Coinbase to Deepen DEX Integration While Revamping Token Evaluation Process

Coinbase, the largest crypto exchange in the US, is revisiting its token listing strategy to address challenges posed by the rapid surge in new cryptocurrency launches.

This move comes as the crypto ecosystem sees unprecedented growth in the number of tokens entering the market.

Coinbase Faces Hurdles as Weekly Token Creation Reaches 1 Million

On January 26, Coinbase CEO Brian Armstrong announced that the platform would reassess its token listing procedures. He highlighted that the exchange cannot manually evaluate every token before listing because approximately 1 million tokens are created each week.

This challenge is not limited to exchanges. Armstrong noted that regulators would struggle to vet tokens at such a pace.

“We need to rethink our listing process at Coinbase given there are ~1m tokens a week being created now, and growing. High quality problem to have, but evaluating each one by one is no longer feasible. And regulators need to understand that applying for approval for each one is totally infeasible at this point as well (they can’t do 1m a week),” he said.

To address these issues, Armstrong proposed a shift from the traditional “allow-list” model to a “block-list” approach. This system would use automated on-chain data scans and community feedback to identify and exclude risky tokens. Armstrong believes this streamlined process enables regulators to focus on eliminating harmful assets without feeling overwhelmed.

Meanwhile, Coinbase also plans to deepen its integration with decentralized exchanges (DEXs). Armstrong stressed that this move aims to simplify the trading process for users, eliminating concerns about whether transactions occur on centralized exchanges (CEXs) or DEXs.

“We’ll continue integrating native DEX support more deeply. Customers shouldn’t need to know or care whether the trade is happening on a DEX or CEX,” Armstrong concluded.

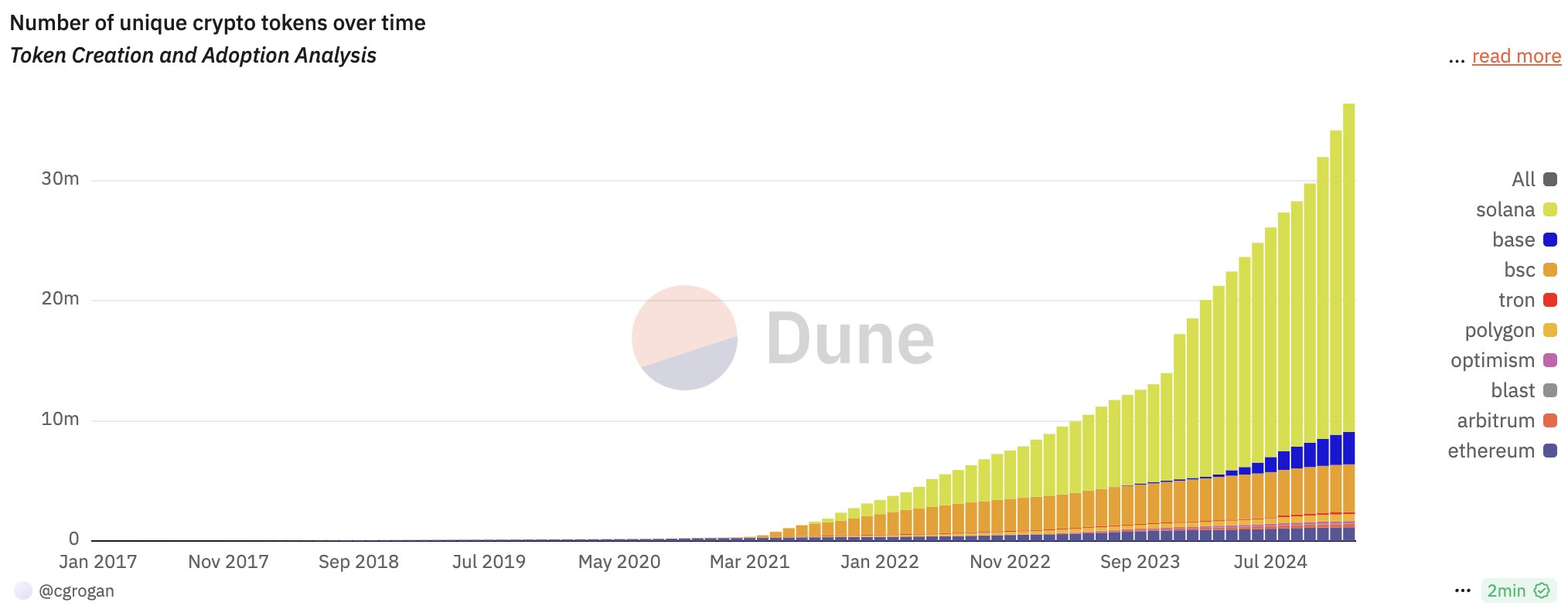

The surge in token creation highlights the pressing need for such changes. Conor Grogan, a Coinbase executive, recently disclosed that the crypto market now hosts over 36 million tokens and is projected to reach 100 million by 2025. By comparison, the 2017-2018 altcoin boom featured fewer than 3,000 tokens.

Total Number of Tokens. Source: X/Grogan

Total Number of Tokens. Source: X/Grogan

Indeed, meme coins have significantly contributed to this growth. Platforms like Solana-based Pump.fun and Tron-based SunPump have democratized token launches, making the process easier for crypto users. According to Dune Analytics, Pump.fun alone has facilitated the creation of over 6 million tokens since its launch last year.