Top 3 Crypto Narratives to Watch For the First Week of February

Crypto narratives are undergoing major shifts this week, with AI tokens, Real-World Assets (RWA), and meme coins all seeing significant corrections. The AI sector, once a top-performing category, has seen its market cap drop 42% in the past month, with major tokens like FET and RENDER extending their losses.

Meanwhile, the RWA sector has fallen from $72 billion to $55.5 billion in just three days, though regulatory clarity in the US could provide long-term support. Meme coins have also taken a hit, with the top 10 largest tokens all down at least 22% in the last week.

AI Tokens

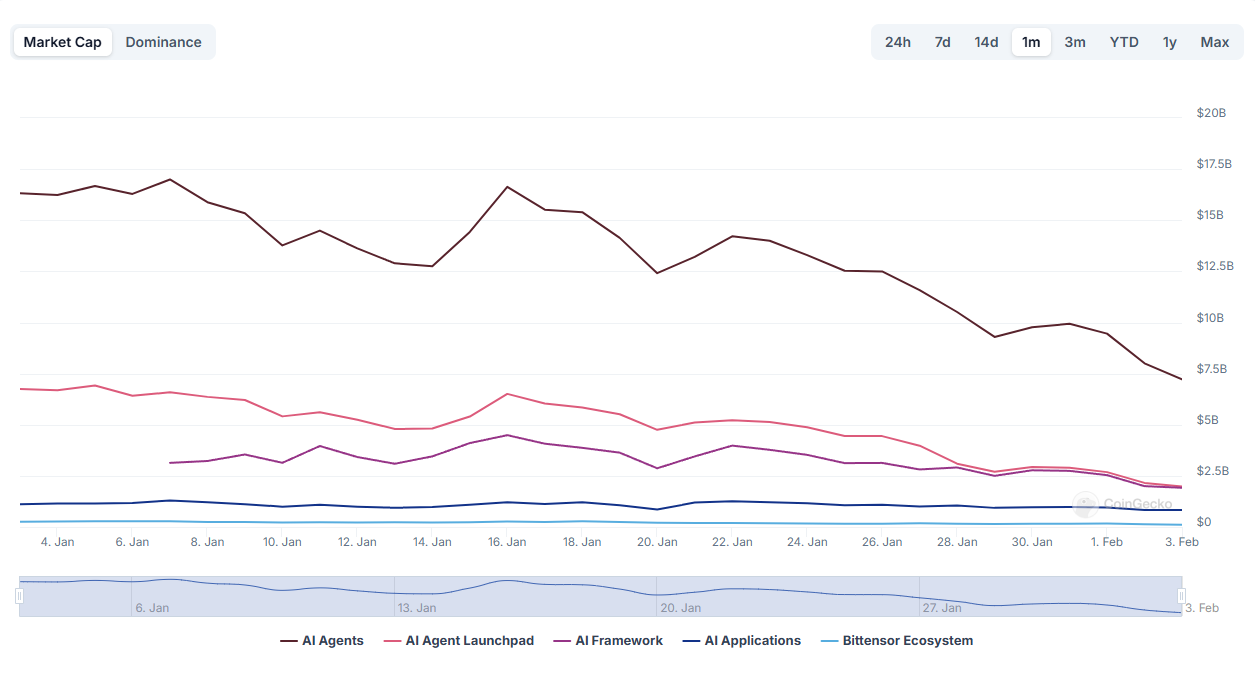

The artificial intelligence sector has been one of the hardest-hit areas in the crypto market over the past month. After reaching a peak market cap of $60 billion on January 6, it has now fallen to $32.8 billion, reflecting a sharp decline.

AI Coins Market Cap Over the Past Month. Source: CoinGecko

AI Coins Market Cap Over the Past Month. Source: CoinGecko

Some of the biggest AI tokens have taken heavy losses in the past seven days, with FET down 32.2%, RENDER dropping 27.21%, and VIRTUAL losing 35%.

The correction, which began roughly two weeks ago with DeepSeek’s impact, has extended across the sector, pushing many AI tokens to multi-month lows.

With the AI crypto market cap down nearly 42% in 30 days, this week could be crucial in determining whether these assets stabilize and get ready for a rebound or face further downside.

Real-World Assets (RWA)

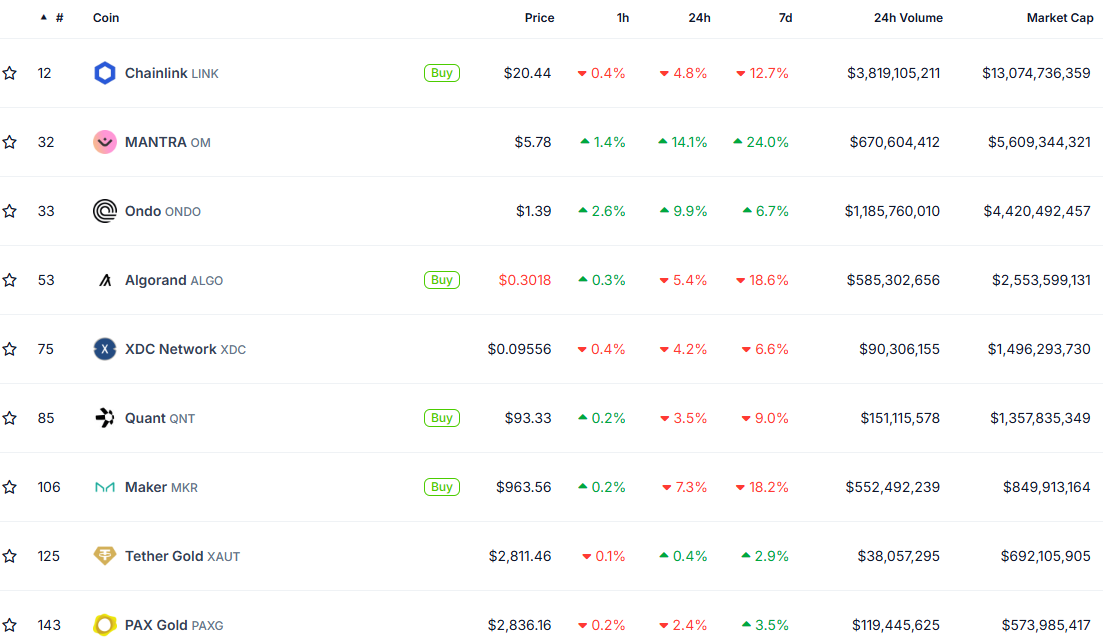

The Real-World Assets (RWA) sector has experienced a sharp decline, with its market cap dropping from $72 billion on January 31 to $55.5 billion in just three days.

Despite this downturn, RWA remains a significant asset class within crypto, currently comprising nine projects with market caps above $1 billion. Key players such as Chainlink, Avalanche, Hedera, Mantra, and Ondo continue to drive the sector’s development.

Top RWA Tokens Price Changes. Source: CoinGecko

Top RWA Tokens Price Changes. Source: CoinGecko

Although the recent correction has impacted RWA valuations, the sector continues to be one of the most interesting crypto narratives. It stands to gain from potential regulatory advancements in the US, a strong promise made by Donald Trump.

A clearer and more favorable regulatory framework could unlock new opportunities for RWA applications. With institutional giants like BlackRock and Morgan Stanley showing interest, the sector is already drawing mainstream attention, further strengthening its long-term growth prospects.

Meme Coins

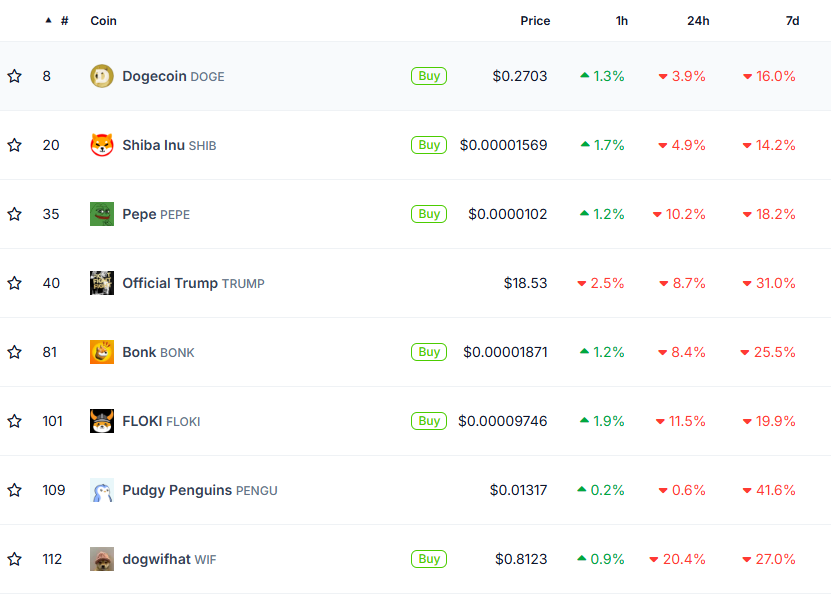

The meme coin sector, one of the biggest crypto narratives in the market, has taken a major hit in today’s liquidation chaos. The top 10 largest meme coins are all down at least 22% in the past week. PENGU has led the losses, dropping 46%, while only five meme coins now maintain a market cap above $1 billion.

Top Meme Coins by Market Cap. Source: CoinGecko

Top Meme Coins by Market Cap. Source: CoinGecko

Over the last 30 days, the entire meme coins market has shrunk by 37%, bringing its total valuation down to $68 billion. This sharp correction highlights a shift in sentiment, with meme coins losing the momentum they had in previous months.

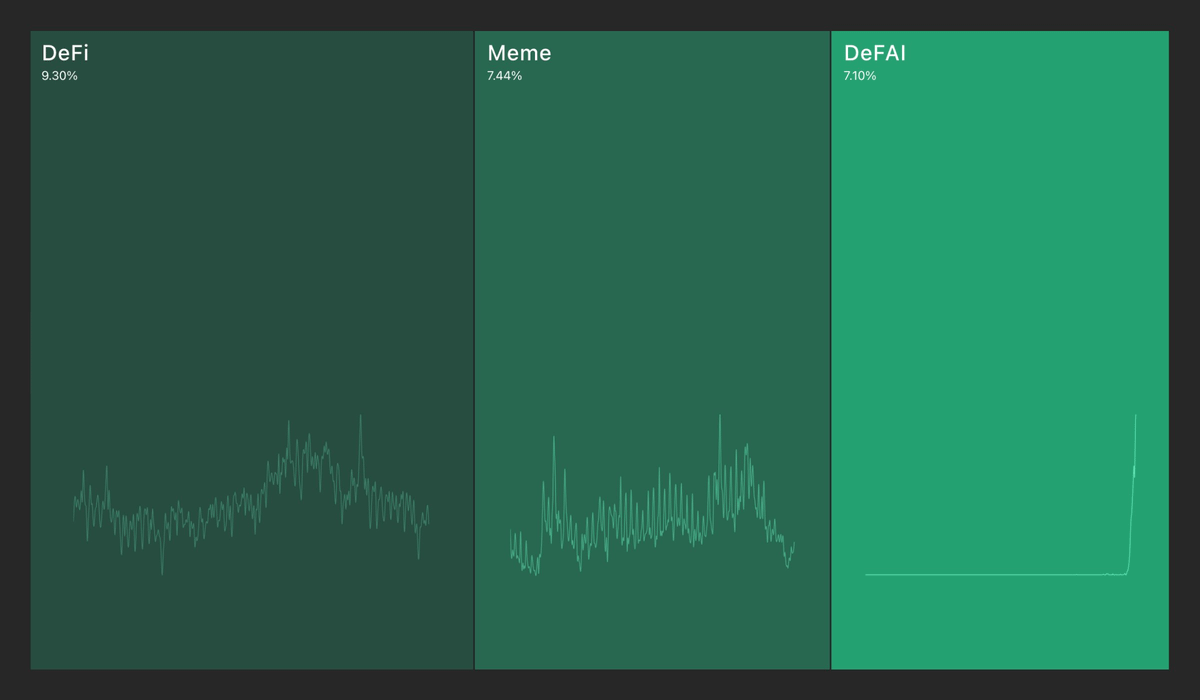

Recent data from Kaito suggests that meme coin mindshare has now fallen below that of DeFi, a trend that hasn’t occurred in months.

Crypto Sectors Mindshare. Source: Kaito

Crypto Sectors Mindshare. Source: Kaito

This shift implies that investors may be rotating funds away from meme coins and into more traditional DeFi assets or stablecoins.

With lower engagement and declining prices, meme coins are facing increased selling pressure. Unless a new catalyst emerges, their market dominance could continue to fade.