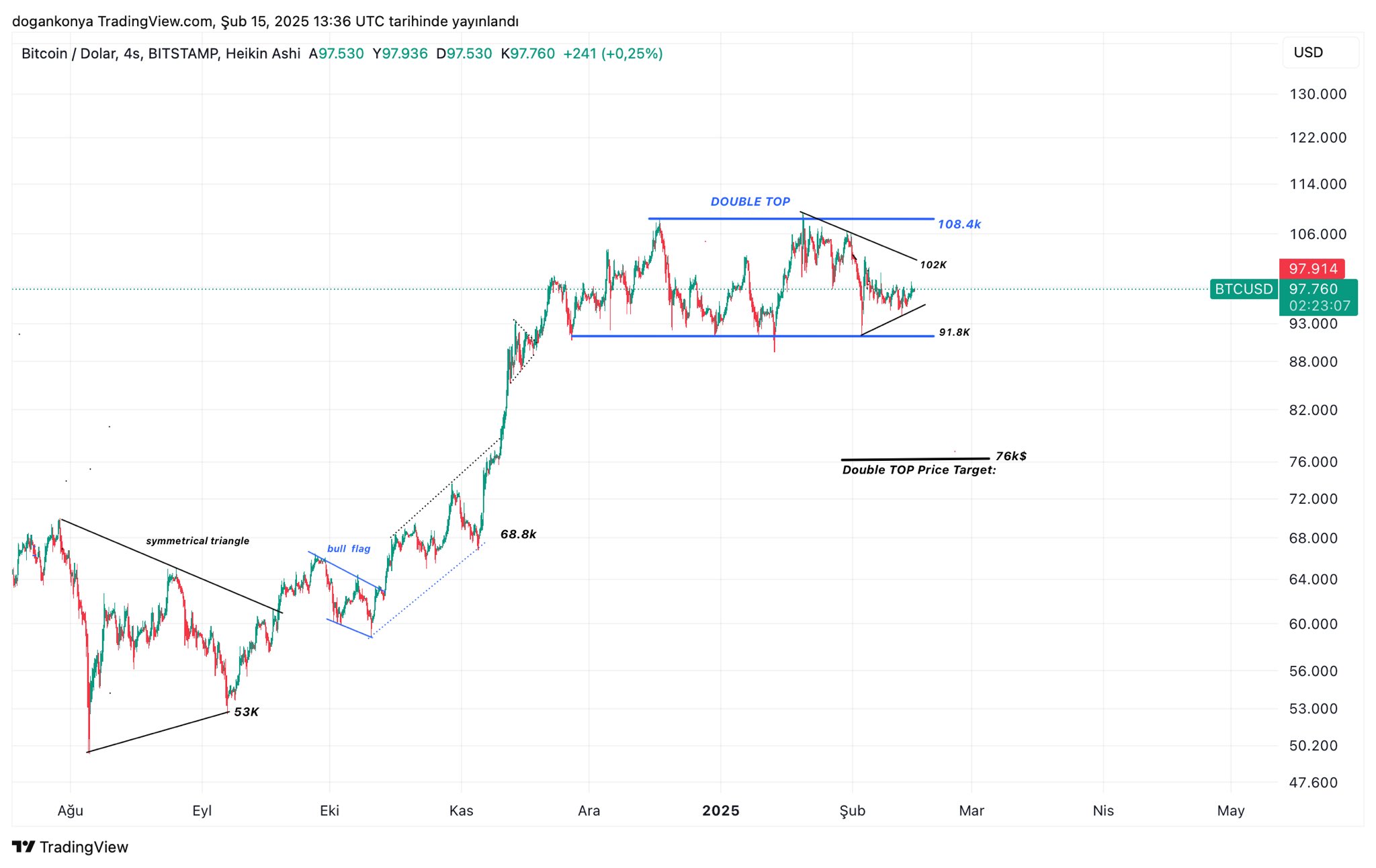

The price of Bitcoin (BTC) has shown only sideways movement in the last day resulting in a minor price loss of 0.37%. In the larger timeframe, BTC remains in a strong consolidation range between $95,000-$98,000, putting majority of traders on alert for an immediate breakout. Meanwhile, a market analyst with X username Cryptododo7 has shared some insights on the current BTC market structure highlighting the influential key price levels in the short term.

Bitcoin At Major Crossroads – Is A Crash To $76,000 Feasible?

Bitcoin registered a new all-time high of $109,114 on January 20 as US President Donald Trump assumed office. However, the premier cryptocurrency has struggled to establish any robust bullish momentum since then, sliding into falling ranges of consolidation.

Currently, BTC trades around $97,000 with no inkling on its future direction. According to Cryptododo7 in an X post on February 15, the asset’s descent from $109,000 has formed a strong downtrend resistance with $102,000 acting as the third point of resistance.

In the case of any price breakout, the crypto analyst postulates Bitcoin will experience a significant decline if it fails to break past $102,000 presenting a serious opportunity to short the market. In that case, Cryptododo7 is banking on BTC to fall to $84,000 which represents a potential support zone where a substantial amount of buyers may step in.

However, if the current Bitcoin position continues to weaken resulting in a steady price fall, the next critical level to watch is $91,800. Cryptododo7 warns that a price break below $91,800 would likely create a backrest scenario where prices temporarily retest this level as resistance before declining further. In such a case, Bitcoin could fall to $76,000 which aligns with historical double-top structures that often act as a strong support or reverse zone.

Market Bulls On Hold Until $108,400 Breakout

In terms of resuming its bull run, BTC must show signs of reclaiming its previous highs of which $108,400 is likely the final confirmation of a bullish reversal.

According to Cryptododo7, a successful price close above the $108,000 level on both a daily and weekly basis would invalidate all bearish predictions signaling a renewed uptrend, with potential for new price discoveries. At press time, Bitcoin trades at $97,593, following a 1.18% gain in the past week. However, daily trading volume is currently down at 45.53% and valued at $17.38 billion.

Featured image from iStock, chart from Tradingview