Ethereum, XRP and AI tokens rally alongside Bitcoin, fuel hopes for Trump rally

- Ethereum, XRP and Artificial Intelligence tokens NEAR, Internet Computer and Render are rallying on Wednesday.

- Bitcoin eyes return to $100,000 milestone, fueling optimism among crypto traders as market gears for Donald Trump’s inauguration.

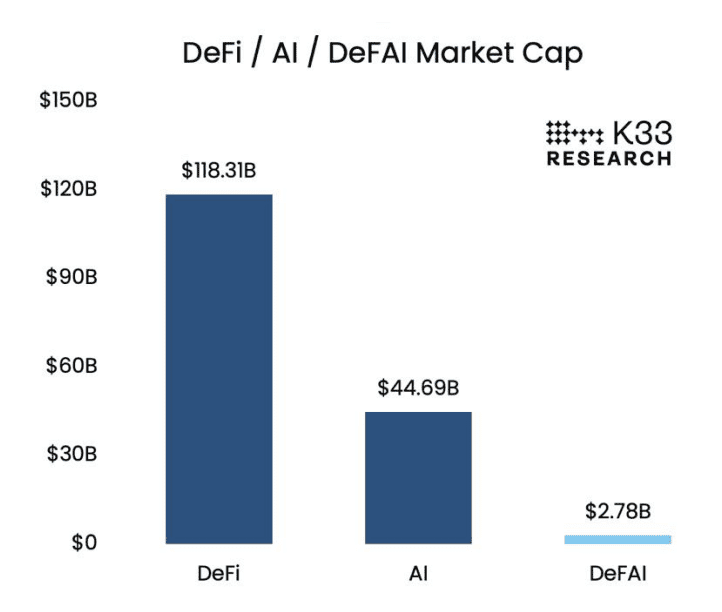

- Experts at K33 research compare the AI token narrative to the DeFi summer of 2020 and identify DeFAI as a promising sector in 2025.

Bitcoin (BTC) eyes a return to the $100,000 level, catalyzing a rally among top altcoins and the Artificial Intelligence (AI) category of tokens. The crypto market capitalization increased over 2% in the last 24 hours, CoinGecko data shows.

Ethereum (ETH) rallied 4% on Wednesday, alongside XRP’s nearly 9% gain at the time of writing. The top three tokens from the AI category, Near Protocol (NEAR), Internet Computer Protocol (ICP) and Render (RNDR) yielded positive returns for traders on Wednesday.

Ethereum, XRP and AI tokens to watch for Trump rally

President-elect Donald Trump’s inauguration is a key event for crypto traders since the incoming President is labeled the first “Crypto President.” Bitcoin broke above the $70,000 resistance on election day and rallied to its new all-time high above $108,000, in what is being referred to as the “Trump effect.”

As Bitcoin looks to return to the $100,000 milestone, there is widespread optimism among crypto traders. Ethereum, XRP, NEAR, ICP and RNDR lead the altcoin rally with gains on Wednesday.

The AI token category is gaining relevance with the emergence of a new narrative, DeFAI. Tokens and protocols positioned in the DeFi sector that are building AI capabilities or utility in their projects are part of this narrative.

Analysts at K33 research discussed the emergence of the DeFAI sector in their latest report titled DeFAI: When DeFi meets AI, which was published early on Wednesday.

DeFi, AI and DeFAI market capitalization | Source: K33 Research

NEAR, ICP and RNDR gained between 4% and 6% on Wednesday, on Binance.

In a nod to the Crypto AI and DeFAI narrative, Bobby Ong, COO and co-founder of CoinGecko, told FXStreet:

“2024 was a testament to the meaningful progress crypto has made in achieving TradFi and institutional recognition. On the other hand, on-chain activity also gathered momentum amid heated competition amongst different blockchain ecosystems for users and developers, with memecoins and Crypto x AI dominating discourse.”

“After the past few challenging years, we look forward to the continued bull market in 2025!,” he added.