Bitcoin Price Forecast: BTC reaches new all-time high above $109K ahead of Trump’s inauguration

Bitcoin price today: $108,300

- Bitcoin price reaches a new all-time high of $109,588 on Monday after rallying 7.1% the previous week, fueled by Donald Trump’s upcoming inauguration.

- US Bitcoin spot ETF recorded a net inflow of $1.86 billion the previous week.

- The technical outlook suggests a rally continuation, projecting the next potential target at the $125K mark.

Bitcoin’s (BTC) price reaches a new all-time high of $109,588 on Monday after rallying 7.1% the previous week. The recent rally is fueled by Donald Trump’s upcoming inauguration. The US Bitcoin spot Exchange Traded Funds (ETFs) also supported the BTC’s rally, recording a net inflow of $1.86 billion the previous week. While technical analysis suggests a continuation of the ongoing rally and a target at the $1250K mark.

Bitcoin hits a new all-time high of $109,588 as Trump’s inauguration comes closer

Bitcoin price reaches a new all-time high of $109,588 on Monday and surpasses $2.16 trillion market capitalization, according to CoinGeko. The recent rally in Bitcoin’s price is fueled by Donald Trump’s inauguration on Monday. Moreover, President Trump’s celebratory victory rally speech on Sunday mentioned Bitcoin.

Trump's speech said, “Since the election, the stock market has surged and small business optimism has soared a record 41 points to a 39-year high. Bitcoin has shattered one record high after another.”

As Donald Trump takes the Oval Office, he may take up crypto-specific legislation and change tax and spending policies that affect broader financial markets and risky assets like Bitcoin.

Moreover, the US macroeconomic data released last week has supported this recent rally in Bitcoin price.

Bitcoin’s institutional demand comeback

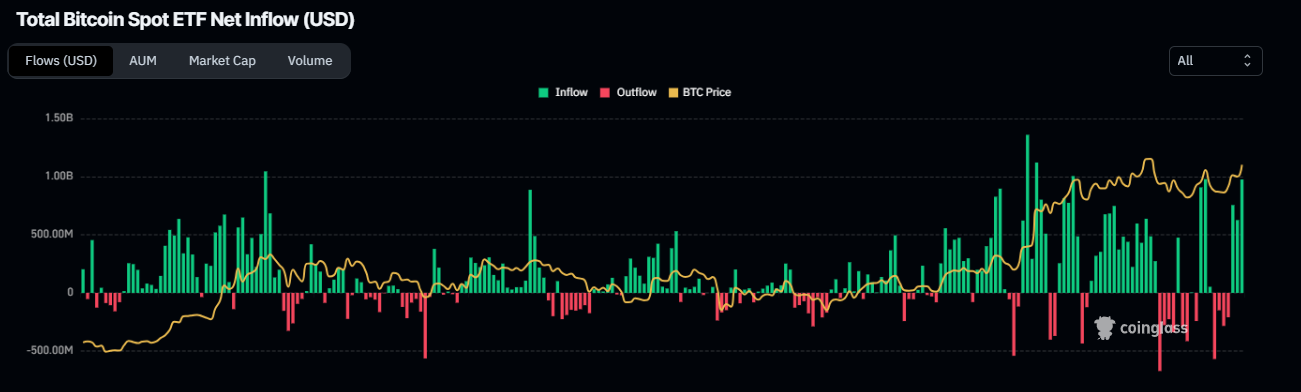

Bitcoin’s institutional demand also shows signs of return. According to Coinglass, Bitcoin spot ETF data recorded a total net inflow of $1.86 billion last week, almost sixfold compared to the previous week’s inflow of $312.8 million. For Bitcoin’s price to continue its upward momentum, the magnitude of the ETF inflow must intensify.

Total Bitcoin spot ETF net inflow chart. Source: Coinglass

Bitcoin could target $145K-$249K in 2025 – CryptoQuant Report

CryptoQuant’s weekly report highlights that Bitcoin could target a price of $145K-$249k in 2025. The report explains that institutional capital flows could drive this in a favorable regulatory environment, accommodative monetary policy in the US and historical cyclical patterns.

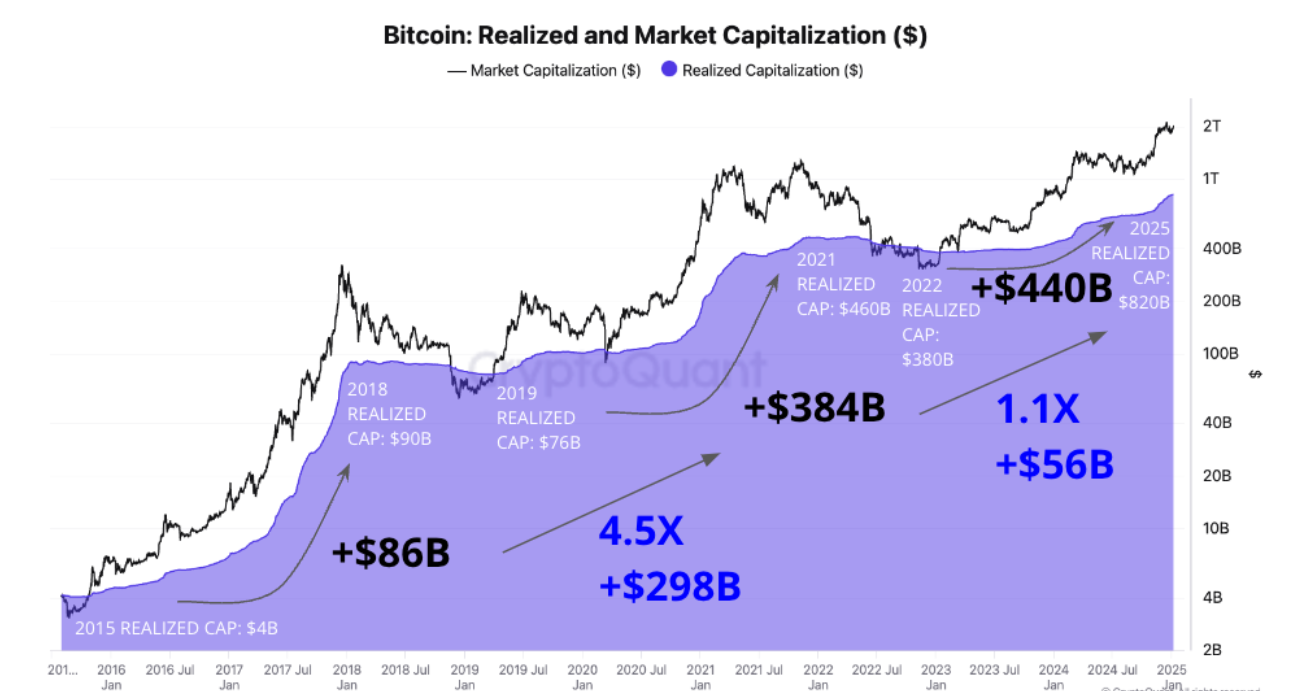

According to the report, about $520 billion of fresh capital could flow into Bitcoin in 2025. The chart below shows Bitcoin’s realized capitalization (purple area) since 2015. It shows how each bull cycle increases as fresh capital enters Bitcoin.

It is important to note the growth in the flow of new capital (blue text in the chart). From 2018 to 2021, fresh capital flowing into Bitcoin grew by 4.5 times (or $298 billion). However, during this current cycle (end of 2022 to 2025), the growth in the flow of capital has been only $56 billion or 1.1 times, which suggests that it could witness an important amount of flows into Bitcoin during 2025. This expectation also makes sense because there are new sources of demand for Bitcoin in this cycle, such as ETFs and more companies buying Bitcoin like MicroStrategy, Riot Platforms,(...).

If the change in the flow of capital into Bitcoin were to behave in this cycle (including 2025) as it did in the previous one (2019-2021), the realized cap would grow by $520 billion in 2025, says the report.

Bitcoin Realized and Market Capitalization chart. Source: CryptoQuant

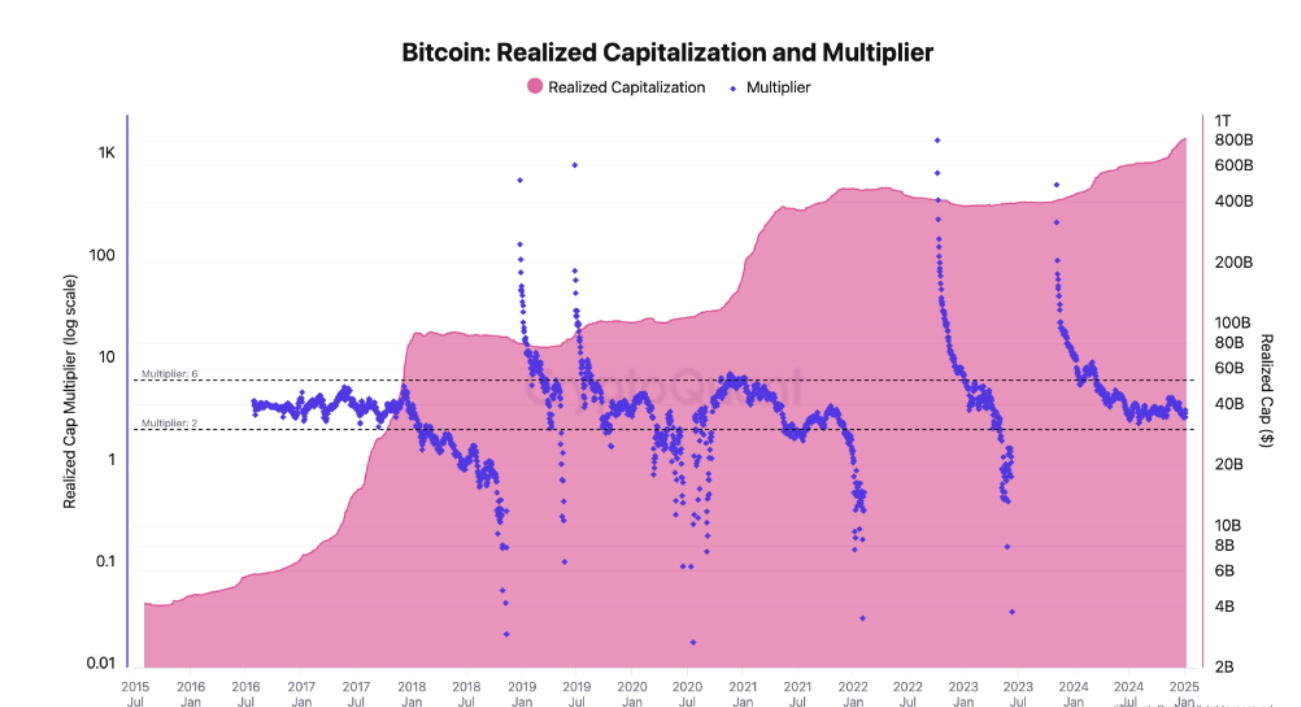

Additionally, the Bitcoin multiplier (violet dots in the chart below) usually stays between a lower limit of 2 and an upper limit of 6, specifically during bull markets like the current one. This indicates that for every $1 of capital that flows into Bitcoin, the total market value can increase by $2-$6.

Bitcoin Realized Capitalization and Multiplier chart. Source: CryptoQuant

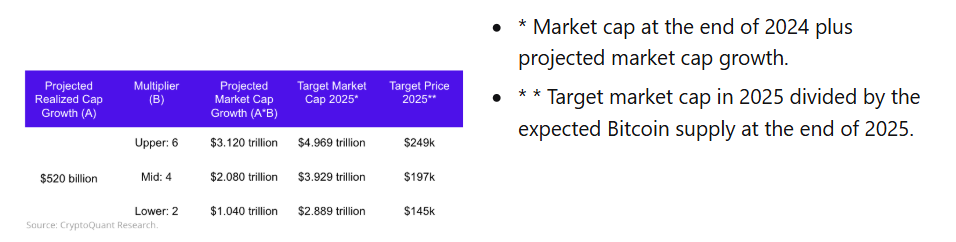

Assuming that new capital flows in 2025 will total $520 billion, as mentioned in the report, and using the multiplier, it projects a target market capitalization and price for Bitcoin in 2025 as shown in the table below.

Bitcoin projection for 2025 chart. Source: CryptoQuant

Bitcoin Price Forecast: BTC bulls reach new high of $109,588

Bitcoin price bounced after retesting its $90,000 support level at the start of the previous week and rallied 10.6% until Saturday. However, it faced rejection around the $106K level, declining 3.08% on Sunday and retesting its key support level at $100K. On Monday, BTC recovers bullish momentum and surpasses its December 17, 2024, all-time high (ATH) of $108,353, reaching a new ATH of $109,588.

If BTC continues its upward momentum, it could extend the rally above the $125K mark, calculated by the 141.40% Fibonacci extension level (drawn from the November 4 low of $66,835 to Monday’s ATH of $109,588) at $127,287.

The Relative Strength Index (RSI) indicator on the daily chart reads 66, above its neutral level of 50, and points upwards, indicating a rise in bullish momentum. Additionally, the Moving Average Convergence Divergence (MACD) indicator flipped a bullish crossover on Wednesday, giving a buy signal and suggesting an uptrend.

BTC/USDT daily chart

However, if BTC faces a pullback and closes below $100,000, it could extend the decline to retest its next support level at $90,000.

Bitcoin, altcoins, stablecoins FAQs

Bitcoin is the largest cryptocurrency by market capitalization, a virtual currency designed to serve as money. This form of payment cannot be controlled by any one person, group, or entity, which eliminates the need for third-party participation during financial transactions.

Altcoins are any cryptocurrency apart from Bitcoin, but some also regard Ethereum as a non-altcoin because it is from these two cryptocurrencies that forking happens. If this is true, then Litecoin is the first altcoin, forked from the Bitcoin protocol and, therefore, an “improved” version of it.

Stablecoins are cryptocurrencies designed to have a stable price, with their value backed by a reserve of the asset it represents. To achieve this, the value of any one stablecoin is pegged to a commodity or financial instrument, such as the US Dollar (USD), with its supply regulated by an algorithm or demand. The main goal of stablecoins is to provide an on/off-ramp for investors willing to trade and invest in cryptocurrencies. Stablecoins also allow investors to store value since cryptocurrencies, in general, are subject to volatility.

Bitcoin dominance is the ratio of Bitcoin's market capitalization to the total market capitalization of all cryptocurrencies combined. It provides a clear picture of Bitcoin’s interest among investors. A high BTC dominance typically happens before and during a bull run, in which investors resort to investing in relatively stable and high market capitalization cryptocurrency like Bitcoin. A drop in BTC dominance usually means that investors are moving their capital and/or profits to altcoins in a quest for higher returns, which usually triggers an explosion of altcoin rallies.