Ethereum Price Forecast: Staking could spark ETH rally in 2025 as PostFinance launch stirs bullish sentiment

Ethereum price today: $3,320

- PostFinance AG launched an Ethereum staking service that allows customers to earn passive income.

- The announcement has stirred hopes of Ethereum ETFs integrating staking, which Standard Chartered and Bernstein predict will happen in 2025.

- Ethereum needs to overcome the resistance near its key SMAs to reclaim the $3,550 and $3,770 levels.

Ethereum (ETH) experienced a 3% decline on Thursday despite growing excitement over the launch of ETH staking services by PostFinance AG. Investors are optimistic that this development may lead to the approval of staking in Ethereum ETFs. Standard Chartered predicts the approval could push ETH's value to $14,000.

Ethereum staking could be the game-changer in 2025

PostFinance AG, a Swiss state-owned bank, announced on Thursday that it's launching a service that allows customers to stake Ethereum and earn passive income.

"We're expanding our crypto service and introducing staking. This will allow our customers to generate passive income by depositing cryptocurrencies," the bank wrote in an X post.

The bank, which began offering crypto services last year, plans to expand into other digital assets gradually.

Staking is the process of earning passive income on your digital assets by using it to contribute to the security of a cryptocurrency network.

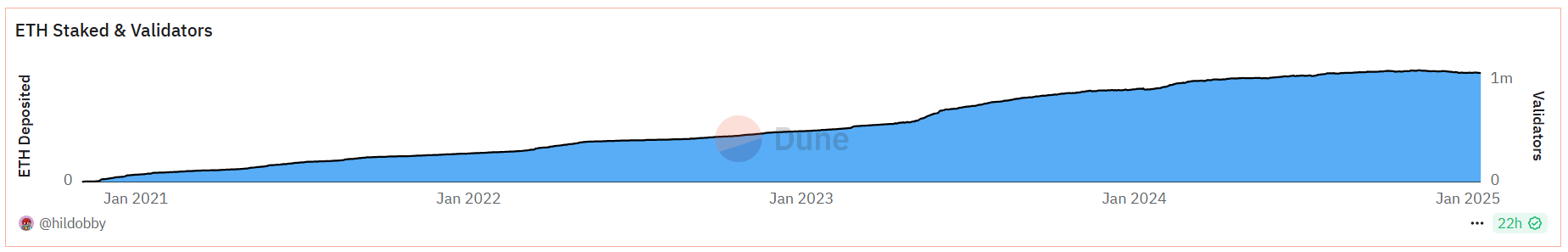

The total value of staked ETH grew to an all-time high of 35,000 ETH — about 30% of Ethereum's total supply — in early November before declining following the crypto market rally.

ETH Total Value Staked. Source: Dune (@hildobby)

With the incoming Donald Trump administration leaning towards the crypto industry, most community members anticipate that Wall Street firms may begin offering similar services. The sentiment aligns with predictions from Standard Chartered and Bernstein that staking will be integrated into Ethereum ETFs in 2025.

Notably, issuers initially included staking as part of their ETH ETF filings but later removed it because the Securities and Exchange Commission (SEC) wasn't comfortable with the process. The SEC's stance could quickly change, as pro-crypto Paul Atkins is expected to replace Gary Gensler as Chair.

The approval of staking in Ethereum ETFs could significantly boost inflows into the product and solidify its narrative as an "internet bond". Standard Chartered predicts that such a narrative could skyrocket Ethereum above $14,000 by year-end.

In an ambitious prediction, Nate Geraci, president of The ETF Store, stated that staking Ethereum ETFs could likely surpass Bitcoin ETFs if they get approval to stake their assets under management (AUM).

For comparison, Bitcoin ETFs have attracted a total net inflow of $36.66 billion since launching in January 2024. On the other hand, Ethereum ETFs are far below, with a cumulative net inflow of $2.48 billion since their launch in July.

Ethereum Price Forecast: ETH faces SMAs hurdle in the quest to surge past $3,550 and $3,770 key levels

Ethereum saw $39.85 million in liquidations, with liquidated long and short positions accounting for $28.30 million and $11.55 million, respectively, in the past 24 hours, per Coinglass data.

The top altcoin saw a rejection around the 50-day, 100-day and 200-day resistance levels — just below the $3,550 key level — in the early hours of Thursday. The resistance prevents ETH from completing a rounded bottom move that could stretch its price above $4,400 for the first time since 2021.

ETH/USDT 8-hour chart

ETH is attempting to retest the level as bulls are looking to improve their buying pressure. A successful move above the SMAs could help ETH smash the resistance levels near $3,550 and $3,770 and test its ten-month high of $4,093. However, a sustained rejection at this level could send ETH back toward the $3,000 psychological level.

The Relative Strength Index (RSI) is testing its neutral level line, while the Stochastic Oscillator (Stoch) is testing the overbought line. Successful bounces of these lines indicate sustained bullish momentum and vice versa for a cross below it. The Awesome Oscillator (AO) looks to cross above its neutral level, indicating rising bullish pressure.

A daily candlestick close below $2,817 will invalidate the bullish thesis.

Ethereum FAQs

Ethereum is a decentralized open-source blockchain with smart contracts functionality. Its native currency Ether (ETH), is the second-largest cryptocurrency and number one altcoin by market capitalization. The Ethereum network is tailored for building crypto solutions like decentralized finance (DeFi), GameFi, non-fungible tokens (NFTs), decentralized autonomous organizations (DAOs), etc.

Ethereum is a public decentralized blockchain technology, where developers can build and deploy applications that function without the need for a central authority. To make this easier, the network leverages the Solidity programming language and Ethereum virtual machine which helps developers create and launch applications with smart contract functionality.

Smart contracts are publicly verifiable codes that automates agreements between two or more parties. Basically, these codes self-execute encoded actions when predetermined conditions are met.

Staking is a process of earning yield on your idle crypto assets by locking them in a crypto protocol for a specified duration as a means of contributing to its security. Ethereum transitioned from a Proof-of-Work (PoW) to a Proof-of-Stake (PoS) consensus mechanism on September 15, 2022, in an event christened “The Merge.” The Merge was a key part of Ethereum's roadmap to achieve high-level scalability, decentralization and security while remaining sustainable. Unlike PoW, which requires the use of expensive hardware, PoS reduces the barrier of entry for validators by leveraging the use of crypto tokens as the core foundation of its consensus process.

Gas is the unit for measuring transaction fees that users pay for conducting transactions on Ethereum. During periods of network congestion, gas can be extremely high, causing validators to prioritize transactions based on their fees.