XRP Ledger Activity Surges With DEX Volume Exceeding $1 Billion in Q4 2024

Ripple’s Q4 2024 XRP Markets report highlights a strong resurgence in on-chain activity, trading volume, and institutional demand.

The last financial quarter marked a critical shift for XRP, as increased adoption and market confidence drove its performance to new highs.

XRPL Hits $1 Billion on DEXs as On-Chain Activity Expands

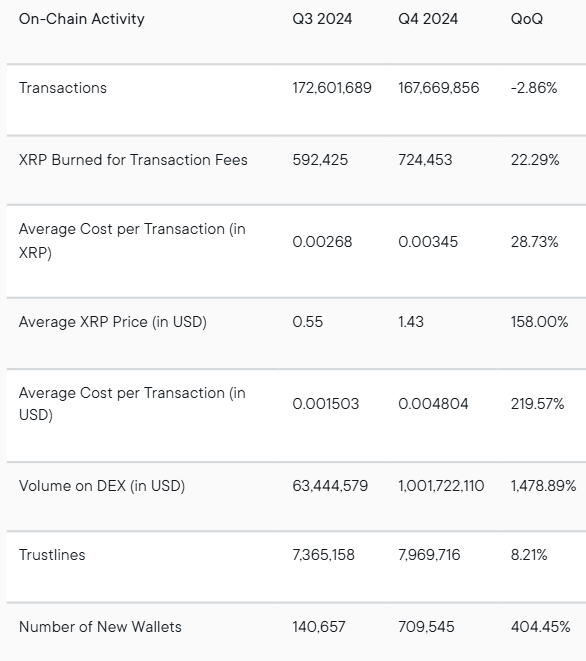

Transaction count on the XRP Ledger (XRPL) saw a slight 2.86% decline to 167 million in Q4 2024. However, overall engagement on the network surged, according to Ripple’s latest market report.

The Automated Market Maker (AMM) feature, introduced in March, saw a massive surge in swap volume, jumping from $31.23 million in Q3 to $774.15 million in Q4. This increase significantly boosted trading on the XRPL DEX, which expanded from $63.4 million to $1 billion.

Overall, AMM swaps accounted for 77% of total transactions, highlighting their growing influence on the network.

Network adoption also grew to record highs for XRPL. New wallet registrations surged from 140,000 in Q3 to 709,000 in Q4, reflecting a sharp rise in user participation.

Since Trump’s election victory, XRP’s average closing price jumped from $0.55 to $1.43, hitting a peak of $2.80 by the end of December 2024. This rally led to higher transaction fees and token burns, with XRP burned increasing from 592,000 to 724,000 in Q4.

Ripple’s XRPL On-Chain Activity. Source: Ripple

Ripple’s XRPL On-Chain Activity. Source: Ripple

As BeInCrypto reported earlier, meme coin activity also surged on the network. ARMY, an XRP meme coin launched in January, gained a $100 million market cap in days.

Moreover, the issuance of new tokens on XRPL also accelerated. Trustlines grew from 7.3 million to 7.9 million, with 600,000 new connections established. Among these, 37,000 trustlines linked to Ripple’s RLUSD stablecoin, signaling strong early adoption.

Ripple credited this growth to rising XRP prices and the increasing traction of First Ledger, a meme coin launchpad. According to the firm, XRP’s 280% surge in Q4 marked a critical recovery for the asset, which had been weighed down by the SEC’s prolonged legal battle.

“Ripple and the broader XRP ecosystem had been stifled by the SEC’s actions, which artificially manipulated the market, dampened trader confidence, and held back growth. Seven years ago, before the SEC anointed ETH and attacked XRP and Ripple, XRP was the second most valuable digital asset. With regulatory overhang easing, XRP found itself in a new position of strength,” Ripple stated.

XRP Trading Volume Skyrockets After US Election

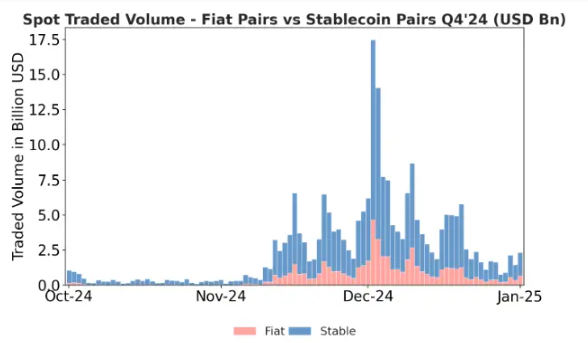

Ripple pointed out that XRP’s momentum accelerated following the November US presidential election, where pro-crypto candidate Donald Trump secured victory.

This shift triggered a surge in trading volume. Average daily volume skyrocketed from $500 million in October to $5 billion by mid-November and December. On December 2, trading activity reached nearly $25 billion across major platforms.

XRP Trading Volume. Source: Ripple

XRP Trading Volume. Source: Ripple

Binance led XRP’s trading, handling 36% of total spot volume, followed by Upbit Korea at 20% and Coinbase at 9%. Notably, Coinbase’s market share doubled post-election, indicating rising US investor interest in the digital asset.

“After the US election, US exchanges like Coinbase and Kraken managed to get more shares from Bybit or Crypto.com. Nevertheless, Binance, Bybit and Upbit accounted for over 60% of the total traded volume,” Ripple explained.

Meanwhile, the surge in trading volume was largely driven by long-term buyers rather than short-term speculative traders.

This trend reflected the growing confidence in XRP’s future, with investors positioning themselves for sustained growth amid improving regulatory clarity and increasing institutional interest