B3 Price Surges to Become One of the Biggest Coins on Base Chain

B3 price surged roughly 50% on February 12, making it one of the fastest-growing tokens launched on Base in recent months. As a gaming-focused project founded by former Base team members, B3 has also become one of the most talked-about gaming coins this cycle.

Despite its strong rally, technical indicators suggest that trend momentum is easing, and selling pressure has started to increase. Whether B3 can sustain its bullish momentum or face a deeper correction will depend on key support and resistance levels in the coming sessions.

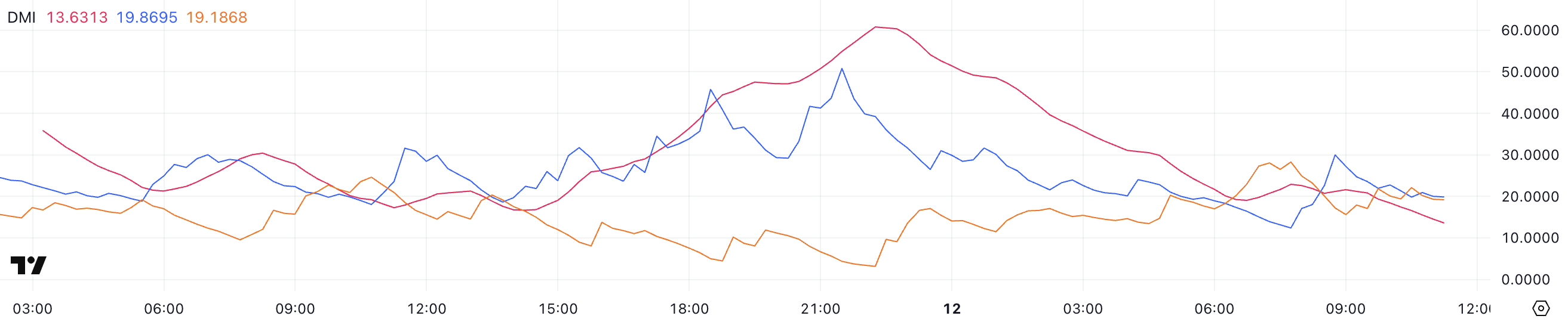

DMI Chart Shows B3 Trend Is Easing

B3 – which defines itself as an “Open Gaming Layer-3” – DMI chart shows a sharp decline in its ADX, dropping from 60.8 to 13.6 in the last 12 hours, signaling a rapid loss of trend strength.

The ADX (Average Directional Index) measures the strength of a trend, with values above 25 indicating a strong trend and values below 20 suggesting weakness or consolidation.

While a high ADX confirms a strong trend, a sudden drop like this often points to fading momentum or a potential shift in market direction.

B3 DMI. Source: TradingView.

B3 DMI. Source: TradingView.

Despite this decline in trend strength, B3 is still in an uptrend, as indicated by the +DI at 19.8, though it has fallen from 30. Meanwhile, the -DI has risen from 15.6 to 19.1, showing increasing selling pressure for the gaming coin.

Since the +DI and -DI remain close, the market is at a critical point where a decisive move could define the next trend.

If +DI regains strength, the uptrend could resume, but if -DI continues rising, B3 may enter a consolidation phase or even a downtrend. Since yesterday, B3 has surged, becoming the 9th biggest asset on Base in terms of market cap, ahead of famous tokens like AIXBT.

With its recent surge, it became the biggest gaming coin on Base ecosystem.

B3 CMF Is Currently Negative, After Staying Positive Between Yesterday and Today

B3’s CMF is currently at -0.08 after remaining positive for several consecutive hours between yesterday and today. The Chaikin Money Flow (CMF) measures the buying and selling pressure based on volume and price action, with values above zero indicating accumulation and values below zero signaling distribution.

A rising CMF suggests stronger buying interest, while a declining or negative CMF points to increasing selling pressure. Earlier, B3’s CMF dropped to a negative peak of -0.22, showing a brief period of heavy outflows before attempting to recover.

B3 CMF. Source: TradingView.

B3 CMF. Source: TradingView.

Although B3’s CMF has rebounded from its lowest levels, its remaining negative at -0.08 suggests that selling pressure is still present. This could indicate a weakening of bullish momentum, making it harder for the price to sustain an uptrend.

If CMF continues to recover and turns positive again, it would signal renewed accumulation, potentially supporting a price rebound. However, if it declines further, it may confirm increasing sell-side pressure, leading to further downside or prolonged consolidation.

B3 Price Prediction: Will B3 Rise More 42%?

B3’s EMA lines still indicate bullish momentum, as short-term EMAs remain above long-term ones. However, the narrowing gap between them suggests that buying pressure may be weakening.

The price is currently near a key support level at $0.01259, which will be crucial in determining the next move. If this support is tested and fails, B3 could see a significant drop, potentially falling to $0.0068 or even $0.0053, marking a steep 61% correction, as gaming coins still try to perform well this cycle.

B3 Price Analysis. Source: TradingView.

B3 Price Analysis. Source: TradingView.

On the other hand, if the uptrend strengthens, B3 could push toward the $0.016 resistance level.

A breakout above this level could signal renewed bullish momentum, leading to a move toward $0.0195, representing a 42% upside, potentially making it one of the most relevant new cryptos in the Base ecosystem.