Stablecoin market expands in 2025, signaling bullish outlook for Bitcoin

The stablecoin market has significantly risen in value and has gained around $16.97 billion in 2025, as reported by blockchain analytics firm Glassnode. The total supply of cryptocurrencies has shot up slightly from around $194.2 billion to $211.2 billion in circulation, highlighting growing liquidity in the crypto sector.

#Stablecoin circulating supply has increased by $16.97B since the start of 2025, rising from ~$194.2B to ~$211.2B. However, the pace of growth has varied, with a slowdown in early 2025 before picking up again in February. pic.twitter.com/Tda7t3fs8T

— glassnode (@glassnode) February 11, 2025

The stablecoin issuance has fluctuated throughout the year. Between November and December 2024, the market grew nearly $450 million a day. In January 2025, issuance averaged $400 million per day. While momentum in February seemed to have faltered, the past few days have been infused with new life as stablecoin supply has grown by an average of $541 million per day.

A key shift was recorded around mid-January when the seven-day average issuance exceeded the 30-day simple moving average (SMA) indicating short-term demand and capital inflows into crypto markets. “The market’s liquidity is growing again,” the firm further added.

An increase in the supply of stablecoin usually equals an increase in purchasing power for digital assets. Stablecoin holders tend to be set up to pump more Bitcoin and other crypto, which helps the price rise.

Market leaders in the stablecoin sector

Tether (USDT) remains the dominant stablecoin, with a market cap of $142.32 billion, holding 63% of total market share according to DefiLlama. Moreover, in the last 30 days, USDT’s supply has increased by more than 4 billion.

USD Coin by Circle (USDC) has recovered from prior losses and now has a market cap of $56.17 billion, according to CoinMarketCap. This is an improvement from $45.6 billion in January and higher than the low of $24.1 billion recorded in November, 2023.

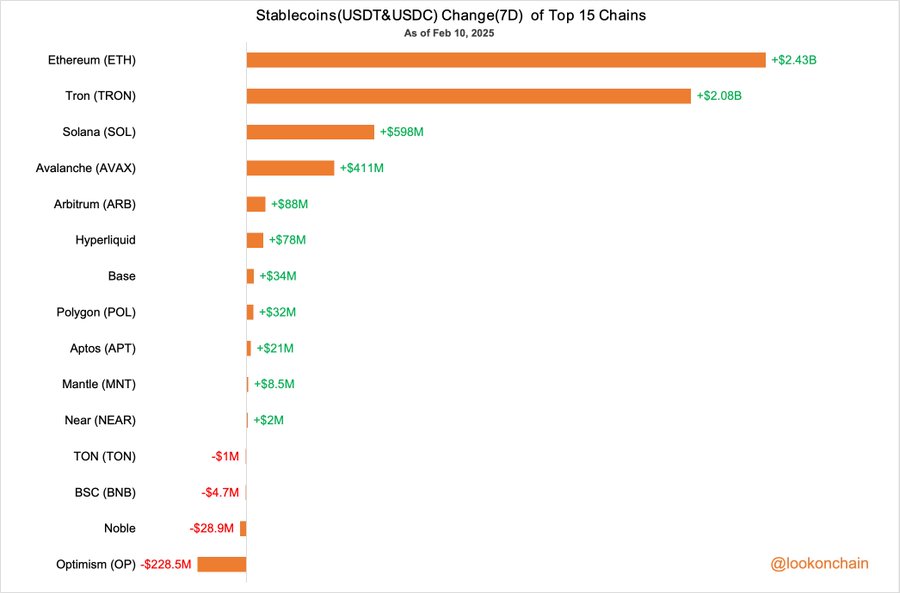

Notably, according to Lookonchain, stablecoin activity on both Ethereum and Tron has also increased by $4.5 billion.

Regulatory developments in the stablecoin sector

The expanding market of stablecoins has drawn attention from U.S. policymakers. Stablecoin policies have been a topic of interest in US cryptocurrency policies since the beginning of President Donald Trump’s administration.

White House AI and crypto advisor David Sacks has noted that stablecoins have the potential to increase the role of the U.S. dollar in the international market.

Legislators are now planning and initiating the process of drafting appropriate legislation. Last week, the U.S. Senate and the House of Representatives introduced bills to regulate dollar-linked stablecoins under federal law. Republican Senator Bill Hagerty proposed the Guiding and Establishing National Innovation for U.S. Stablecoins (GENIUS) Act.

On the same day, House Financial Services Committee Chairman French Hill (AR-02) and Digital Assets, Financial Technology, and Artificial Intelligence Subcommittee Chairman Bryan Steil introduced the Stablecoin Transparency and Accountability for a Better Ledger Economy Act of 2025 (STABLE Act of 2025) discussion draft.

Cryptopolitan Academy: FREE Web3 Resume Cheat Sheet - Download Now