XRP, Bitcoin Recovery Only Short-Lived? TD Sequential May Suggest So

An analyst has revealed how XRP and Bitcoin are among the cryptocurrencies seeing a sell signal on the Tom Demark (TD) Sequential after the market recovery.

XRP & Bitcoin Among Coins Seeing TD Sequential Sell Signal

In a new post on X, analyst Ali Martinez has talked about the TD Sequential pattern that four top assets in the sector have formed recently. The “TD Sequential” refers to an indicator from technical analysis (TA) that’s used for locating probable points of reversal in any asset’s price.

The indicator involves two phases: the setup and countdown. During the first of these, candles of the same color in the cryptocurrency’s chart are counted up to nine. These candles don’t have to be one after the other.

Once the candles are in, the coin may be considered to have arrived at a spot of reversal. Naturally, this would suggest a shift to a downtrend if green candles completed the setup and that to the upside in case of red ones.

As soon as the setup is done, the second phase, the countdown, begins. There isn’t anything different about how the countdown works, except for the fact that here thirteen candles are counted, not nine. This phase’s finish, too, can be assumed to coincide with a likely turnaround in the asset.

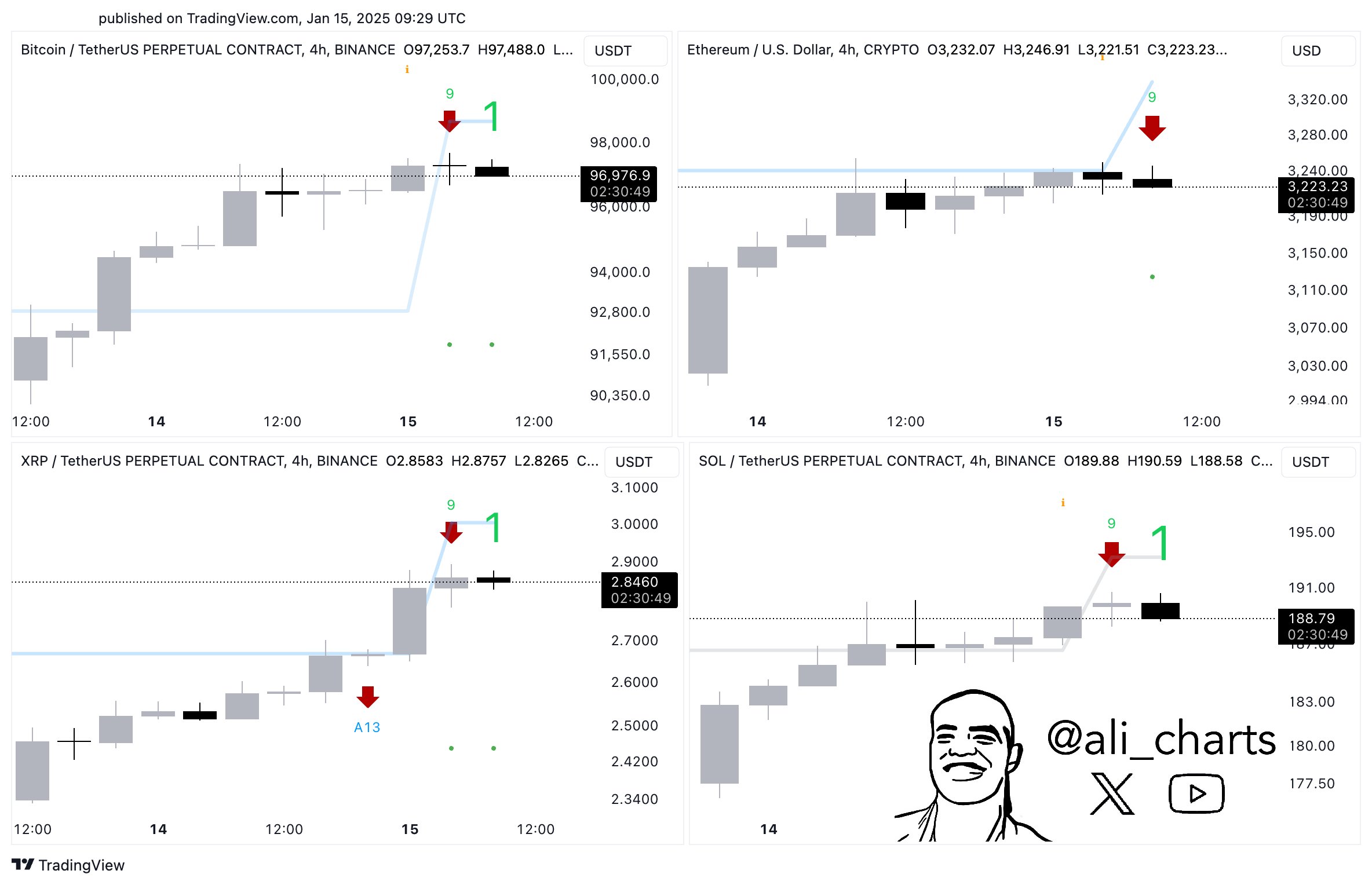

Four cryptocurrencies, Bitcoin (BTC), Ethereum (ETH), XRP (XRP), and Solana (SOL) have completed a TD Sequential phase of the former type on their 4-hour prices recently. Here are the charts shared by the analyst that shows the trend leading up to this signal:

As is visible in the above graphs, all of these assets have just finished a TD Sequential setup with nine green candles. These candles have corresponded to the recovery that the coins have enjoyed during the last couple of days.

Considering what such a TD Sequential setup implies, though, this uptrend may not be here to stay for the cryptocurrency market. So far, XRP, Bitcoin, and the others have continued to rise despite this signal, but it remains to be seen how long the trend would last.

In some other news, whale activity on the XRP network has witnessed an increase recently, as Martinez has pointed out in another X post.

The chart shows the data for the “Whale Transaction Count” metric from the on-chain analytics firm Santiment. This indicator keeps track of the total amount of transfers taking place on the XRP network that are carrying a value of more than $1 million.

The metric has seen a jump during the last couple of days and has hit a value of 341. This implies the whales are making a high number of moves on the blockchain right now.

XRP Price

At the time of writing, XRP is floating around $2.95, up more than 15% over the last 24 hours.