CLV price prediction 2025-2031: Will Clover Finance ever go back up?

Key takeaways

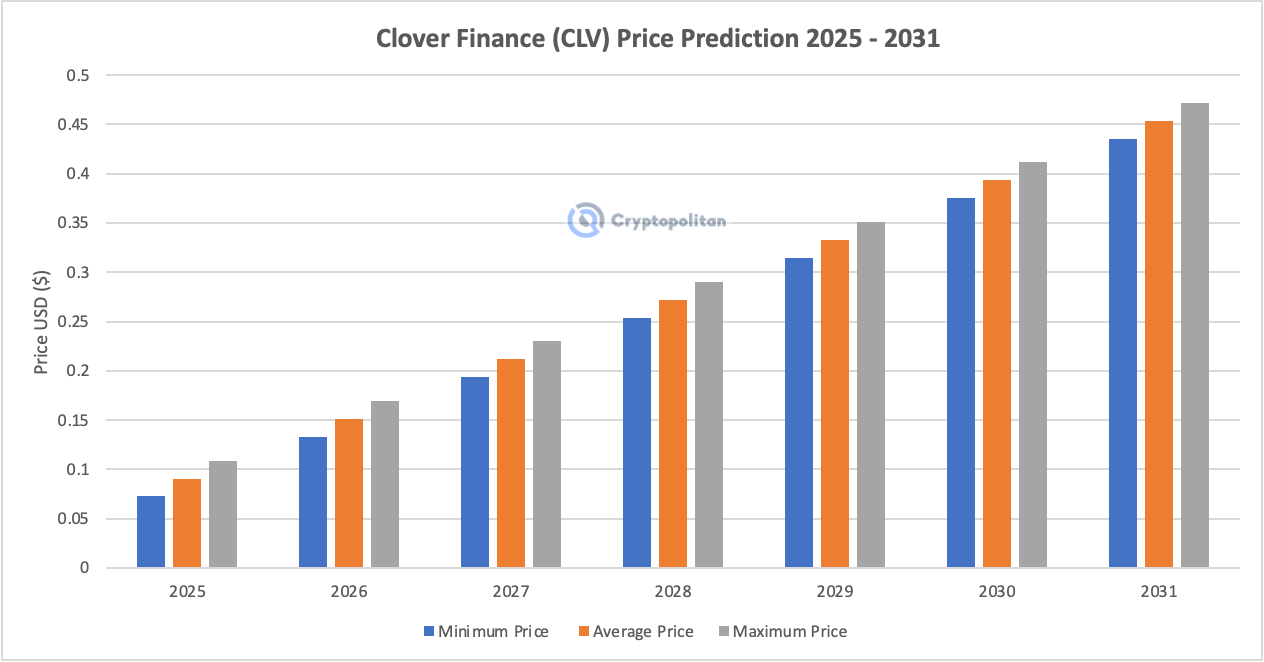

- Current CLV price prediction suggests that the coin’s price can reach $0.1512 by the end of 2025.

- By 2028, CLV may reach a peak price of $0.2904 and an average price of $0.2722.

- In 2031, the target price for CLV is between $0.4356 and $0.4719, with an average price of $0.4537.

Clover Finance (CLV) is one cryptocurrency many traders are looking at regarding its future price and if it is a good investment. While the existing products and the token $CLV will remain the same, the new branding aims for a strategic change from finance to everything web3.

According to its whitepaper, Clover Finance aims to simplify transaction fees. Unlike other DeFi platforms that ask users to pay transaction fees in specific tokens, Clover Finance allows users to pay these transaction fees in the same token where the transaction occurs. Clover Finance has many use cases, including deploying Dapps on the Clover network, paying transaction fees, staking, voting, and nominating node validators.

CLV has fluctuated significantly in the past few months. Will it reach its ATH at $2.17 again? How high will it go in 2025? Let’s get into the details.

Overview

| Cryptocurrency | Clover Finance |

| Token | CLV |

| Price | $0.06126 |

| Market Cap | $74.99M |

| Trading Volume | $14.1M |

| Circulating Supply | 1.22B CLV |

| All-time High | $2.17, Aug 31, 2021 |

| All-time Low | $0.02902, Oct 12, 2023 |

| 24-hour High | $0.06241 |

| 24-hour Low | $0.05785 |

CLV technical analysis

| Metric | Value |

| Price Prediction | $0.18093 (230.04%) |

| Volatility | 5.85% |

| 50-Day SMA | $0.056983 |

| 14-Day RSI | 55.15 |

| Sentiment | Neutral |

| Fear & Greed Index | 61 (Greed) |

| Green Days | 13/30 (43%) |

| 200-Day SMA | $0.070087 |

CLV price analysis: Token surges with 3.26% daily gain – bullish momentum ahead?

TL;DR Breakdown

- CLV experienced a sharp increase of 3.26%, signaling bullish momentum.

- If broken, the token approaches key resistance at $0.06241, which could trigger further upward movement.

- The support at $0.05785 has proven strong, providing a foundation for potential consolidation or further gains.

CLV is experiencing a notable price uptick on January 17th, trading at $0.06126, representing a 3.26% increase in the last 24 hours. The token has broken out of its prior consolidation zone, with a significant surge toward the day’s high of $0.06241. This marks a shift in sentiment as the market starts to build bullish momentum after trading in a relatively tight range. CLV’s current trajectory signals growing interest among investors, with increased volume backing the recent rally.

CLV 1-day price chart: CLV shows signs of recovery as momentum indicators signal strength

The 4-hour price chart for CLV highlights a gradual recovery, with the token currently trading at $0.06126 after a 6.24% gain in the last session. The price shows a bullish structure, rebounding from its recent lows near $0.05785. Buyers are beginning to regain control, pushing CLV toward its near-term resistance of $0.06241. The consistently higher lows on the chart indicate growing bullish sentiment, with the potential for a breakout if buying pressure sustains above the resistance level.

The Relative Strength Index (RSI) is currently at 46.04, suggesting a shift toward neutral territory from oversold conditions, signaling room for further upward movement. The MACD histogram displays positive momentum, with the MACD line crossing above the signal line, confirming a bullish crossover. These indicators suggest that CLV may continue its upward trajectory, provided volume and buyer interest remain robust.

CLV 4-hour price chart: CLV gains momentum as indicators signal strength

CLV demonstrates a steady upward movement on the 4-hour chart, trading at $0.06126 with a 3.26% increase. After bouncing off the $0.05785 support level, the token shows resilience, forming higher lows and suggesting a short-term bullish trend. The price is approaching a critical resistance near $0.06241, and a breakout above this level could signal a continuation of the upward momentum.

The Relative Strength Index (RSI) is 60.82, edging toward the overbought zone, indicating intense buying pressure. The MACD is in positive territory, with the MACD line at 0.00075 crossing above the signal line at 0.00049, signaling bullish momentum. Additionally, the MACD histogram shows increasing positive bars, reinforcing the potential for upward movement. Overall, the indicators suggest continuing bullish momentum if buying volume sustains.

Clover Finance technical indicators: Levels and action

Daily simple moving average (SMA)

| Period | Value | Action |

| SMA 3 | $0.053064 | BUY |

| SMA 5 | $0.051238 | BUY |

| SMA 10 | $0.050069 | BUY |

| SMA 21 | $0.050806 | BUY |

| SMA 50 | $0.056983 | SELL |

| SMA 100 | $0.067324 | SELL |

| SMA 200 | $0.070087 | SELL |

Daily exponential moving average (EMA)

| Period | Value | Action |

| EMA 3 | $0.050056 | BUY |

| EMA 5 | $0.050388 | BUY |

| EMA 10 | $0.05148 | BUY |

| EMA 21 | $0.055067 | SELL |

| EMA 50 | $0.062746 | SELL |

| EMA 100 | $0.068517 | SELL |

| EMA 200 | $0.067631 | SELL |

What to expect from the CLV price analysis

CLV showcases bullish momentum with a notable 3.26% daily gain, trading at $0.06126. This surge has moved the token closer to the key resistance level of $0.06241, a crucial threshold that, if surpassed, could ignite further upward movement. Buyers have effectively defended the $0.05785 support level, creating a strong foundation for potential price consolidation or continued gains. The recent increase in trading volume and consistent higher lows on the chart further reinforce the bullish sentiment.

Is CLV a good investment?

Based on recent data, Clover Finance (CLV) shows potential as a promising investment. Currently priced at $0.0551 with a market capitalization of $55,092,167, CLV has demonstrated consistent growth and stability. Technical indicators such as the 14-day RSI at 55.15 and the narrowing Bollinger Bands suggest a stable market environment. Despite some bearish sentiment in the short term, the overall bullish trend and investor confidence indicate that CLV is likely to maintain its upward momentum, making it a potentially good investment opportunity.

Will Clover Finance reach $0.1?

Yes, analysts’ Clover Finance 2025 prediction suggests the token will exceed the $0.1 mark soon.

Will Clover Finance reach $0.5?

Yes, CLV could potentially reach a maximum price of $0.5 after 2031.

Will Clover Finance reach $1?

Having attained an ATH of over $2, recapturing the $1 mark remains a possibility. However, analysts suggest this will not happen soon.

Does Clover Finance have a good long-term future?

Yes, based on the long-term price predictions from 2025 to 2031, Clover Finance shows significant growth potential, with projected increases in minimum, average, and maximum prices each year. This suggests a positive outlook and potential for sustained growth in the cryptocurrency market.

CLV Price Prediction January 2025

Cryptopolitan predicts Clover Finance (CLV) to experience varying price levels in January 2025. Their forecast suggests a minimum price expectation of $0.0505, an average price projection of around $0.0644, and a maximum potential price of $0.0767.

| Clover Finance price prediction | Minimum Price | Average Price | Maximum Price |

| Clover Finance price prediction January 2025 | $0.0505 | $0.0644 | $0.0767 |

CLV price prediction 2025

Cryptopolitan forecasts Clover Finance (CLV) to show significant potential in 2025, with a predicted minimum price of $0.0726, an average price projection of $0.0907, and a maximum expected price of $0.1089.

| Clover Finance Price Prediction | Minimum Price | Average Price | Maximum Price |

| Clover Finance Price Prediction 2025 | $0.0726 | $0.0907 | $0.1089 |

CLV price predictions 2026 – 2031

| Year | Minimum Price ($) | Average Price ($) | Maximum Price ($) |

| 2026 | 0.1331 | 0.1512 | 0.1694 |

| 2027 | 0.1936 | 0.2117 | 0.2299 |

| 2028 | 0.2541 | 0.2722 | 0.2904 |

| 2029 | 0.3146 | 0.3327 | 0.3509 |

| 2030 | 0.3751 | 0.3932 | 0.4114 |

| 2031 | 0.4356 | 0.4537 | 0.4719 |

CLV Price Prediction 2026

The Clover price prediction for 2026 suggests a maximum price expected to reach $0.1694. Clover Finance’s price could be around a minimum of $0.1331, with an average price of $0.1512.

CLV Price Prediction 2027

In 2027, Clover Finance’s price prediction projects significant growth. The maximum forecasted price is $0.2299, with an average price expected to reach $0.2117 and a minimum of $0.1936.

CLV Price Prediction 2028

The CLV price forecast for 2028 estimates that the cryptocurrency could reach a peak of $0.2904. The average price is projected at around $0.2722, with a minimum expected of $0.2541.

CLV Price Prediction 2029

The Clover Finance (CLV) price prediction for 2029 estimates a peak value of $0.3509. The projected minimum trading price is $0.3146, with an average market value projected around $0.3327.

CLV Price Prediction 2030

According to the CLV price prediction for 2030, analysts anticipate the cryptocurrency potentially reaching a peak price of $0.4114. The projected minimum price is expected to be $0.3751, with an average trading price of around $0.3932.

CLV Price Prediction 2031

According to the Clover Finance price prediction for 2031, analysts foresee the cryptocurrency potentially reaching a maximum price of $0.4719. The projected minimum price is expected to be $0.4356, with an average value of around $0.4537.

CLV market price prediction: Analysts’ Clover Finance price forecast

| Firm Name | 2025 | 2026 |

| SwapSpace | $0.0435 | $0.1165 |

| CoinCu | $2.45 | $4.09 |

| Digital Coin Price | $0.13 | $0.15 |

Cryptopolitan’s Clover Finance (CLV) price prediction

Cryptopolitan’s CLV price prediction suggests a minimum of $0.5992, an average of $0.6203, and a maximum of $0.7128 in 2025, suggesting substantial growth potential. Further into the future, from 2025 to 2031, CLV’s price is anticipated to soar significantly in a bullish market scenario, with projections ranging from a minimum of $6.39 to a potential maximum of $7.13 by 2031.

CLV historic price sentiment

- CLV started October 2022 at $0.08402 and dropped to $0.05227 by December, reflecting high volatility. In early 2023, it rebounded sharply, starting January at $0.05227 and rising to $0.12701 by March, driven by positive market sentiment.

- After fluctuating between $0.06340 in April and $0.05271 in June, CLV consolidated in the second half of 2023, starting July at $0.03621 and gradually climbing to $0.05820 by December.

- In January 2024, CLV opened at $0.04476 and climbed to $0.05286 by March. The following months saw fluctuations, with a peak in May at $0.06995 before dipping to $0.05271 in June due to market corrections.

- By July 2024, CLV stabilized, trading between $0.051 and $0.059. In December 2024, the price held steady at $0.059.

- As of January, CLV’s price still hovered near $0.059, showcasing a persistent lack of volatility and minimal trading activity over the six-month period.