Litecoin Price Forecast: Traders bet $580M on LTC as US court lifts Tornado Cash ban

- Litecoin price dipped 2% to $117 on Wednesday as crypto traders reacted to US court’s decision to lift the Federal ban on the cryptocurrency mixer platform, Tornado Cash.

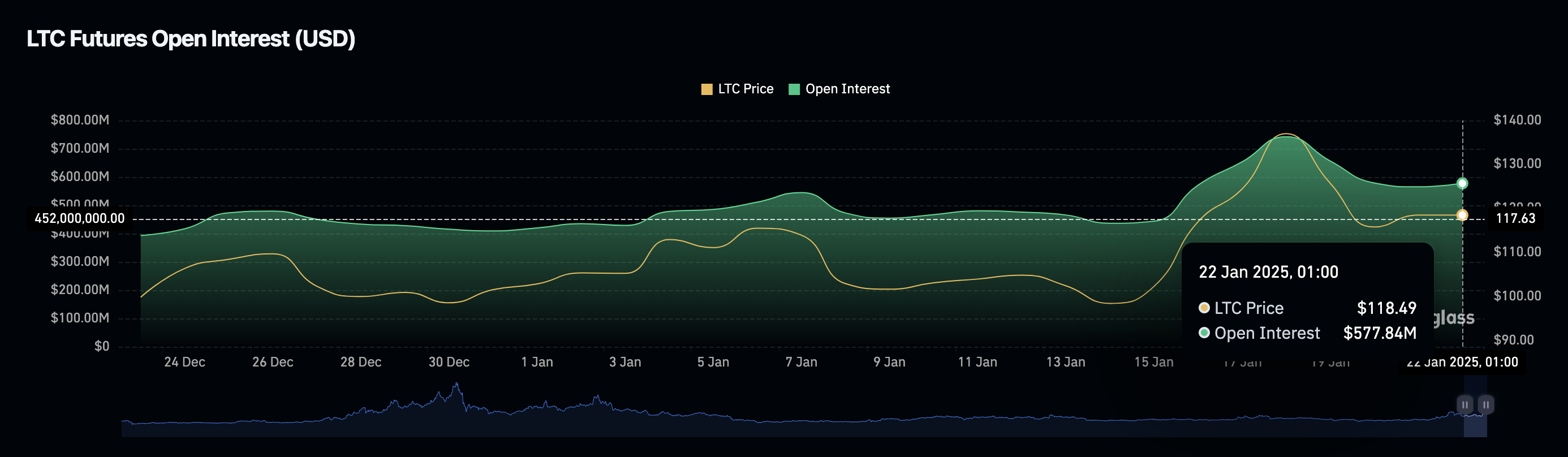

- Litecoin traders continued to enter new positions amid the price dip, with LTC open interest rising to $577 million

- With speculative traders capitalizing on the price dip to enter fresh positions at lower prices, technical indicators also highlight key rebound signals.

Litecoin price slipped toward $117 as a United States (US) court overturned the federal sanctions level against the Tornado Cash cryptocurrency mixing protocol. Will the regulatory clarity surrounding privacy-preserving technologies drive cryptocurrencies like LTC to new peaks in the near term?

Litecoin price holds $115 support as traders react to Tornado Cash sanctions reversal

Litecoin price wobbled on Wednesday as crypto traders leaned towards more compelling narratives grabbing media headlines this week.

After the TRUMP and MELANIA token frenzy dominated newsreels ahead of the Monday inauguration, a US court ruling introduced further volatility on Wednesday.

A recent US court ruling has overturned sanctions imposed on the cryptocurrency mixer protocol Tornado Cash over alleged North Korean hackers' utilization of the protocol to launcer stolen funds, during the previous administration.

This ruling has sparked optimism among blockchain technology enthusiasts eager for the proliferation of privacy-preserving cryptocurrency payment protocols.

Tornado Cash’s exoneration presents a bullish long-term outlook for privacy-focused coins such as Litecoin (LTC), Bitcoin (BTC), and Dash (DASH).

In terms of market reaction, Tornado Cash (TORN) and Monero (XMR) have seen double-digit gains within 12 hours of the ruling. TORN surged to $18.61, while XMR reached $218.83.

Litecoin price action | LTCUSDT

Litecoin price action | LTCUSDT

However, while Tornado Cash and Monero rallied by double-digits, Litecoin’s short-term price momentum was negatively impacted.

The chart above shows that LTC price dipped 2% on Wednesday, to $117 at the time of writing. This short-term divergence suggests traders may be reallocating capital from established assets like Litecoin into tokens benefiting directly from the Tornado Cash ruling.

TORN and XMR, both heavily scrutinized under the Biden administration, appear to be attracting short-term speculative interest.

Litecoin’s muted response hints at a broader trend of crypto traders prioritizing immediate gains over long-term fundamentals amid the euphoria surrounding Trump’s Presidency.

Speculative traders bet $580million on early Litecoin rebound

Litecoin (LTC) dipped 2% on Wednesday, trading at $117 as market participants reacted to a landmark US court ruling lifting the federal ban on Tornado Cash, a cryptocurrency mixer protocol.

The decision, announced late Tuesday, has injected volatility into the broader cryptocurrency market, creating divergent trends among major coins.

Litecoin price vs. LTC Open Interest | Source: Coinglass

Litecoin price vs. LTC Open Interest | Source: Coinglass

Despite the Litecoin price dip, Coinglass’ open interest chart shows speculative traders continued to enter new positions.

As depicted above, Open interest for Litecoin futures contracts climbed $12 million in the past 24 hours, rising from $565 million to $577 million—an equivalent 2% increase.

This influx of capital suggests that speculative traders are entering new positions to counteract the bearish pressure in spot markets.

The simultaneous 2% price dip and matching 2% rise in open interest underscore a compelling narrative: traders appear confident in a potential Litecoin rebound.

Historically, a surge in open interest during price dips often signals bullish accumulation, as market participants look to buy in at discounted levels.

The broader market context adds weight to this interpretation. Coins such as Tornado Cash and Monero have surged in double digits following the court ruling, attracting traders eager to capitalize on privacy-centric tokens.

Litecoin, however, remains a favored asset among institutional and retail traders, with its long-standing reputation as a “silver to Bitcoin’s gold.”

While Tornado Cash and Monero have captured attention, Litecoin’s surge in open interest indicates resilience among bullish traders aiming to neutralize bearish sell-offs.

The LTC derivatives market may also signal a strategic repositioning of capital, with traders diversifying into privacy-focused assets while keeping an eye on Litecoin’s rebound potential.

LTC Price Forecast: Close above $117 could validate $150 rebound prospects

After a 2.19% intraday decline on Wednesday, Litecoin's price outlook currently paints a neutral outlook, as it hovers near the $116.50 mark, with immediate support evident at $115.

Bollinger Bands reveal moderate compression, suggesting the potential for a significant price move in either direction. The lower band at $112.3 aligns with a key support zone, while the upper band at $131.8 highlights an initial bullish target if momentum reverses.

Litecoin Price Forecast | LTCUSDT

Litecoin Price Forecast | LTCUSDT

The RSI currently reads 53.06, indicating neutral momentum.

However, its marginal decline hints at weakening buying strength, posing a bearish risk of further downside if the $115 support breaks.

In such a scenario, the price could retreat toward the $112 level, a key psychological floor.

Conversely, the midline VWAP at $117.15 suggests an equilibrium zone.

A close above this level could reinvigorate bullish sentiment, driving LTC toward $122 resistance and beyond.

The prevailing structure hints at speculative accumulation, evident in steady open interest growth.

In the bullish scenario, sustained buying pressure could catalyze a breakout above $122, targeting the $150 resistance zone.

However, failure to reclaim $117 decisively could tilt the near-term outlook bearish.