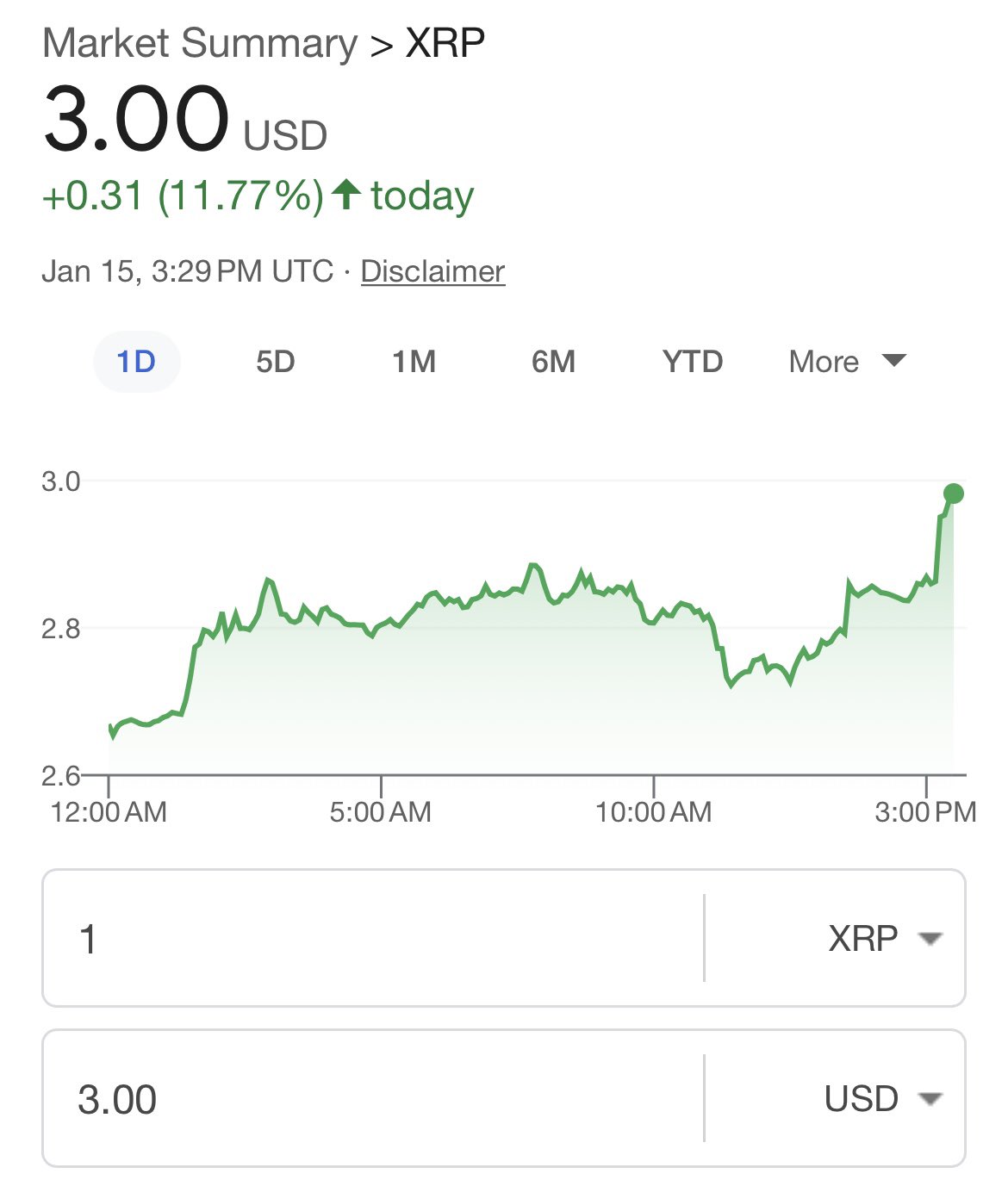

XRP surged past $3 for the first time since 2018

XRP momentarily smashed through the $3 barrier today, a dramatic comeback not seen since early 2018. Though it quickly corrected back to $2.97. The crypto, often at the center of legal and regulatory drama, surged by more than 31% in just the first two weeks of the year.

XRP’s trading volume exploded, climbing 141% in a single day as traders and investors swarmed in. Analysts linked the surge to rising optimism about Ripple’s ongoing legal battles with the SEC and whispers of regulatory clarity under the incoming Trump administration.

Ripple vs. the SEC heats up

The SEC declined Ripple’s request to delay its appeal filing deadline, leaving Ripple’s legal team—led by CEO Brad Garlinghouse and Chief Legal Officer Stuart Alderoty—calling out the regulator’s hardball tactics.

Alderoty vented his frustrations on X (formerly Twitter), pointing to the SEC’s refusal as just another chapter in the legal nightmare Ripple has been dealing with since 2020. Back then, the SEC sued Ripple, accusing it of selling XRP as an unregistered security.

In 2023, Ripple scored a partial win when a judge ruled that XRP sales to retail investors didn’t violate securities laws. However, the court found that institutional sales were a different story.

Now, as Gary Gensler prepares to leave office, he seems determined to fire one last shot at Ripple, refusing to budge on his stance that XRP is a security.

“Bitcoin is not a security,” Gensler reiterated in a recent interview. But he made it clear he thinks most other tokens, including XRP, operate in a speculative market that doesn’t follow the rules.

With a crypto-friendly administration about to take over in Washington, optimism around regulatory changes is high. Ripple’s legal troubles may not be over, but the momentum is undeniable.

Land a High-Paying Web3 Job in 90 Days: The Ultimate Roadmap