Bitcoin ‘Permanent Holder’ Demand Is Sharply Rising: Fresh Rally Incoming?

On-chain data shows the Bitcoin investors with no history of selling are back to intense accumulation, a sign that could be bullish for BTC’s price.

Bitcoin Accumulation Addresses Have Been Showing High Demand Recently

In a new post on X, the on-chain analytics firm CryptoQuant has talked about how the demand is looking from the Permanent Holders of Bitcoin. Permanent Holders, also known as Accumulation Addresses, refer to the BTC wallets that have never made an outflow transaction.

That is, the Permanent Holders are the investors who only have a history of buying and none of selling. There are also a few other restrictions on which addresses can fall inside this category, with a key one being that they shouldn’t be associated with miners or exchanges.

The reason behind this is that these two entities sort of play the role of selling pressure in the market. As such, the holdings attached to them can be looked at as the ‘sell supply’ of the cryptocurrency, which is the exact opposite of what the Accumulation Addresses represent.

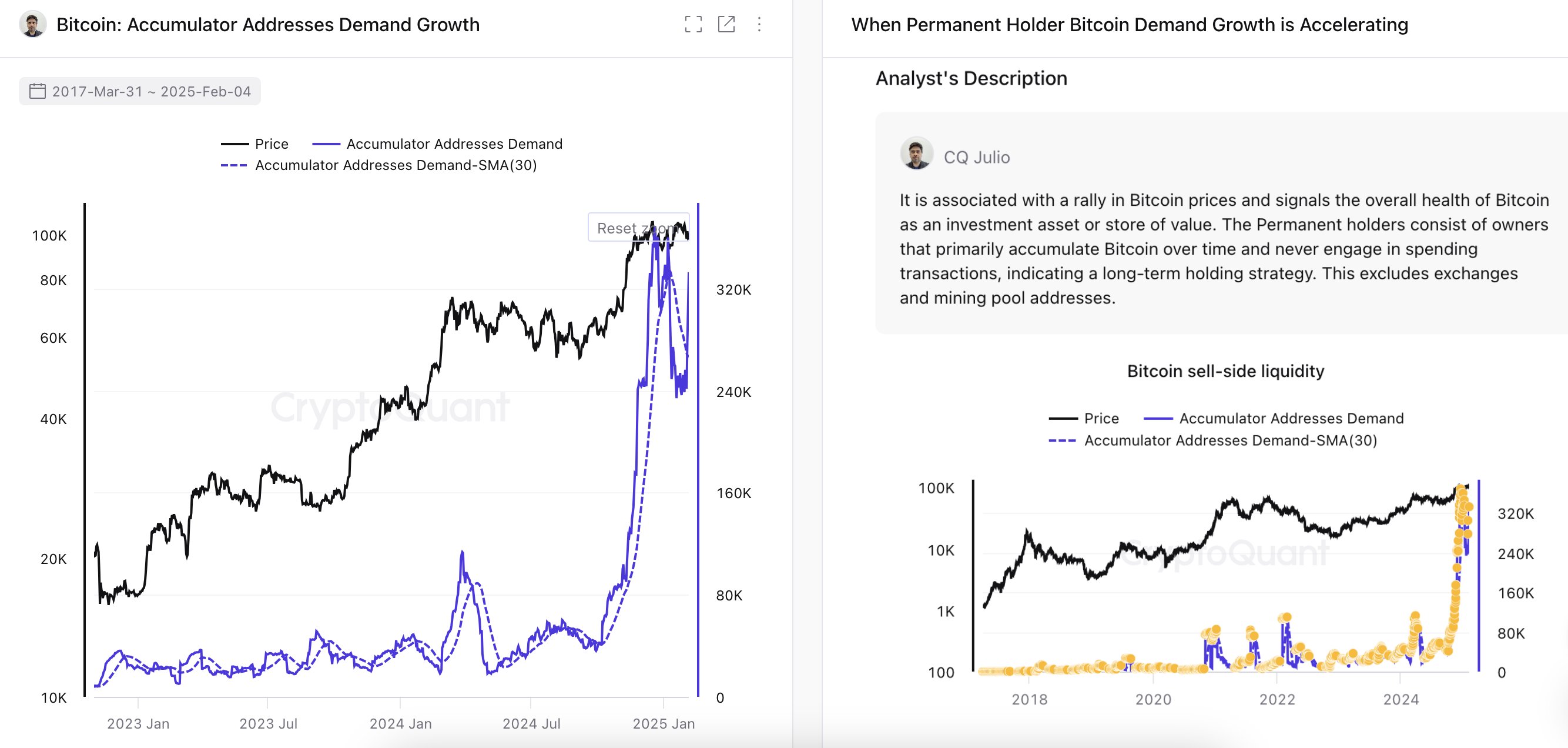

Now, here is the chart shared by the analytics firm that shows the trend in the demand coming from these investors over the last couple of years:

As displayed in the above graph, the Bitcoin Accumulation Addresses were going through a buying spree during the last couple of months of 2024, but in January of this year, they saw their demand sharply go down and drop below the 30-day simple moving average (SMA).

Clearly, the accumulation from this cohort was what supported the bull run and it going away was the probable reason behind the slowdown in the cryptocurrency’s price that followed.

In the last few days, though, demand from the group has once again been showing acceleration, meaning that supply is constantly being locked in the hands of these HODLers.

The indicator has now also broken back above the 30-day SMA in a sharp fashion, similar to the breakout of 2024. “Historically, this signals strong confidence and often precedes rallies,” notes CryptoQuant.

The Permanent Holders are actually not all going to be ‘permanent,’ as one day at least a part of this group would sell to harvest the profits of their patience. Nonetheless, investors who have no history of selling are likely to sustain it for at least some length of time, which is why buying from Accumulation Addresses is considered bullish.

The cohort can now be to keep an eye on in the near future, as where their demand trends could end up being crucial for Bitcoin. Naturally, a continuation of the upwards trajectory would be a positive sign, while a slowdown could lead to flat action in the asset.

BTC Price

Bitcoin has been unable to decide a direction in the last few days as its price is still trading around the $98,700 mark.