Solana Price Forecast: Are US traders dumping Bitcoin and XRP for SOL?

- Solana price continues to consolidate above the $250 line on Monday, having retracted 10% from the all-time high of $275 recorded 24 hours earlier.

- SOL overtook XRP and Bitcoin to become the most popular Layer-1 asset among US investors with growing demand.

- While Solana price increased by 48% within the weekly time frame, BTC and XRP have also gained 34% and 18%, respectively.

- A week-long trend of rising Solana trading volumes signals an oversupplied market, a move that could trigger volatility in either direction.

Solana (SOL) price stabilized near the $250 support level on Monday, having declined 10% from its all-time high over the last 24 hours.

On-chain data trends show that positive speculation on potential altcoin ETF approval and volatility triggered by Trump’s memecoin launch saw SOL become the most in-demand asset among US investors. Will the SOL price advance above $300 or retrace toward $200?

Solana emerges as US investors’ top-searched crypto ahead of Trump inauguration

Solana has experienced significant market volatility since the start of January.

Market sentiment improved as optimism over Donald Trump's presidency and anticipated crypto-friendly policy shifts outweighed bearish headwinds from a hawkish Federal Reserve (Fed).

Notably, Coingecko unveiled a new data dashboard on Monday that highlights the most-searched assets among users in the United States.

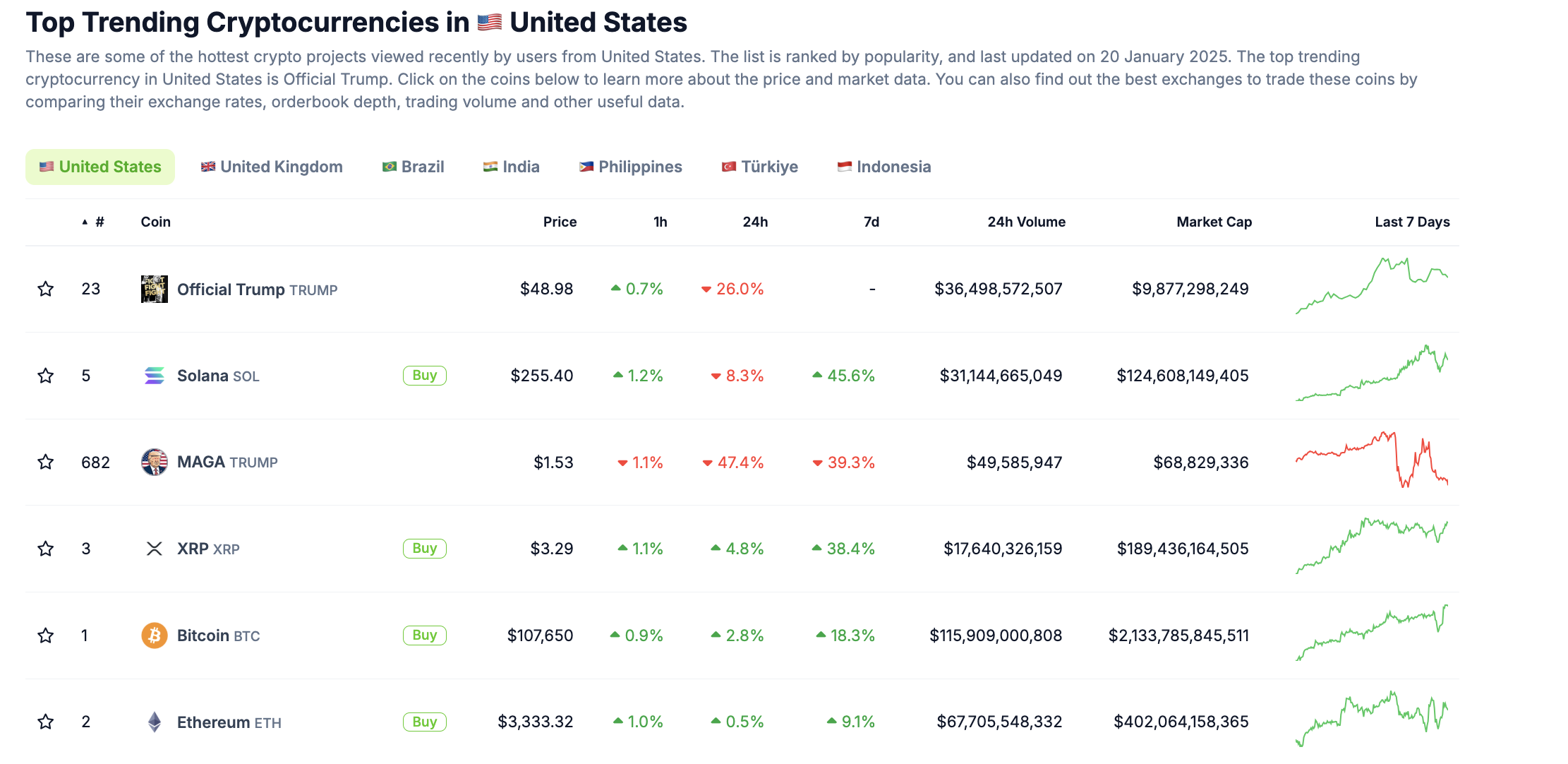

The chart below reveals that Solana overtook both XRP and Bitcoin to become the most popular Layer-1 asset among US traders.

Interestingly, the newly launched Official Trump (TRUMP) coin, hosted on Solana, and the MAGA (TRUMP) token emerged as two of the top three most popular assets among US investors. Solana ranked second on the day, showcasing its growing prominence.

Top Trending Cryptocurrencies in the USA, January 20, 2025 | Source: Coingecko

Top Trending Cryptocurrencies in the USA, January 20, 2025 | Source: Coingecko

Solana’s prominence is not limited to search interest alone. The data also shows that SOL's price performance in the week leading up to Trump’s inauguration significantly outpaced rival Layer-1 assets, reinforcing its position as a key asset for traders.

Solana price action indicates a 48% surge within the past seven days, though it continues to struggle to maintain support above $250.

Meanwhile, Bitcoin is trading at $107,650 at press time, having gained 18%, while XRP, hovering above $3.20, has risen by 38%.

Solana has outperformed BTC, XRP and ETH over the past week, drawing significant attention from US traders.

Following market trends, this data indicates that Solana has emerged as the most in-demand token ahead of Donald Trump's inauguration.

Strategic investors could interpret this as a signal that Solana is now widely-tipped as the crypto project best-positioned to benefit from Trump's administration.

How will Trump’s presidency impact Solana price?

Trump's presidency has dominated crypto market discussions since his re-election.

Two crucial topics have emerged as key drivers of Solana's recent market-leading performance.

First, optimism surrounding altcoin ETF applications has fueled bullish sentiment, with Solana, XRP, and Litecoin (LTC) all having active ETF proposals in progress.

This development has bolstered Solana's attractiveness to institutional investors.

Second, Trump’s decision to use Solana as the native blockchain for launching the $TRUMP and $MELANIA memecoins just hours before the election has further amplified interest.

Solana’s current price rally may face a steep correction from $250 if traders opt to take profits as the euphoria from Trump’s inauguration tapers off.

However, the upcoming ETF approval speculation and $TRUMP memetoken era remain active bullish catalysts.

They are likely to reignite interest in Solana and could potentially drive prices higher in the long term.

Solana Price Forecast: Downside risks ahead of $250 support caves

Solana (SOL) is trading slightly above its VWAP at $252.55, reflecting active buying interest at the current levels.

However, the sustained trend of increasing SOL trading volume over the past week hints at an oversupplied market.

If the current wave of residual demand from $TRUMP and $MELANIA speculation frenzy wears out, SOL could be at risk of rapid corrections ahead.

From a bearish perspective, the daily candlestick shows rejection from the upper Donchian Channel ($295.83), a clear indication of weakening upward momentum.

Solana Price Forecast | SOLUSDT

With SOL failing to reclaim the channel midpoint, the risk of a retest of $232.36 — a key level within the lower channel — remains high.

Furthermore, the 14% decline over the past two sessions highlights waning confidence among buyers.

If traders look to capitalize on recent gains from Trump’s inauguration to execute a "sell-the-news" strategy, SOL price could tumble as low as $230 in the near term.

On the bullish side, SOL's position above the VWAP signifies underlying strength.

If it manages to break past $260 resistance, buyers could regain control, targeting $280 and above.

However, without a prolonged consolidation or an accumulation phase, the bearish divergence in volume metrics might override upward momentum.