CryptoQuant Survey Reveals Top Exchange Preferences and Investor Trends for 2024

CryptoQuant, a prominent on-chain data provider, has released its 2024 survey report highlighting emerging trends in crypto exchange usage and investor behavior. The survey sheds light on how cryptocurrency users navigate the market, their preferences, and the underlying factors influencing their decisions.

The report, according to the key takeaways shared through a series of posts on X (formerly Twitter), offers a comprehensive look at the state of the digital currency industry and its evolving market.

Crypto Exchange Preferences And Investor Trends

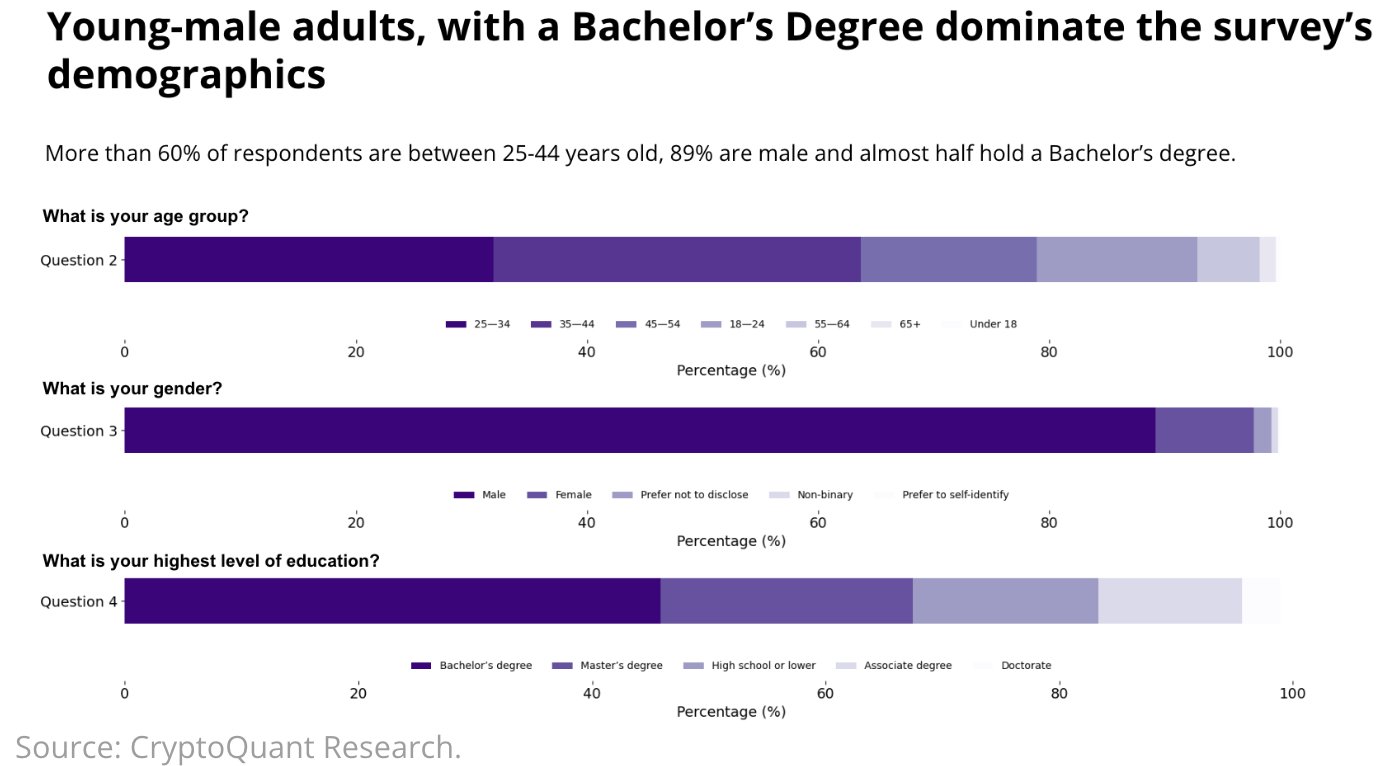

One of the report’s central findings is the demographic profile of digital currency investors. According to the survey, 60% of participants fall within the 25-44 age range, with over 62% having more than three years of experience in the industry.

This experienced and relatively young user base reflects a dominant retail investor presence, with most respondents reporting annual investments under $10,000. The data highlights the retail-driven nature of the market and provides insights into how users engage with exchanges.

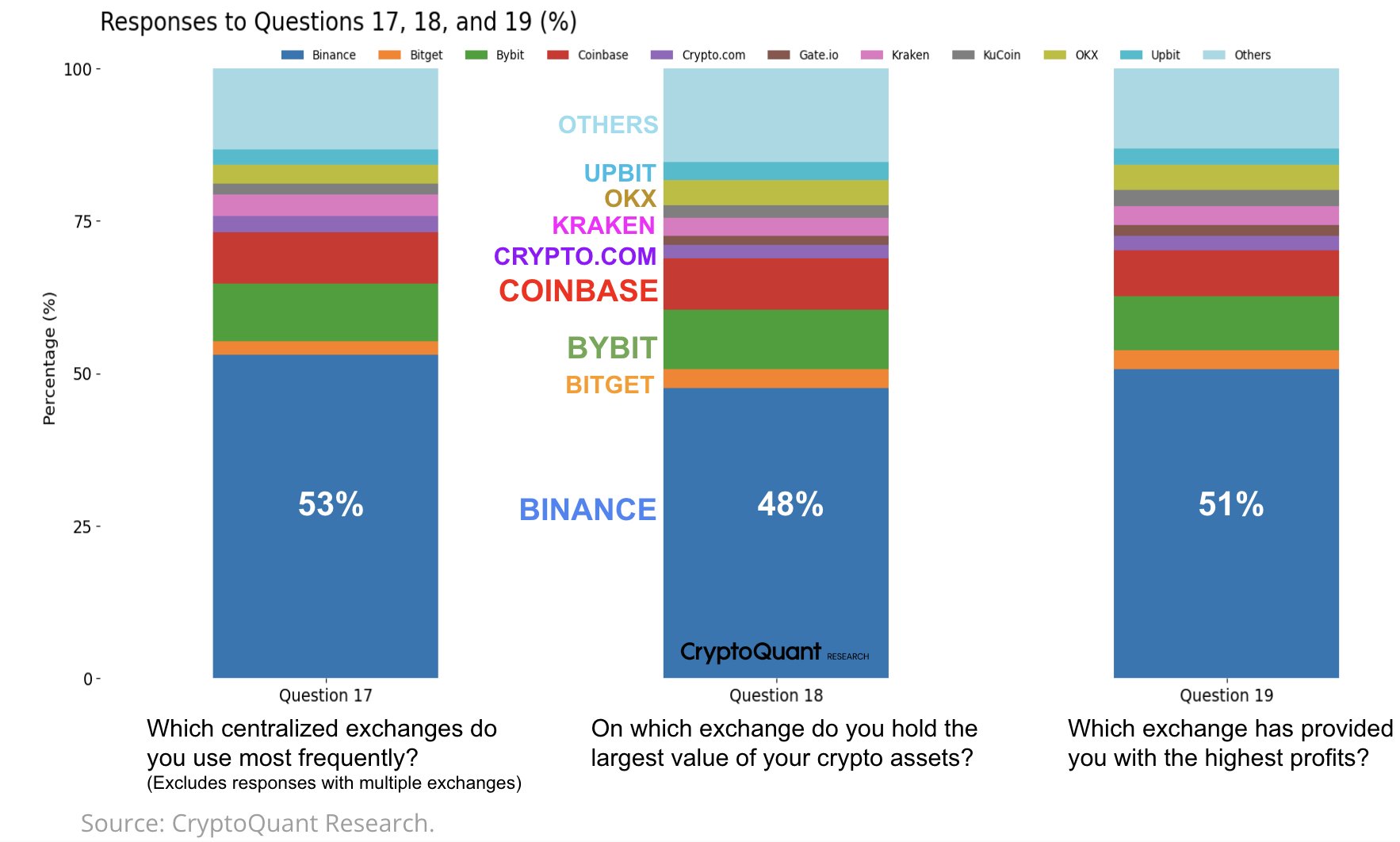

Speaking of exchanges, the survey reveals significant patterns in exchange preferences among digital currency users. Binance emerges as the leading global exchange, favored by 53% of respondents as their primary platform.

It is also the exchange where 51% of users reported the highest profits and where 48% hold most of their assets. Interestingly, regional variations were noted, with Coinbase being the top choice in North America.

The report also highlights the distinct preferences of full-time and part-time traders, with full-time traders gravitating towards platforms like Binance, Bybit, Bitget, and OKX, while part-time traders favoring Coinbase and Kraken.

In terms of investment interests, Bitcoin, Ethereum, and Layer 2 projects dominate the spotlight. The report also identifies AI-blockchain integrations as an emerging area of innovation and investment.

Spot trading remains the most popular activity, with 76% of respondents prioritizing it over derivatives trading and staking. However, only 28% of users reported utilizing earn products, indicating a potential growth area for exchanges seeking to enhance user engagement.

For context, the data provider platform defined earn products noting:

Earn products are financial services offered by cryptocurrency exchanges that allow users to earn passive income on their crypto holdings. These products typically include options like staking, savings accounts, yield farming, and liquidity provision. Users can lock or lend their assets in exchange for rewards, such as interest, new tokens, or a share of platform fees

Independent Research and Future Trends

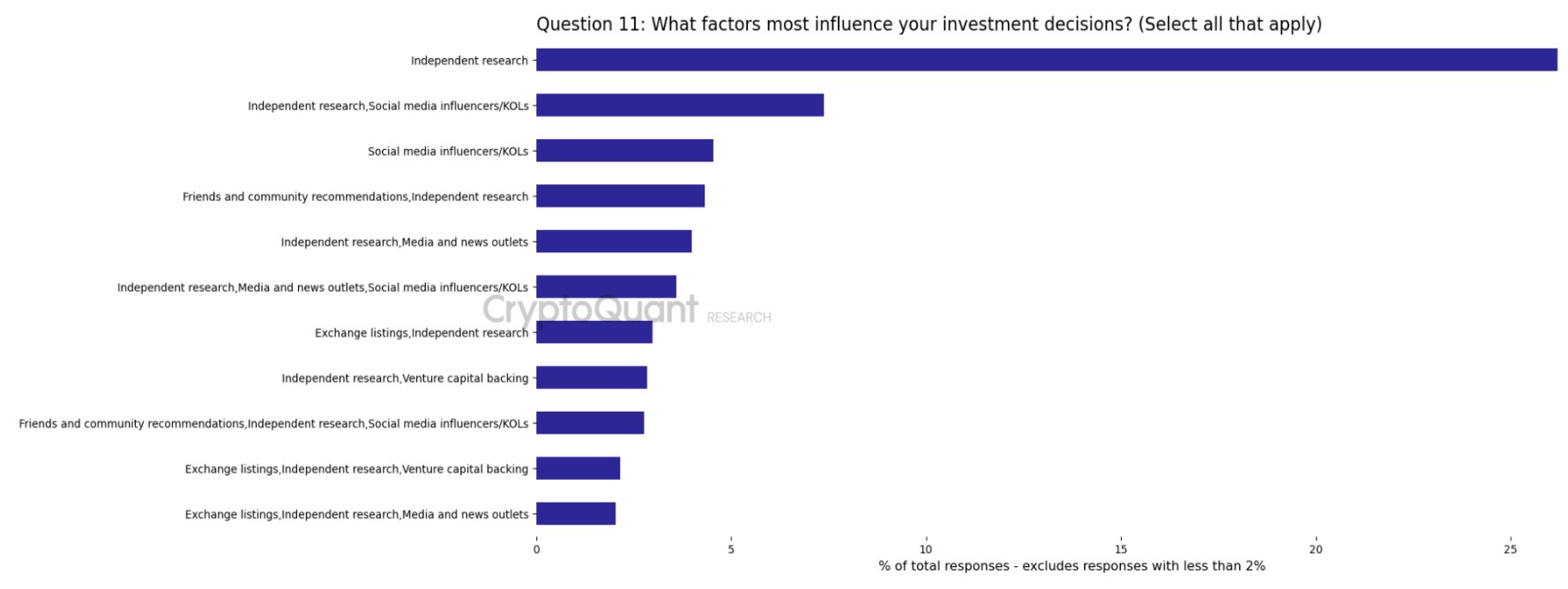

The survey further highlighted the importance of independent research (DYOR) in guiding investment decisions. A majority of users rely on their own research rather than external opinions, emphasizing the value of credible, data-driven insights.

This trend reflects a maturing market where investors prioritize informed decision-making over speculative actions. Looking forward, the report hints at areas ripe for development within the digital currency ecosystem.

The untapped potential of earn products presents an opportunity for exchanges to diversify their offerings. Meanwhile, the growing interest in AI-blockchain integrations could redefine the market, driving new projects and investment opportunities.

Featured image created with DALL-E, Chart from TradingView