Cardano (ADA) Price Rises 6% While Whale Accumulation Stalls

Cardano (ADA) price is up 6% in the last 24 hours, bringing its market cap to $34 billion as it attempts to reclaim the $1 level. Despite this short-term gain, ADA’s trend remains uncertain, with technical indicators showing mixed signals.

The ADX suggests weak momentum, while whale accumulation has remained stable, indicating a lack of strong buying pressure. Whether ADA continues its recovery or faces another pullback will depend on key support and resistance levels in the coming days.

Cardano Lacks Clear Trend

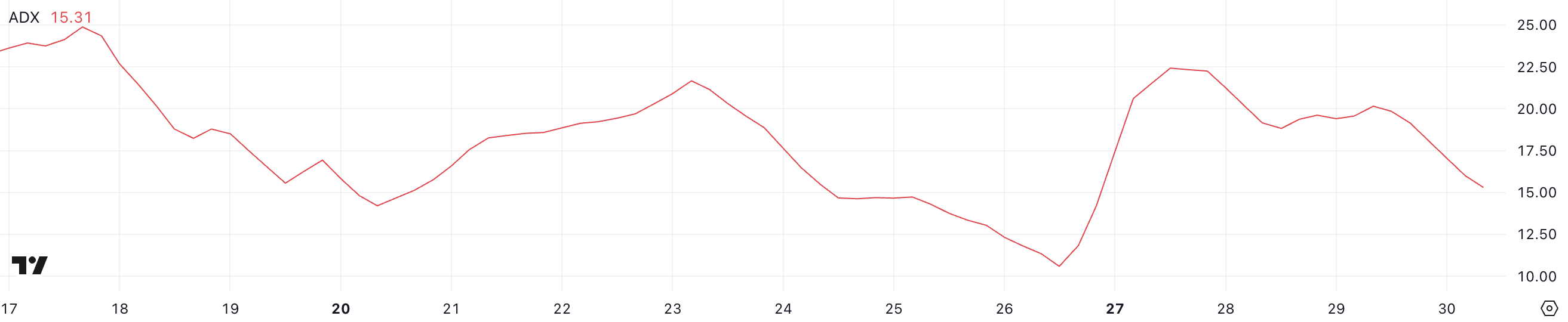

Cardano ADX is currently at 15.3, down from 22.2 three days ago after it announced a roadmap of upcoming changes. The ADX (Average Directional Index) measures trend momentum, with values below 20 signaling weak or non-existent trends, while readings above 25 indicate a developing trend.

When ADX rises above 40, it reflects strong momentum in either direction, but the current drop suggests that ADA’s trend has lost strength and is entering a more indecisive phase.

ADA ADX. Source: TradingView

ADA ADX. Source: TradingView

With ADX at 15.3, ADA is in a consolidation period with no clear bullish or bearish momentum. This suggests that price movements may remain range-bound until ADX begins to rise again.

If momentum strengthens and ADX moves back above 25, it could indicate the start of a new trend. However, as long as ADX remains low, ADA price is likely to continue trading sideways without a strong directional move.

ADA Whales Stopped Accumulating

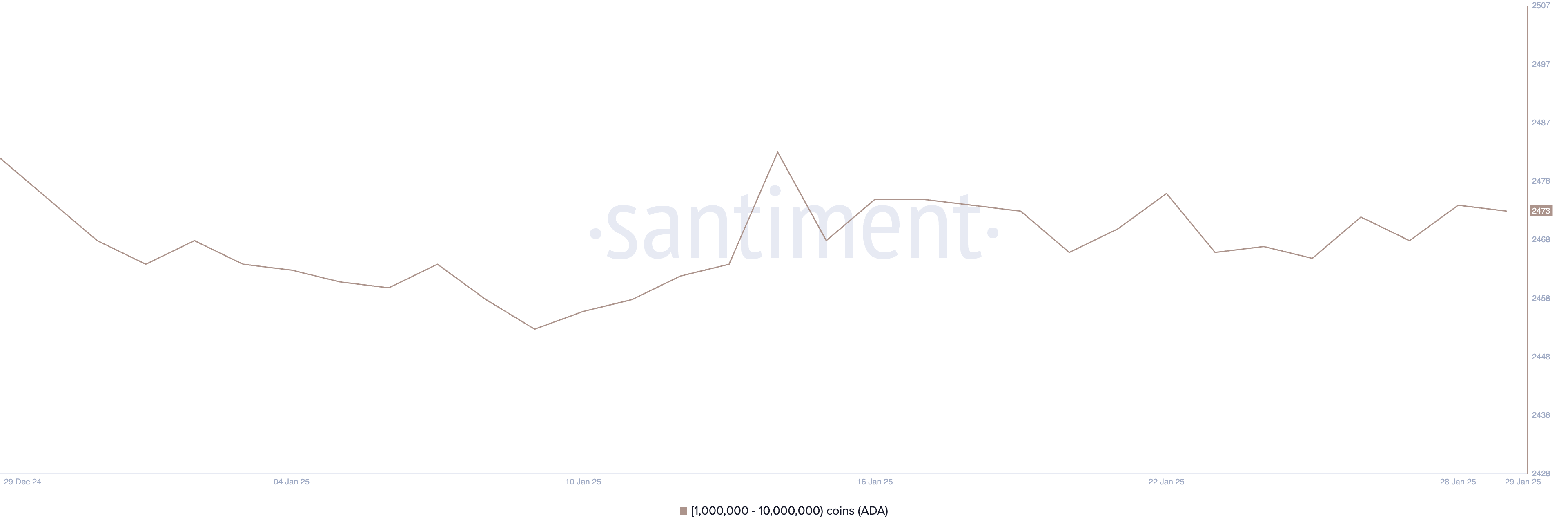

The number of ADA whale addresses – wallets holding between 1 million and 10 million ADA – currently stands at 2,473, remaining within a tight range of 2,465 to 2,476 over the past 15 days.

Tracking these whales is important because large holders can significantly impact market liquidity and price action. An increase in whale addresses often signals accumulation, while a decline may indicate distribution or selling pressure.

Addresses Holding Between 1 Million and 10 Million ADA. Source: Santiment

Addresses Holding Between 1 Million and 10 Million ADA. Source: Santiment

The stability in Cardano whale addresses suggests that large holders are neither aggressively accumulating nor offloading their positions. This follows a surge from 2,453 to 2,483 between January 9 and January 14, indicating that whales previously increased their holdings before leveling off.

The current consistency may imply a wait-and-see approach, where whales are positioning themselves for the next major move rather than actively shifting their exposure. If this number starts rising again, it could suggest renewed confidence in ADA’s price potential.

ADA Price Prediction: Will It Surge 20%?

ADA price is currently hovering near its support at $0.95, a critical level that could determine its next move. If this support is tested and fails to hold, selling pressure could increase, pushing ADA down toward $0.87.

A break below this level would signal a continuation of the downtrend, reinforcing bearish momentum.

ADA Price Analysis. Source: TradingView

ADA Price Analysis. Source: TradingView

However, its EMA lines suggest that a golden cross could form soon, which would indicate strengthening bullish momentum. If this crossover happens, ADA price could test the $0.99 resistance, potentially pushing it to $1.03, a potential 20% upside.