US Inflation Surges to 3% as Crypto Market Shows Bearish Sentiment

According to the latest CPI data, US inflation hit 3% year-over-year on February 12, 2025, while core inflation reached 3.3%. The report beat expectations, and crypto investors are already reacting negatively.

The overall crypto market cap fell by 5% today, and Bitcoin slipped below $95,000.

Soaring Inflation Can Hurt Crypto Market’s Momentum

This inflation marks the highest level since June 2024. Market players worry that the Fed might tighten policy sooner than expected. They favor safer assets over riskier ones like crypto. Short-term volatility in crypto looks likely as traders adjust positions.

Investors watch the situation closely. Some may exit crypto for less volatile investments. This shift could lead to more price swings. Analysts expect the market to remain unsettled until the Fed offers clear signals.

Yesterday, Fed Chairman Jerome Powell told a Senate Banking Committee that he is not in a hurry to cut interest rates. President Trump pressed for bigger rate cuts to counter high inflation. Powell, however, held firm on his stance.

Market participants now brace for further adjustments as they await additional policy updates.

“A bit of reverse wealth effect may be the top factor to alleviate inflation, which means highly speculative crypto’s at the forefront. The US stock market added about $12 trillion of market capitalization in 2024 – the most ever and about 40% of GDP. It may be silly to expect inflation to drop until risks assets do, with the stock market cap stretched to over 2x GDP – the most in about a century,” wrote analyst Mike McGlone.

The market was already reeling from Trump’s earlier tariffs on Canada, Mexico, and China. The potential of a trade war and macroeconomic factors triggered a $2 billion liquidation in the crypto market on February 3.

Some reports suggested that liquidations were more than $10 billion, exceeding the 2022 levels during the FTX collapse.

However, the market has since rebounded to some extent after tariffs against Canada and Mexico were paused for a month. Today’s inflation data might have a broader effect on the short-term bearish sentiment.

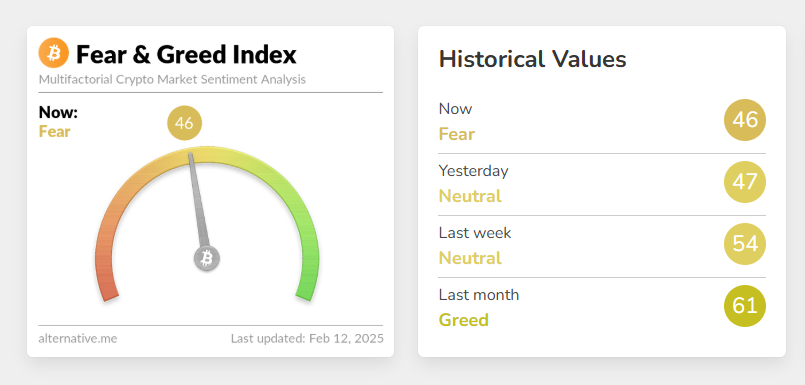

Since today’s CPI announcement, Bitcoin’s Fear and Greed index has dropped to ‘Fear.’ Many analysts, including Arthur Hayes, recently predicted that BTC might drop to $70,000 given the current uncertain macroeconomic conditions.

Bitcoin Fear and Greed Index. Source: Alternative

Bitcoin Fear and Greed Index. Source: Alternative

Yet, long-term predictions are still bullish. Most analysts project that the asset will likely surge to new all-time highs before the end of the year.