Artificial Superintelligence Alliance (FET) Whales Accumulate After 34% Price Crash

Artificial Superintelligence Alliance (FET) has recently experienced a sharp 34% price decline, marking its largest drop in months. This crash validated a three-month-old pattern, which predicted such a correction.

While investors are suffering historic losses, whales seem to be capitalizing on the lower prices, indicating potential confidence in a future recovery.

Artificial Superintelligence Alliance Investors Are Spooked

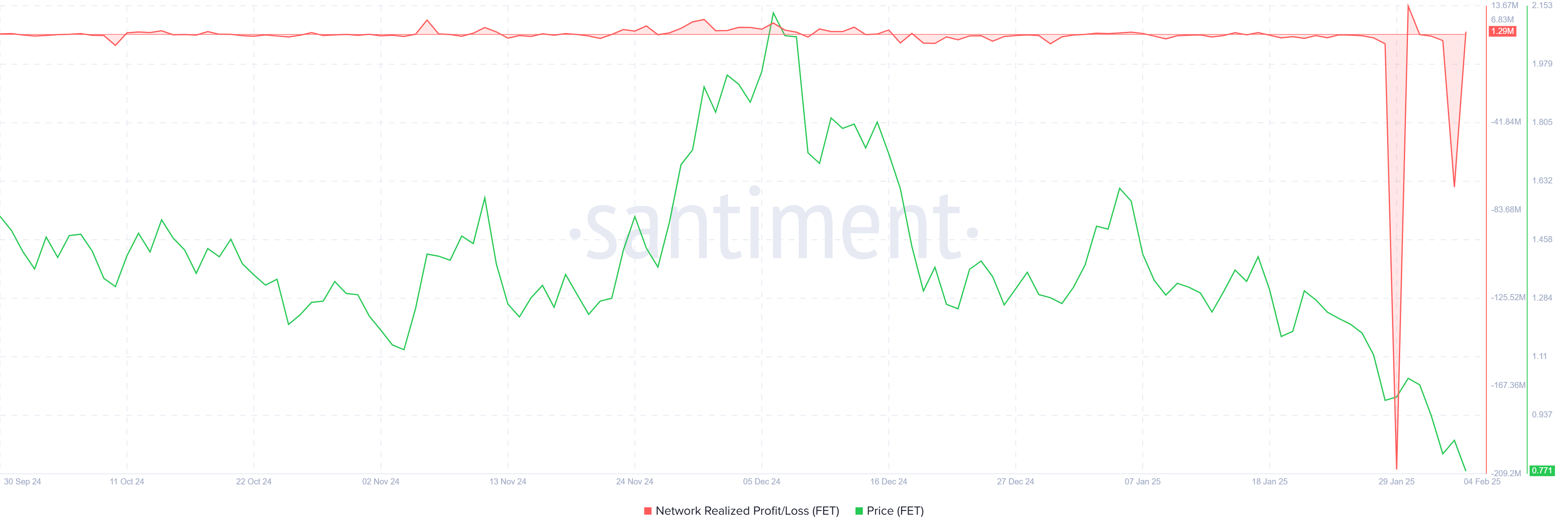

Realized losses for FET holders have reached their highest levels in the altcoin’s history. This is a result of many investors selling off their holdings earlier this week to prevent further losses. As a result, the general market sentiment remains highly bearish.

Many retail investors are hesitant to make moves, reflecting the pessimistic outlook within the market.

This sell-off has led to heightened caution among the investor base, with traders refraining from significant action in the face of market volatility. The fear of additional losses is currently overpowering the desire to accumulate, causing many to stay on the sidelines.

FET Realized Losses. Source: Santiment

FET Realized Losses. Source: Santiment

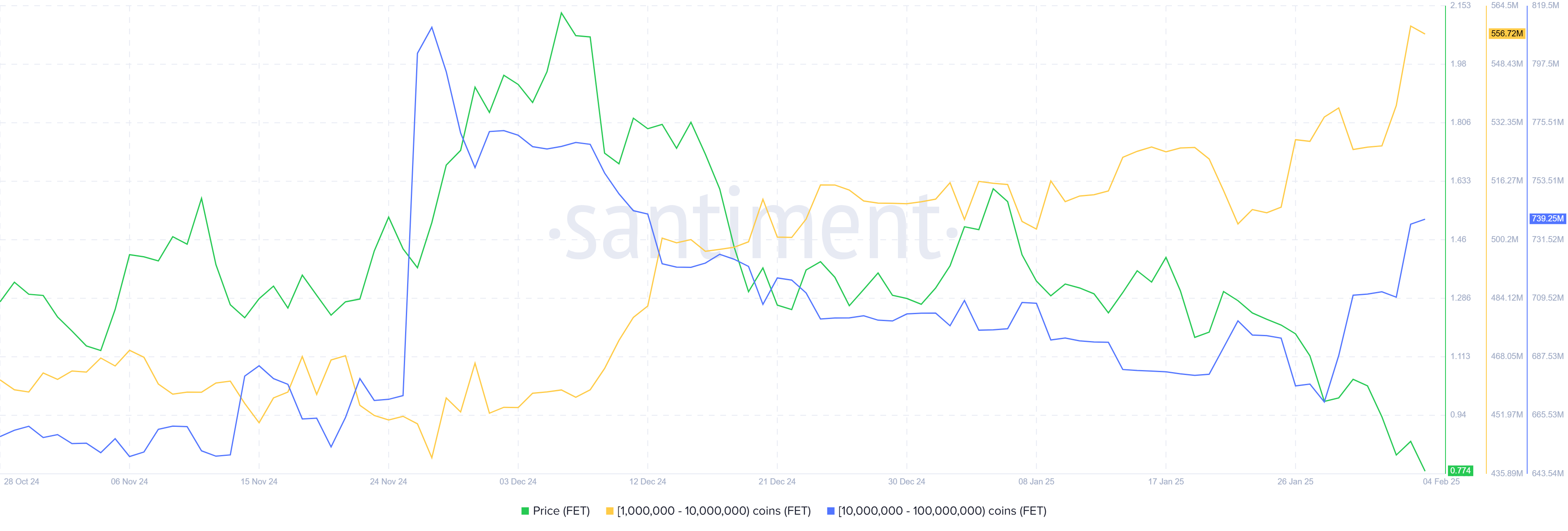

Despite the widespread losses, whale activity has been notably bullish. Addresses holding between 1 million and 100 million FET have added approximately 92 million FET to their holdings over the past week, valued at $70.8 million. This accumulation at lower price levels signals that whales are positioning themselves for a potential recovery, showing confidence in FET’s long-term potential.

This whale accumulation is a key sign of optimism despite the current market downturn. Whales are often viewed as the more experienced market participants, and their ability to buy during periods of significant price decline may indicate their belief in an eventual recovery.

FET Whale Holdings. Source: Santiment

FET Whale Holdings. Source: Santiment

FET Price Prediction: Bouncing Off The Support

FET’s price broke through the key support level of $1.19, falling to $0.77 at the time of writing. This decline confirms the validity of the head and shoulder pattern, which predicted a 43.6% drop to $0.73. The market seems to be experiencing a sharp correction, as expected, leading to this significant pullback.

Currently, FET is holding above the support of $0.76, suggesting it may have reached its market bottom. If this support is sufficient, the altcoin will have a chance to recover its recent losses. However, for a successful recovery, FET must flip $1.04 into support, signaling the end of the correction phase.

FET Price Analysis. Source: TradingView

FET Price Analysis. Source: TradingView

On the other hand, if FET loses the $0.76 support level, it could fall further. The next potential target is $0.73, and a drop below this level could see the price approaching $0.64, which would invalidate the bullish outlook and lead to further losses.