Bitcoin and crypto traders lose over $2.25 billion in liquidations, here’s why

- Bitcoin corrects to $91,231 early on Monday, dragging down altcoins within the market correction.

- President Trump’s tariff announcements usher in a global market crash, influencing Bitcoin and crypto prices.

- Derivatives markets note the biggest single-day liquidation, larger than the LUNA-UST collapse of May 2022.

Bitcoin (BTC) slipped to a $91,231 low on Monday, wiping out January’s gains as crypto traders digest US President Donald Trump’s tariff announcements over the weekend and the expectation of inflationary pressures.

Derivatives traders took a bigger liquidation hit than the day Terra’s LUNA-UST collapsed in May 2022 and wiped out over $1 billion in leverage from the market.

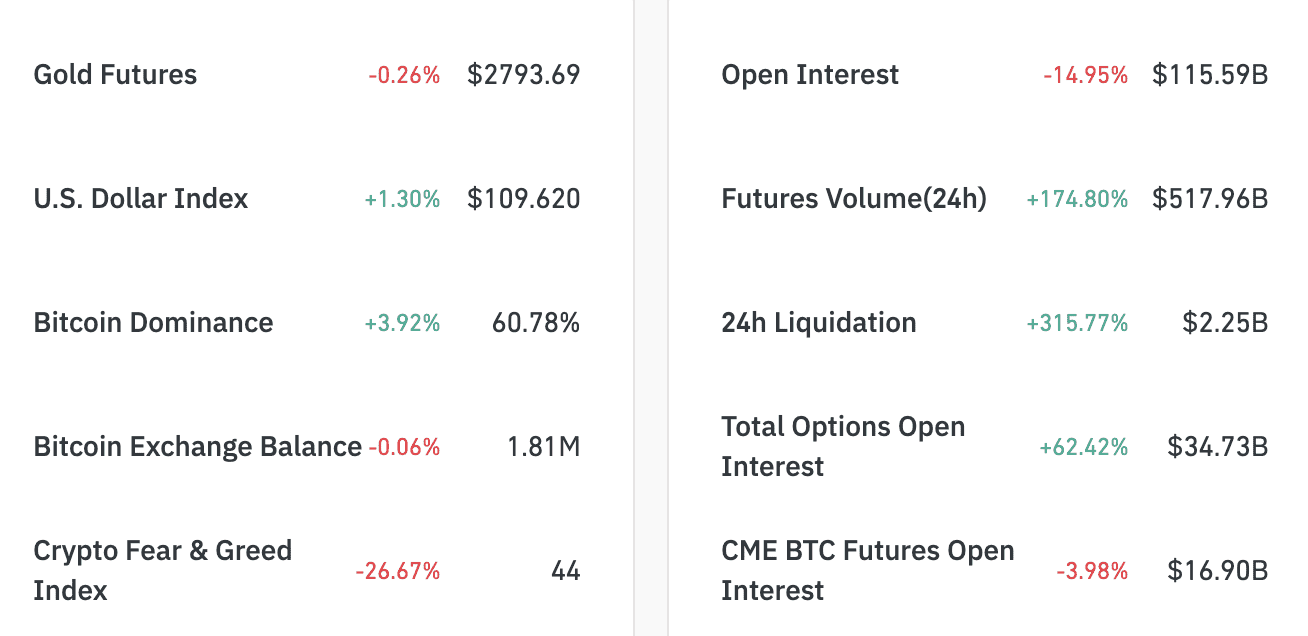

Crypto market 24-hour liquidation | Source: Coinglass

Three key factors influencing Bitcoin and crypto correction

US President Donald Trump’s tariff announcements over the weekend sent shockwaves to global markets, ushering a steep correction in stock markets worldwide. The pan-European STOXX 600 index is down 1.30% at the time of writing on Monday, its biggest one-day slide this year.

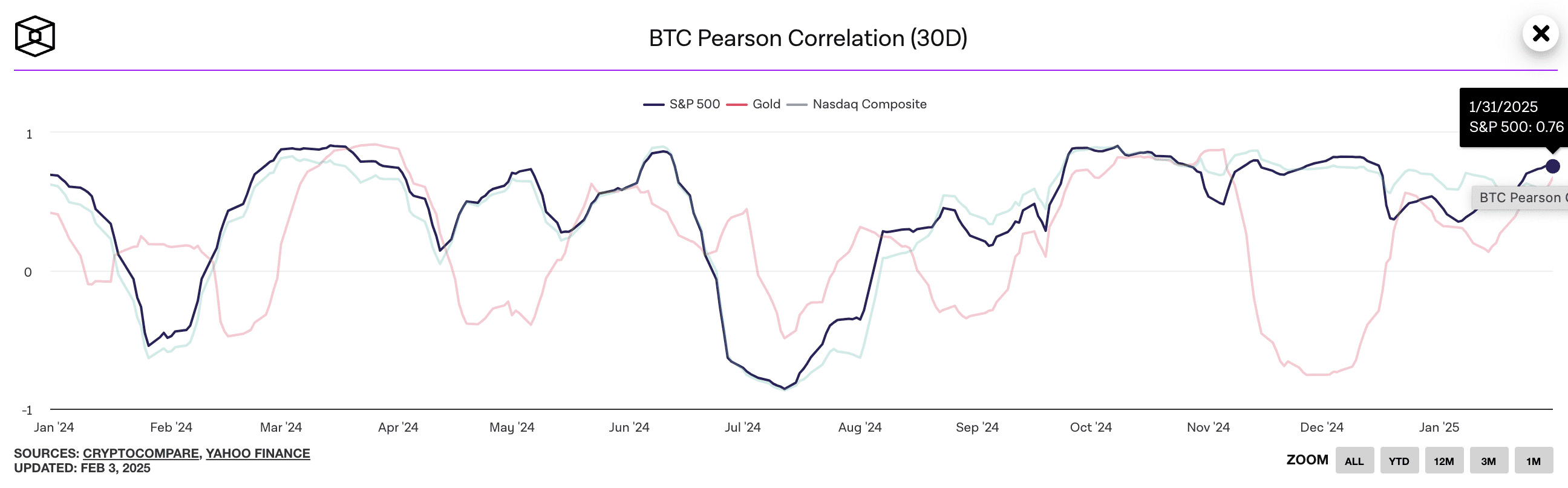

Nasdaq 100 futures are down 1.61%, the S&P 500 slips 1.36% and the Dow Jones Industrial Average corrects 1.22% early Monday. Bitcoin’s heavy correlation with US stocks and equities dragged down BTC by nearly 3% on the day.

BTC’s price plummeted to a low of $91,231 during the Asian session, but it has recovered above $95,000 since then. The worldwide stock and crypto selloff is a response to US President Donald Trump's tariffs on Canada, Mexico and China, which are likely to fuel a global trade war that could curb economic growth and increase inflationary pressures.

Bitcoin’s 30-day Pearson correlation coefficient with the S&P 500, which measures the linear relationship between the two datasets, is 0.76, according to data from The Block.

Bitcoin Pearson Correlation (30-day) | Source: The Block

The 24-hour liquidation in crypto has hit $2.25 billion, according to Coinglass data. This marks a 315% increase in the past day and one of the largest single-day liquidation events in crypto.

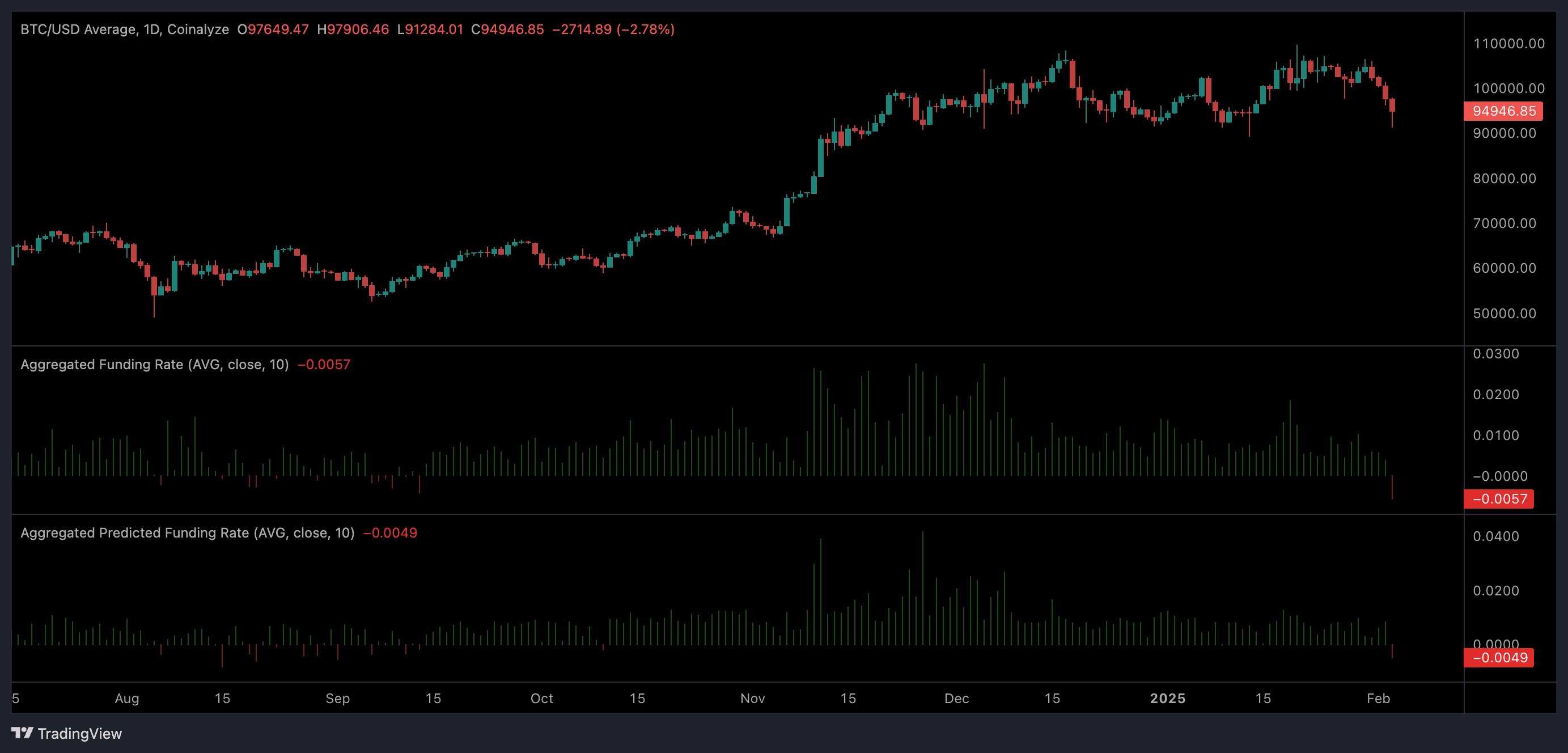

The Bitcoin funding rate has turned negative, a sign of bearish sentiment among derivatives traders. Data from Derive.xyz shows signs of heightened market volatility. Bitcoin’s 30-day Implied Volatility (IV) climbed up to 54% in the wake of US tariffs and economic uncertainty.

BTC/USD Average daily price chart | Source: Coinalyze

Nick Forster, Founder at Derive.xyz, told FXStreet in an exclusive interview:

“We expect this volatility to persist as more negative catalysts likely unfold in the coming weeks. BTC has regained its dominance in the market, now accounting for 60%, while ETH has seen its dominance drop to just 10.9% from 17.3% at the start of 2024.

Additionally, several US states, including Illinois, have announced plans for BTC reserves, which is a strong signal of political intent to accelerate crypto adoption. While these measures will take time to bear fruit, we believe they will contribute to a positive long-term trajectory for the sector, laying the groundwork for growth later in 2025.”

Forster maintains a positive outlook on Bitcoin price this year.

Tim Ogilvie, Global Head of Institutional at Kraken, told FXStreet in an exclusive interview:

“Inflation remains a key concern for the Fed, potentially delaying the next rate cut until the second half of the year. Historically, cryptocurrencies have thrived in looser monetary conditions, as investors with higher risk appetites allocate more capital to the space. If a rate cut materializes, we can expect a broad crypto rally, particularly among smaller-cap altcoins. However, an intriguing question arises if inflation rebounds.

While previous rate hikes have been unfavorable for crypto, Bitcoin’s evolving role as a store of value and a potential corporate treasury asset could position it differently this time. If inflation fears resurface, Bitcoin—alongside traditional store-of-value assets like gold—could see increased demand as investors seek protection against the erosion of purchasing power.”

Bitcoin trades at $95,053 at the time of writing.