Nearly $4 Billion Worth of Bitcoin and Ethereum Options Expiring Today: What to Expect

Crypto markets will witness nearly $4 billion worth of Bitcoin (BTC) and Ethereum (ETH) options expire today.

Market watchers are particularly attentive to this event due to its potential to influence short-term trends through the volume of contracts and their notional value. Examining the put-to-call ratios and maximum pain points can provide insights into traders’ expectations and possible market directions.

Bitcoin and Ethereum Options Expiring Today

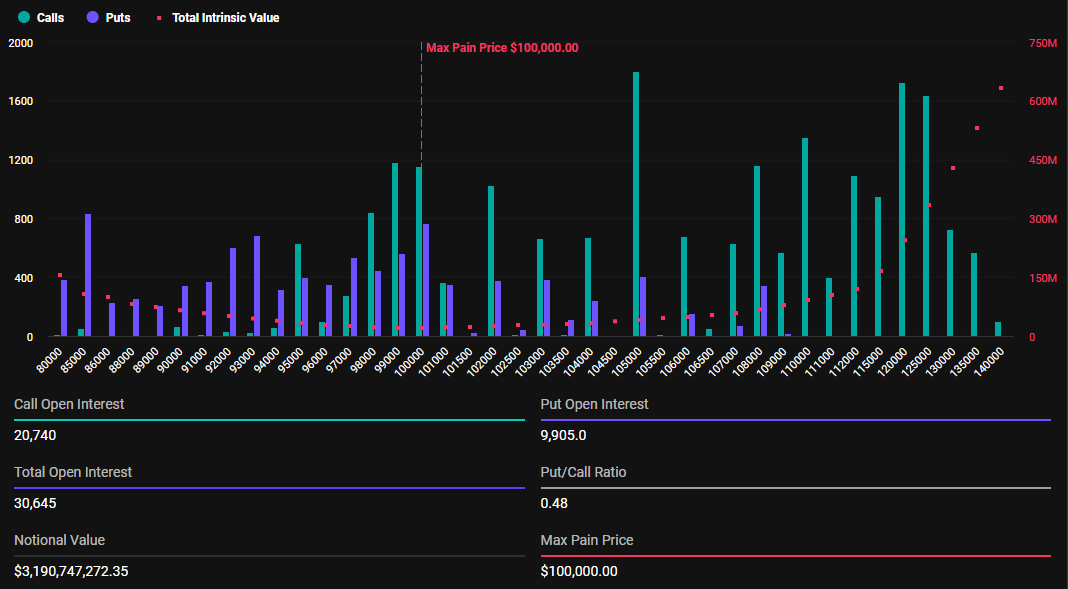

The notional value of today’s expiring BTC options is $3.19 billion. According to Deribit’s data, these 30,645 expiring Bitcoin options have a put-to-call ratio of 0.48. This ratio suggests a prevalence of purchase options (calls) over sales options (puts).

The data also reveals that the maximum pain point for these expiring options is $100,000. In crypto options trading, the maximum pain point is the price at which most contracts expire worthless. Here, the asset will cause the greatest number of holders’ financial losses.

Expiring Bitcoin Options. Source: Deribit

Expiring Bitcoin Options. Source: Deribit

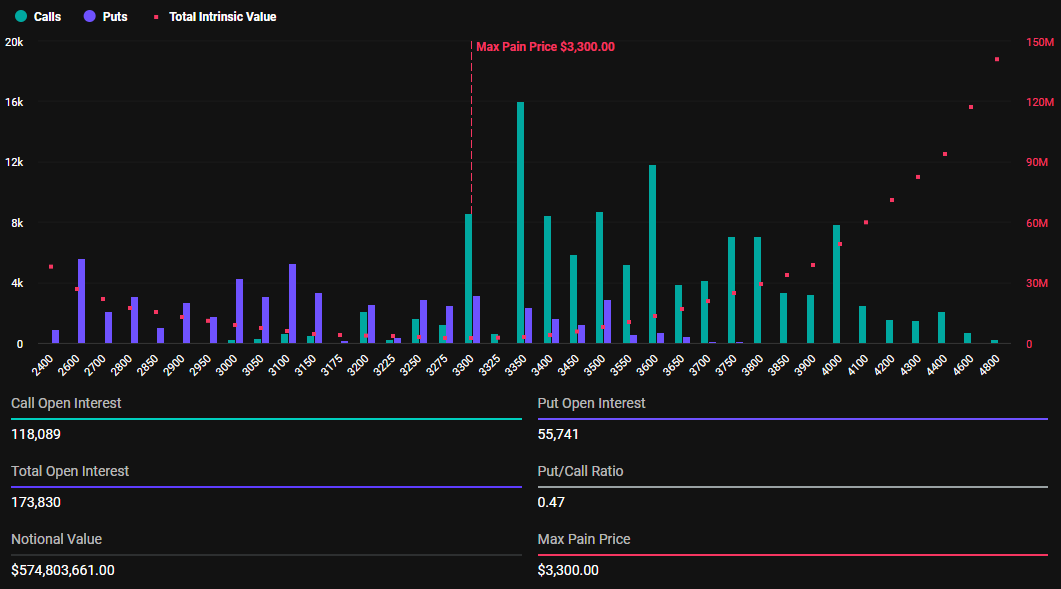

In addition to Bitcoin options, 173,830 Ethereum contracts are set to expire today. These expiring options have a notional value of $574.8 million and a put-to-call ratio of 0.47. The maximum pain point is $3,300.

Expiring Ethereum Options. Source: Deribit

Expiring Ethereum Options. Source: Deribit

The current market prices for Bitcoin and Ethereum are above their respective maximum pain points. BTC is trading at $103,388, while ETH sits at $3,305.

“BTC max pain ticks higher, while ETH traders position near key levels,” Deribit observed.

This suggests that if the options were to expire at these levels, it would generally signify losses for option holders.

The outcome for options traders can vary significantly depending on the specific strike prices and positions they hold. To assess potential gains or losses at expiration accurately, traders must consider their entire options position, along with current market conditions.

What the Expiring Contracts Mean for the Market

These expiring contracts come amid President Donald Trump’s executive order to create a digital asset stockpile in the US. If approved, this initiative could include a reserve capturing more crypto assets other than Bitcoin.

Beyond a digital asset stockpile, the president also established a cryptocurrency work group to develop a federal regulatory framework governing digital assets. The US SEC (Securities and Exchange Commission) has also repealed the SAB 121 policy, giving banks the green light to custody crypto.

These developments, coupled with the expiration of the BTC and ETH options, serve as bullish fundamentals that could inspire volatility. Analysts at CryptoQuant reveal an interesting investor outlook that shows comprehensive evaluation is essential before concluding.

“Is this the calm before an impending storm? The market continues to grind lower even after the SEC announced the establishment of a Crypto Regulatory Task Force. BTC has broken below $106,000 and is currently hanging by a thread around the $102,000 level,” the analysts wrote.

Further, the analysts observe increased interest in purchasing options contracts with a strike price of $95,000 for January. This could indicate that traders are seeking protection against potential downside risk as Bitcoin teases with a loss of momentum.

The shift in sentiment from a bullish to a more cautious attitude is attributed to the fluctuating market conditions.

Nevertheless, analysts expect the crypto market to remain range-bound until there is more clarity on how recent economic data, specifically the weak Consumer Price Index (CPI) reading, will impact the Federal Open Market Committee (FOMC) meeting scheduled for next week. This meeting could potentially influence the Fed’s upcoming policy decisions.