BlackRock’s Bitcoin ETF Surpasses $1 Billion in Trading on Friday Opening Hours

BlackRock’s spot Bitcoin ETF (IBIT) surpassed $1 billion in inflows in the first two hours of trading today. This comes despite record outflows earlier in the month, displaying the product’s dramatic recovery.

Bitcoin ETFs are still significantly ahead of Ethereum-based products, and analysts believe that they will continue dominating even if the SEC approves more altcoin ETFs.

BlackRock’s IBIT Rebounds in Force

IBIT, BlackRock’s Bitcoin ETF, has been performing exceptionally well over the last six months. Despite momentarily seeing record outflows earlier this January, it’s now on route to a strong recovery.

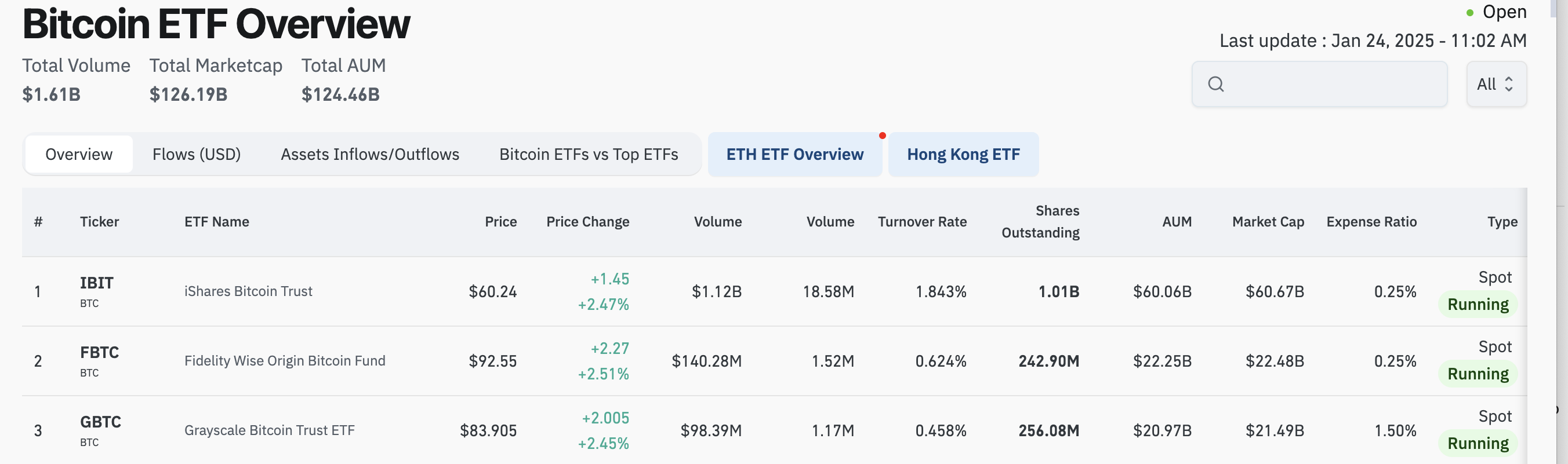

According to Coinglass data, the ETF saw over $1 billion in trading volume during today’s first two hours of trading.

Real-Time Trading Volume of BlackRock’s IBIT Bitcoin ETF. Source: Coinglass

Real-Time Trading Volume of BlackRock’s IBIT Bitcoin ETF. Source: Coinglass

As the above data shows, this rally isn’t isolated to BlackRock or IBIT. Instead, all the Bitcoin ETFs are performing well, likely because BTC has found a strong support level at $105,000.

There were several pro-crypto regulatory developments in the US yesterday. Most notably, the SEC overturned the controversial SAB 121 bulletin, which means banks can now custody Bitcoin without any hurdles. This positive move likely influenced retail investors to crowd the ETF market today.

Also, BlackRock CEO Larry Fink believes institutional adoption will push its value as high as $700,000. ETF analyst Eric Balchunas explained the discrepancy between Bitcoin and all other crypto products:

“The spot bitcoin ETFs quietly on fire to start year, with $4.2 billion in flows which is 6% of all ETF flows. Now at +$40 billion net since launch with AUM at $121 billion and return of 127%. For context, Ether ETFs are like +$130m YTD, which isn’t bad, but this why BTC is on another level and will utterly dominate this category,” he claimed.

Data from Arkham Intelligence also reveals that BlackRock acquired more than $600 million worth of Bitcoin yesterday, allowing it to generate more IBIT shares.

As a group, the ETF issuers have been consistently purchasing huge amounts of Bitcoin. Nonetheless, BlackRock clearly exceeds them in every category.

All things considered, this IBIT trade volume is just one factor in BlackRock’s current ETF success. The firm just released a version of IBIT for Canadian markets. Additionally, NASDAQ ISE recently lobbied the SEC to raise the options trading limits on IBIT.

In any event, BlackRock has once again proved that IBIT is one of the most successful ETFs of all time, not just in crypto. The Bitcoin ETFs have brought monumental inflows of capital to the crypto space, transforming the industry forever.

It may be unclear what the future will hold, but BlackRock has all the tools to respond to many unprecedented market factors.