Solana (SOL) Pulls Back 14.5% from ATH Despite Record Whale Numbers

Solana (SOL) price has experienced significant volatility in recent days as it faces key technical challenges. After reaching a new all-time high on January 19, SOL has pulled back 14.5%, though it maintains a 16.7% gain over the past seven days.

Technical indicators suggest the strong uptrend is losing momentum, with key support and resistance levels likely to determine the next major price move. The growing number of whale addresses holding large SOL positions indicates strong institutional interest, despite the recent price correction.

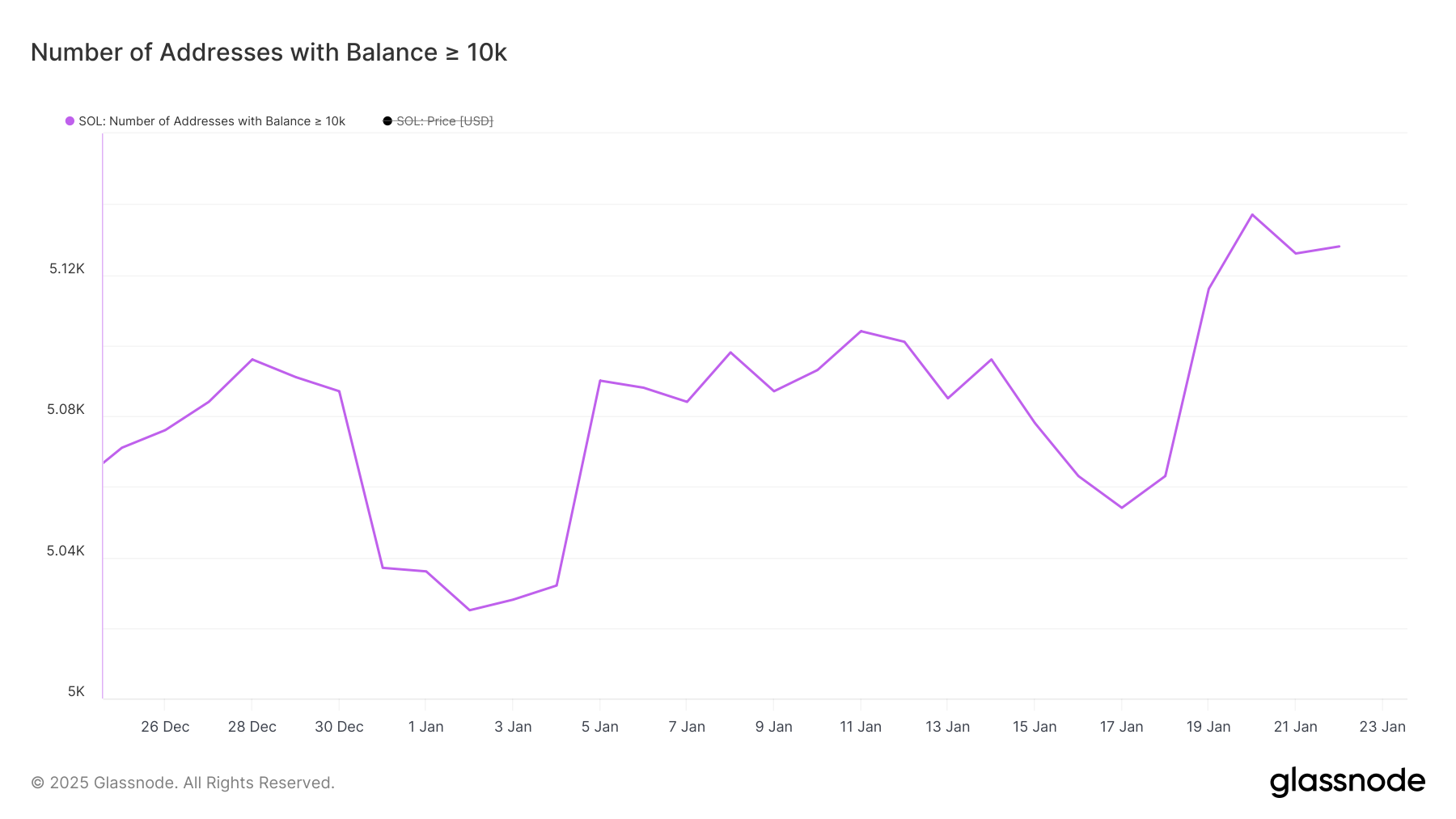

SOL Whales Are Reaching All-Time Levels

Solana whales have reached historic levels, with addresses holding 10,000+ SOL peaking at 5,137 three days ago before slightly declining to 5,128.

Tracking these large holders is crucial for market analysis since whales can significantly impact price movements through their trading decisions and often represent institutional players whose actions can signal broader market sentiment and potential price trends.

SOL Whale Addresses. Source: Glassnode

SOL Whale Addresses. Source: Glassnode

The current elevated whale count, which jumped from 5,054 on January 17 to 5,128 in just six days, suggests strong institutional confidence in SOL despite the minor recent decline.

This rapid accumulation by large holders could indicate positive price momentum for Solana. However, investors should remain aware that concentrated holdings also carry the risk of increased volatility if whales make coordinated moves.

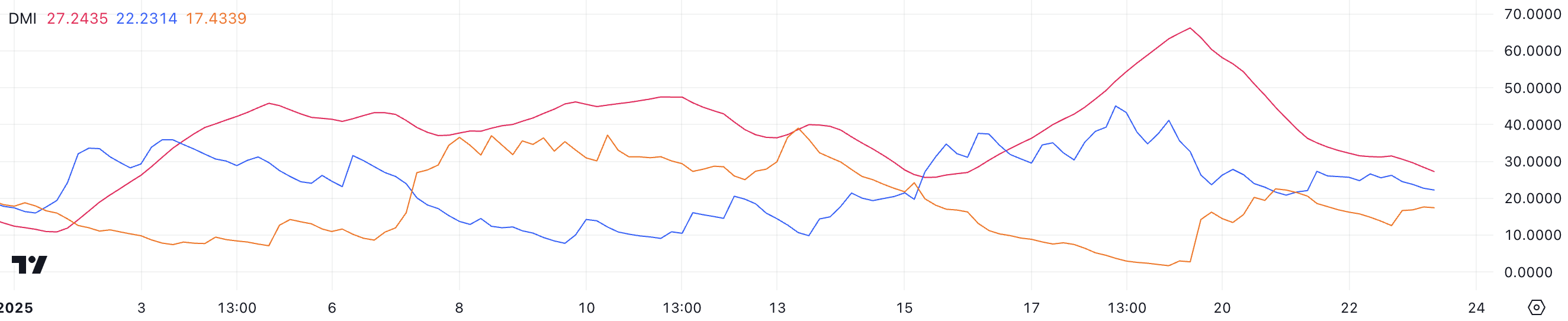

Solana DMI Shows the Trend Is Losing Its Steam

Since SOL price recent all-time high, the average directional index (ADX) for Solana has declined sharply from 66.2 to 27.2 over the past four days.

ADX measures trend strength regardless of direction, with readings above 25 indicating a strong trend and below 20 suggesting a weak trend. The current 27.2 reading shows the trend is still strong but significantly weakening from its recent extremely strong levels.

SOL DMI. Source: TradingView

SOL DMI. Source: TradingView

The decline in +DI (Positive Directional Indicator) from 26.2 to 22.2 alongside an increase in -DI (Negative Directional Indicator) from 12.5 to 17.4 suggests momentum is shifting. While SOL remains in an uptrend, these DMI components indicate selling pressure is increasing while buying pressure is decreasing.

This technical setup often precedes a period of consolidation or potential trend reversal, though the current ADX reading above 25 indicates the uptrend still has some strength remaining.

SOL Price Prediction: Will Solana Reach $300 In January?

The narrowing distance between SOL’s EMA lines, while maintaining their bullish alignment (short-term above long-term), typically signals decreasing momentum in the uptrend.

This pattern often suggests a potential period of consolidation or price correction, though the maintained bullish structure indicates that the overall uptrend has yet to break.

SOL Price Analysis. Source: TradingView

SOL Price Analysis. Source: TradingView

The technical analysis reveals critical support and resistance levels that could determine SOL’s near-term direction. A break below $223 could trigger a cascade to $211, with further downside potential to $191.85 if these supports fail.

Conversely, reclaiming bullish momentum could drive Solana price toward $295, with a potential breakthrough above $300 marking a historic milestone.