Chainlink’s large wallet holders pull $216 million worth of LINK out of exchanges, fuel gains

- Chainlink has observed accumulation by large wallet investors and entities.

- LINK’s large wallet holders are pulling their holdings off exchanges, reducing the altcoin’s circulating supply.

- LINK price climbed nearly 5% in the past week, the altcoin could revisit its 2024 high.

Chainlink has noted accumulation by entities and holders in the past two weeks. The altcoin recently rallied to a peak of $20.85 on February 12.

Also read: Arbitrum captures lion share of derivatives transaction volume, ARB price likely to revisit 2024 peak

Chainlink accumulation fuels gains in the altcoin

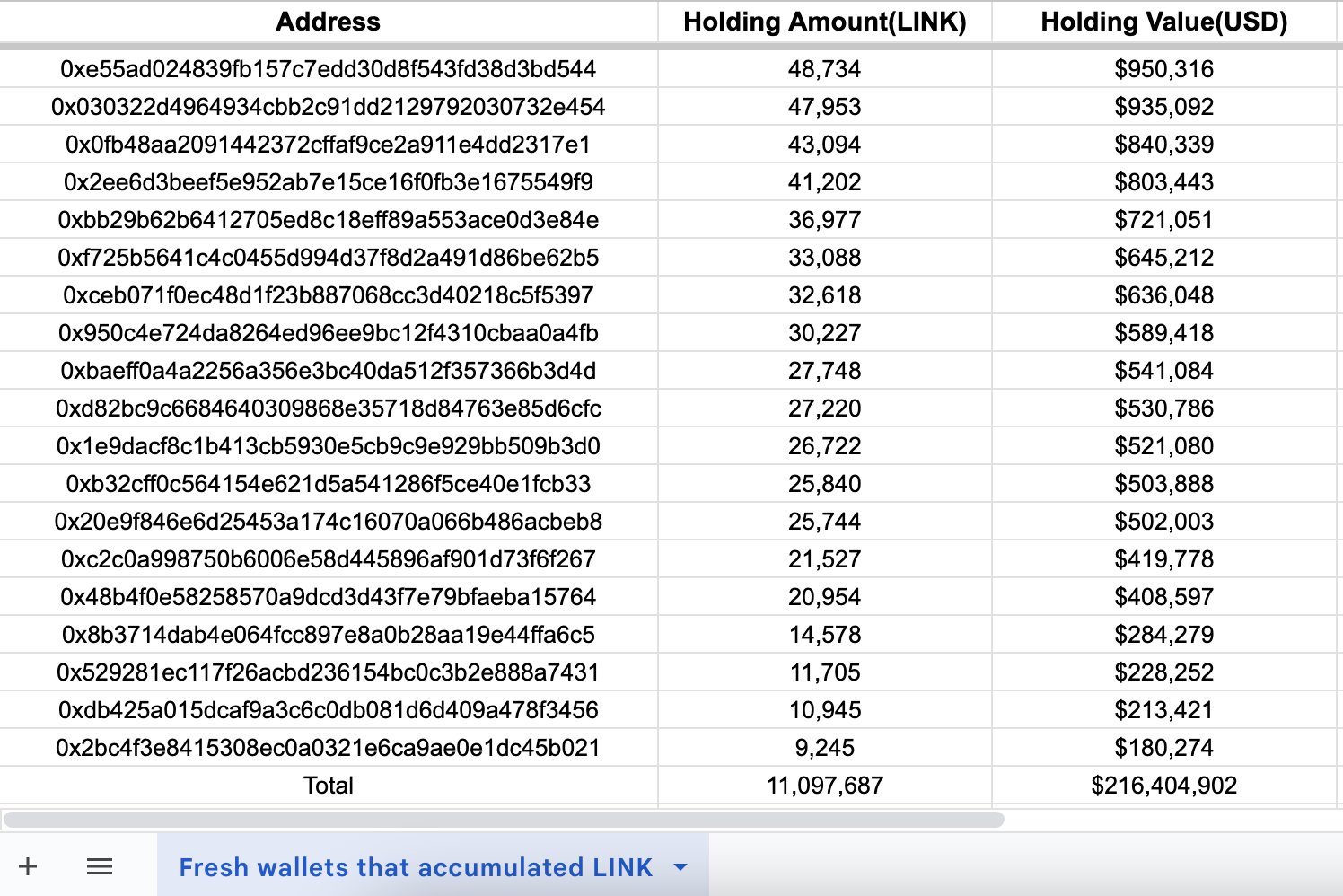

Crypto intelligence tracker Lookonchain identified that 83 fresh wallets, likely belonging to the same institution, have withdrawn a total of 11,097,687 LINK tokens worth $216.4 million from Binance.

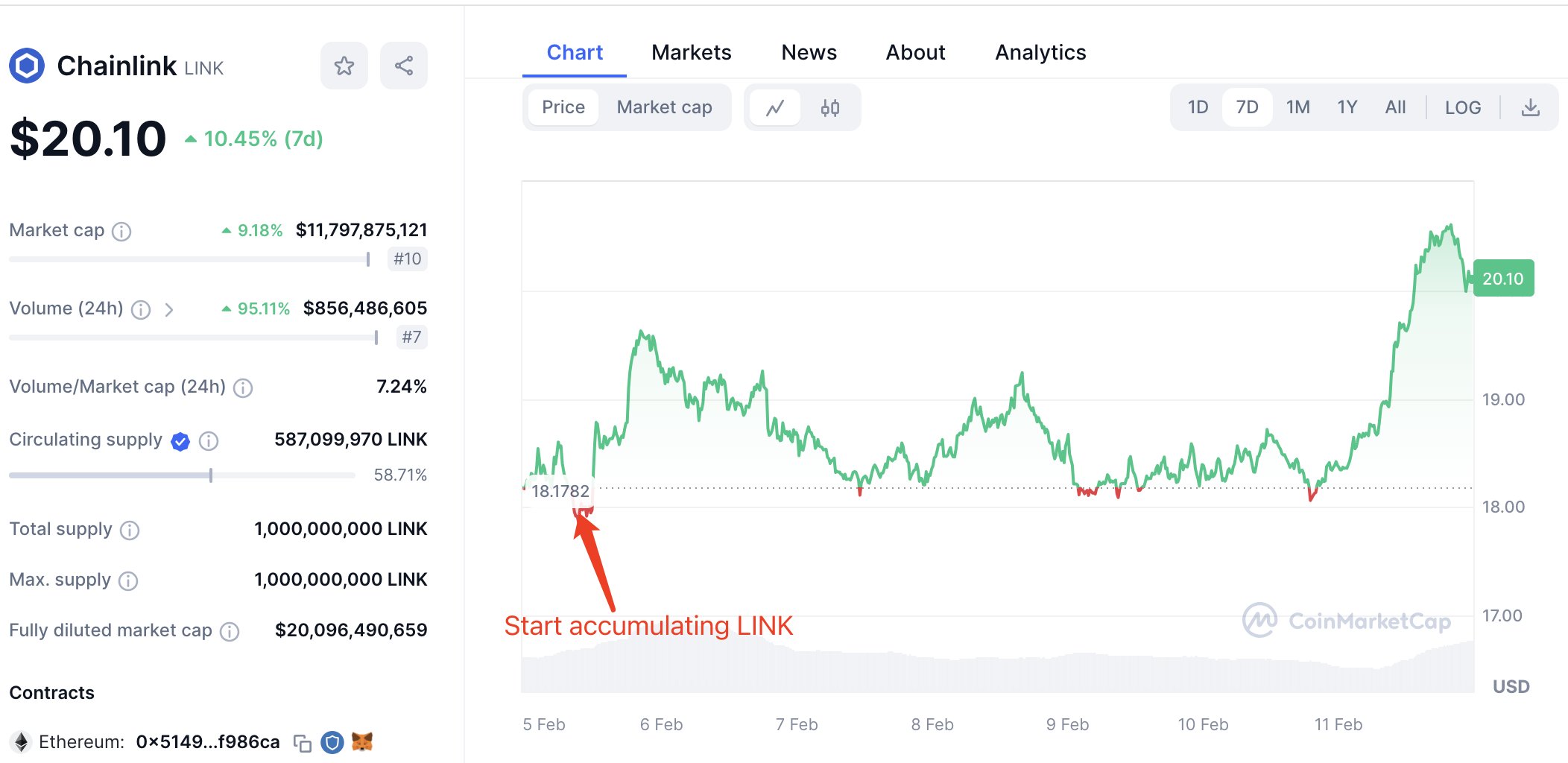

In the past two weeks, over 11 million LINK were effectively pulled out of circulation, likely positively influencing the asset’s price. In the past week, LINK price climbed nearly 5%.

LINK wallet accumulation. Source: Lookonchain

The whale behind these wallet addresses has previously accumulated LINK and positively influenced the asset’s price. In the second week of February, the whale scooped up 5,587,368 LINK tokens worth $112 million from Binance, via 55 addresses. This was followed by a 15% increase in LINK price, in the same timeframe.

Among other catalysts, whale activity has therefore emerged as a key influencer of Chainlink price.

Chainlink accumulation by whales. Source: Lookonchain

LINK price is currently above the 23.6% Fibonacci Retracement level of the climb to Chainlink’s 2024 peak, at $18.81. This level is likely to act as support for LINK in its climb towards the 2024 peak of $20.85.

In the event of a daily candlestick close below $18.81, LINK price could nosedive to 38.2% Fibonacci Retracement at $17.54, before a recovery.

LINK/USDT 1-day chart