Crypto and Wall Street traders brush off Trump’s global tariff war threats

Wall Street traders are tuning out President Donald Trump’s global tariff war threats. Despite the president’s push for reciprocal tariffs on virtually everyone on Thursday, stocks surged, bonds held steady, and crypto traders hardly moved.

The S&P 500 climbed 1.5%, sitting near record highs. 10-year Treasury yields dropped for the fifth straight week, the longest rally since 2021. Junk bond ETFs rallied as investors ignored political noise. Bank of America’s Market Risk indicator—a key measure of expected price swings—fell into negative territory, which basically tells us that traders see no reason to panic.

In his hearing on the Hill on Tuesday, Fed chair Jerome Powell admitted this week that he still has work to do in bringing inflation down, but even that barely moved the needle. The economic policy uncertainty index, tracked by US academics, hit levels last seen during the 2008 financial crisis and the 2020 pandemic.

Markets refuse to panic

The reason markets are unimpressed is because investors have seen this before. Trump’s trade war threats didn’t crash markets in his first term, and traders aren’t betting they will now. UBS Group AG reported on Thursday that recent volatility spikes in the stock market have faded at the fastest rate on record.

Bitcoin’s Realized Volatility—a metric measuring how much BTC price moves—has collapsed, according to CryptoQuant analyst Axel Adler Jr. Historically, extreme volatility lows signal explosive price action ahead.

Even a small shift in capital from stocks to Bitcoin could push BTC beyond $105,000, according to CryptoQuant’s analysis.

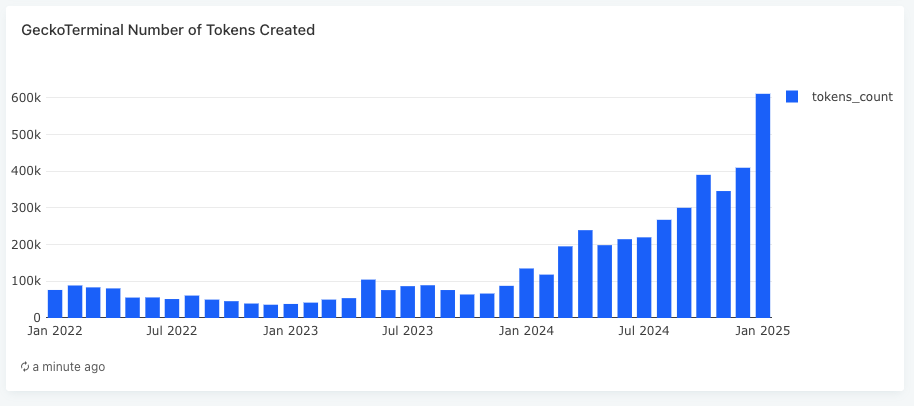

Meanwhile, crypto issuance has surged. Over 600,000 new cryptos launched in January 2025, a 12x increase from a year ago, according to GeckoTerminal data.

“Back in 2022-2023, we saw around 50,000 new tokens per month,” CoinGecko co-founder Bobby Ong posted on X. “Fast forward to Q4 2024, and we’re seeing 400,000 new tokens/month—with January hitting a record 600,000.”

A major driver of this flood is Pump.Fun, a platform making it easier than ever to launch tokens. But this token explosion is stretching liquidity thin, keeping altcoins from reclaiming their 2021 highs.

The crypto market sends mixed signals

Spot Bitcoin ETFs in the US have seen $651 million in net outflows since February 10, raising concerns that Bitcoin could drop below $95,000—a key support level for the past 30 days. And if the ETF outflows continue at this rate, the market could shrink by $1.65 billion within a week.

Meanwhile, Strategy (formerly MicroStrategy), Metaplanet, KULR Technology, and even Italy’s Intesa Sanpaolo have increased their Bitcoin reserves.

Retail investors are also stepping up. Wallets holding between 0.1 and 1 BTC added over $80 million worth of Bitcoin between February 3 and February 13, reversing a two-week decline.

But Google search interest in Bitcoin has collapsed over the past three months, so the retail traders aren’t piling in like they did in 2021.

Bitcoin searches peaked in November 2024, right before BTC surged 38% in ten days, but even after hitting an all-time high of $109,340 on January 20, search interest didn’t spike.

Cryptopolitan Academy: Are You Making These Web3 Resume Mistakes? - Find Out Here