Bitcoin and crypto market sees recovery as Mexico and US agree to delay tariffs

- Bitcoin reclaimed the $100,000 level after Donald Trump and Mexico's President reached a tariff agreement.

- Trump confirmed a deal with President Claudia Sheinbaum on pausing US-Mexico tariffs for one month.

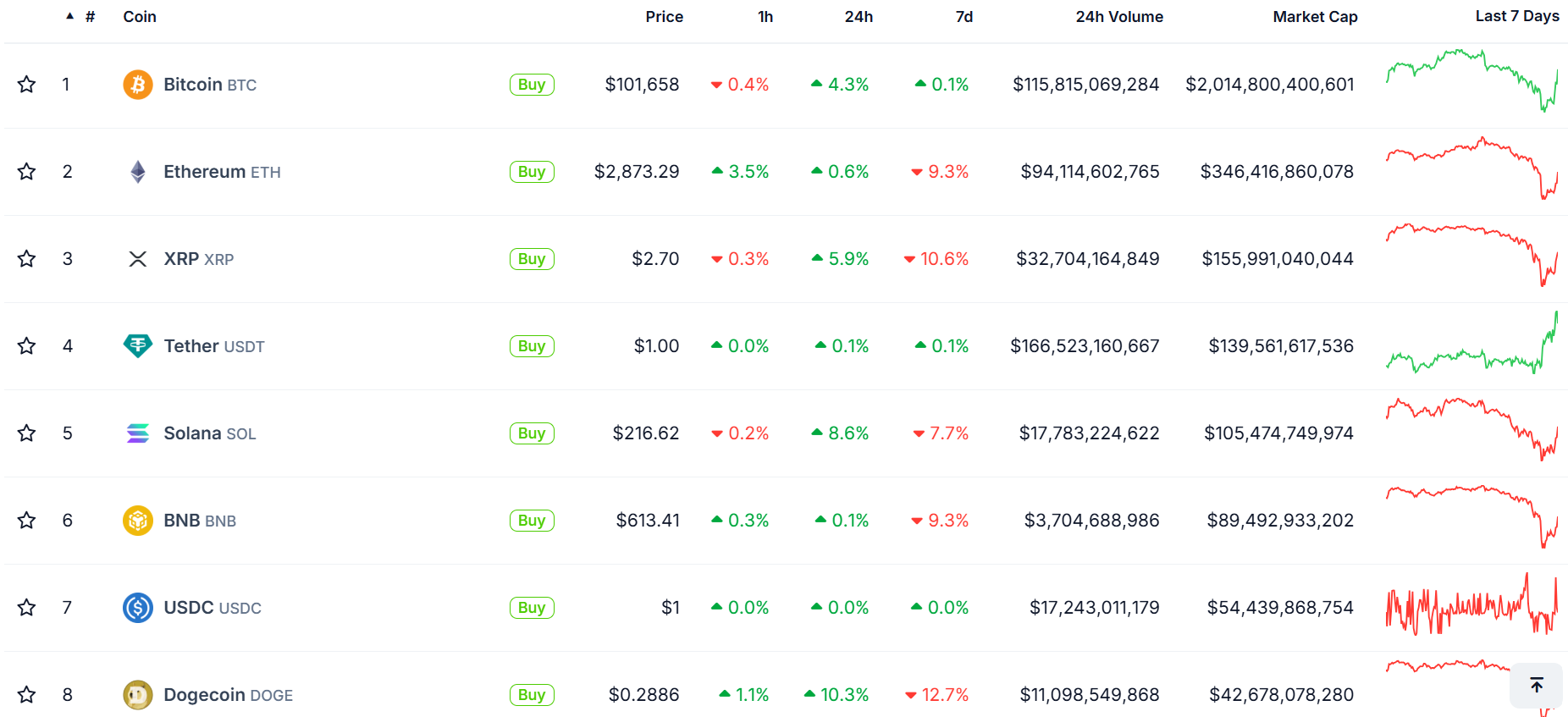

- Ethereum, XRP, Solana, Dogecoin, and other top crypto assets are up in the past few hours following the announcement by Mexico's president.

- The recent crypto market crash and subsequent recovery following news of the trade tariffs reveal its rising correlation with the traditional stock market.

The crypto market saw a recovery as Mexico's President Claudia Sheinbaum reached an agreement with US President Donald Trump on Monday to pause the US-Mexico tariffs for one month. Bitcoin (BTC), Ethereum (ETH), XRP and Solana (SOL) have all been up in the past few hours, recovering from steep declines experienced earlier in the day.

Crypto market rebounds as Trump and Mexico reach new tariff deal

Mexico’s president Claudia Sheinbaum struck a deal with President Trump to cease US-Mexico tariffs for one month. The deal involves the Mexican president deploying 10,000 National Guard troops to help secure the US-Mexico border.

President Trump confirmed the news, stating that both countries will continue negotiations spearheaded by government officials, including Secretary of the Treasury Scott Bessent and Secretary of State Marco Rubio.

Following the resolution, Bitcoin reclaimed the $100,000 key level. Ethereum, Solana, XRP and Dogecoin also witnessed gains in the past few hours, as bulls appear to be staging a comeback.

Top Crypto Assets. Source: CoinGecko

The recent recovery comes after a market-wide decline that wiped out over $2 billion from the crypto derivatives market on Monday following President Trump's new tariffs on Canada, Mexico and China.

The reaction from market participants sparked tension of a global trade war, which also saw the global crypto market briefly shed over $500 billion.

Traditional stock markets also witnessed a recovery in the past few hours, with the S&P 500 rising above 6,000 from an intraday low of 5,920.

This underscores the rising correlation between crypto assets like Bitcoin and the stock market.

A similar move occurred last week after Bitcoin's price dipped following the stock market decline sparked by China's artificial intelligence startup DeepSeek.

Additionally, Bitcoin and the crypto market have responded similarly to US economic data in the past year.

Bitcoin, altcoins, stablecoins FAQs

Bitcoin is the largest cryptocurrency by market capitalization, a virtual currency designed to serve as money. This form of payment cannot be controlled by any one person, group, or entity, which eliminates the need for third-party participation during financial transactions.

Altcoins are any cryptocurrency apart from Bitcoin, but some also regard Ethereum as a non-altcoin because it is from these two cryptocurrencies that forking happens. If this is true, then Litecoin is the first altcoin, forked from the Bitcoin protocol and, therefore, an “improved” version of it.

Stablecoins are cryptocurrencies designed to have a stable price, with their value backed by a reserve of the asset it represents. To achieve this, the value of any one stablecoin is pegged to a commodity or financial instrument, such as the US Dollar (USD), with its supply regulated by an algorithm or demand. The main goal of stablecoins is to provide an on/off-ramp for investors willing to trade and invest in cryptocurrencies. Stablecoins also allow investors to store value since cryptocurrencies, in general, are subject to volatility.

Bitcoin dominance is the ratio of Bitcoin's market capitalization to the total market capitalization of all cryptocurrencies combined. It provides a clear picture of Bitcoin’s interest among investors. A high BTC dominance typically happens before and during a bull run, in which investors resort to investing in relatively stable and high market capitalization cryptocurrency like Bitcoin. A drop in BTC dominance usually means that investors are moving their capital and/or profits to altcoins in a quest for higher returns, which usually triggers an explosion of altcoin rallies.