Toncoin Price Forecast: TON long-term holders spotted taking profits at $5

- Toncoin price bounced just 2% on Friday, as bulls long for a breakout above $5.

- TON’s subdued gains despite rising market volumes in the last 3-days signals heavy sell-side pressurg nullifying the upward momentum.

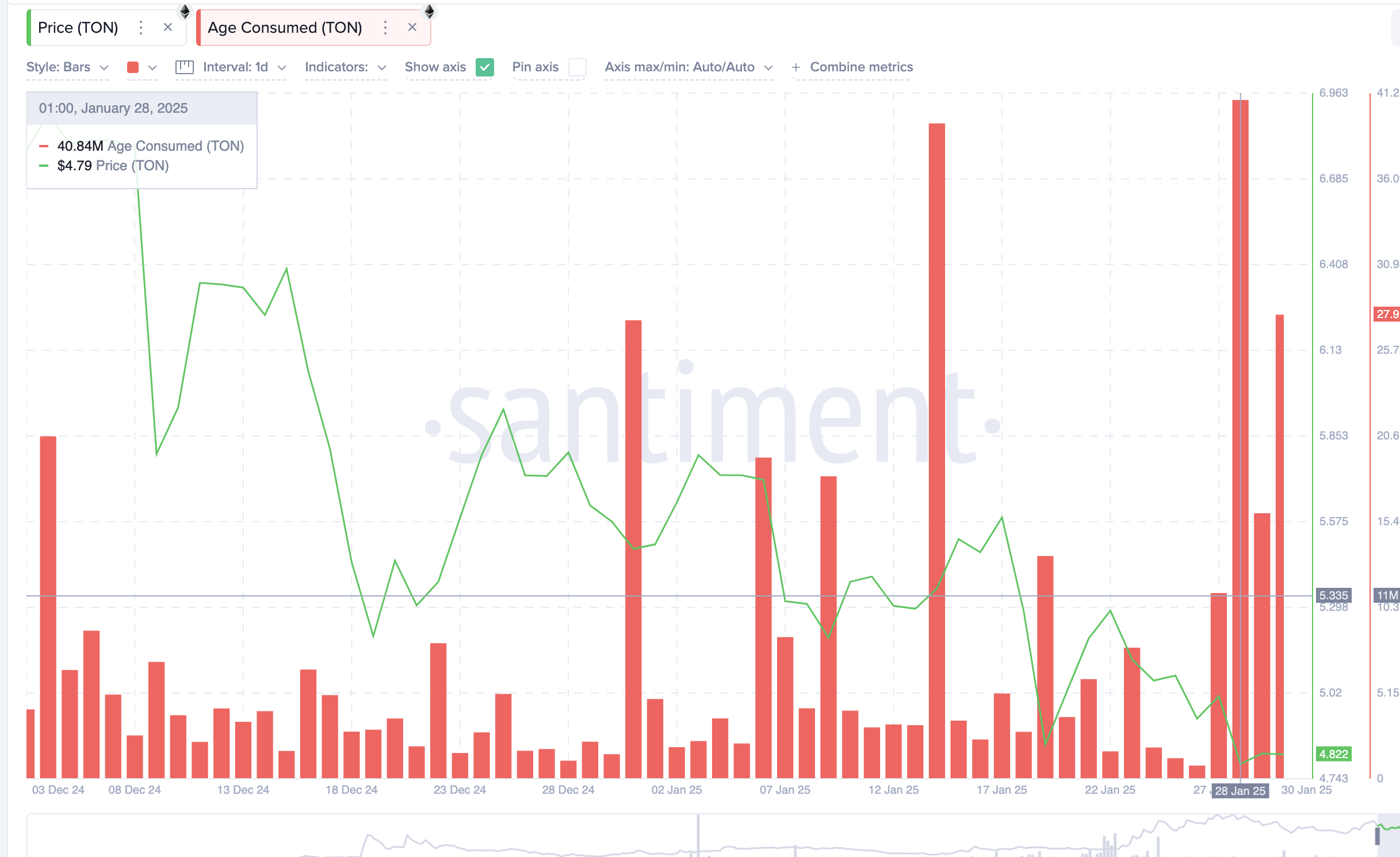

- TON Age Consumed rose to a 5-month peak of 40.8 million this week, signalling a large number of previously long-held coins on the move

Toncoin price has failed to breach the $5 support despite multiple bullish market catalysts. On-chai data suggests long-term holders offloading TON could be nullifying the upward momentum,

Toncoin fails the $5 breakout test as Proof-of-Work sector sees green

Toncoin (TON) price bounced 2% on Friday, attempting to capitalize on bullish sentiment in the broader crypto market. However, despite the uptick, TON failed to decisively break the critical $5 resistance level, raising concerns about its near-term trajectory.

Toncoin (TON) price action

The sluggish price action comes amid increasing regulatory scrutiny surrounding Toncoin.

The ecosystem was rocked last year after its founder was arrested in France, prompting ongoing legal uncertainties that have left some investors hesitant.

This cloud of regulatory ambiguity may have contributed to TON being overlooked even as the broader crypto market benefited from optimism surrounding a potential Litecoin (LTC) ETF approval.

On Friday, several Proof-of-Work (PoW) assets, including Litecoin, Bitcoin Cash (BCH), and Monero (XMR), saw significant gains, while TON lurked below the $5 mark at press time.

Technically, Toncoin’s inability to sustain momentum above $5 despite increased market activity suggests that bears remain firmly in control. The failure to breach this level is particularly noteworthy given the strong bullish tailwinds lifting other altcoins. Until TON can overcome this resistance convincingly, traders may remain cautious about initiating fresh long positions.

Long-Term holders' sell-pressure dampening TON rally

Another major factor weighing on Toncoin’s price action is profit-taking from long-term holders. Blockchain data reveals a sharp increase in Age Consumed, a metric that multiplies the number of TON coins moved on a given day by the number of days since they were last active. When this metric spikes, it often signals that dormant coins are being sold, potentially flooding the market with supply.

Toncoin price vs. Age Consumed | TONUSDT

On Friday, TON’s Age Consumed metric soared to 40.8 million, marking its highest level in over five months.

This suggests that long-term holders, who had accumulated TON as far back as August 2024, are now actively offloading their positions.

The sell-side pressure from long-term holders has created a short-term market oversupply, limiting TON’s ability to build on recent gains.

More so the timing of these sales, coinciding with TON’s struggles around $5, implies that large institutional investors may be taking advantage of recent price increases to exit their holdings in favor of other altcoins with vibrant ETF approval prospects.

Toncoin price forecast: $5.2 breakout unlikely as bearish signals align

Toncoin price action remains constrained below $5.00, struggling to break through resistance despite a 2.5% gain over the last four days.

The Bollinger Bands indicate low volatility, with prices hovering near the lower band at $4.67, reinforcing a bearish undertone.

The Donchian Channel midline at $5.165 remains a key resistance level, suggesting that bulls lack the momentum to reclaim higher levels.

Toncoin price forecast | TONUSDT

Market volume has risen to 10.54M in the last four days, yet price appreciation remains weak, indicating persistent sell-side pressure.

The MACD remains in negative territory at -0.012, with the signal line at -0.171, reinforcing a bearish outlook as momentum remains weak.

Until the MACD crosses above zero with an increase in positive histogram bars, any upside could remain corrective rather than a breakout attempt.

A sustained move above $5.165 could trigger a test of the upper Bollinger Band near $5.66, but with downward pressure from the midline and weak MACD signals, a deeper pullback to $4.67 remains the more likely scenario unless buyer demand strengthens significantly