Litecoin Price Prediction: LTC whales demand surges 42% as Trump’s upcoming inauguration fuels altcoin rally

- Litecoin price trades above $102 on Wednesday, up 10% from the weekly low of $92.5 recorded on Monday.

- Whale transactions on the Litecoin blockchain network increased by 42% to reach 3,870 on Monday.

- LTC stands the risk of a prolonged consolidation phase as market volumes decline signals buyers unwilling to commit to large positions.

Litecoin trades above $102 on Wednesday, up 10% from its weekly low of $92.5 recorded on Monday. On-chain data shows whale investors buying large amounts of LTC as market sentiment flipped bullish on Monday. Will this propel the LTC price above the $120 level?

Litecoin retakes the $100 mark as crypto traders anticipate Trump impact

Litecoin (LTC) price rallied above the $100 mark as traders position for potential market-shaking events tied to Donald Trump’s upcoming inauguration.

The broader crypto market has shown volatility this month, driven by an uncertain macroeconomic backdrop.

However, sentiment shifted bullish on Monday as investors focused on Trump’s return to power.

Since Monday’s rebound, Litecoin has gained over 10.6%, climbing from a weekly low of $92.5 to trade at $103 at press time on Wednesday.

The altcoin’s momentum is partly fueled by speculation surrounding regulatory developments expected under the Trump administration.

Litecoin price action | LTCUSDT

Litecoin price action | LTCUSDT

Litecoin, along XRP and ADA, is seen as a key beneficiary of a potential crypto-friendly landscape mooted by Trump.

One of the critical points of optimism is the likelihood of an LTC ETF approval.

With Gary Gensler’s exit as Securities and Exchange Commission (SEC) Chair and pro-crypto Paul Atkins stepping in, the regulatory environment appears more favorable.

Notably, investment firm Canary Capital filed an S-1 registration with the US SEC in October.

With Trump’s inauguration less than a week away, discussions surrounding altcoin ETFs have intensified this week, driving additional demand for LTC.

LTC whales demand surges 42% in 24 hours

Litecoin’s 10% surge within the weekly timeframe has been linked to market reaction to external factors.

However, on-chain data trends show that LTC also received considerable buying pressure from whale investors within the Litecoin network, which propelled prices above the critical $100 mark.

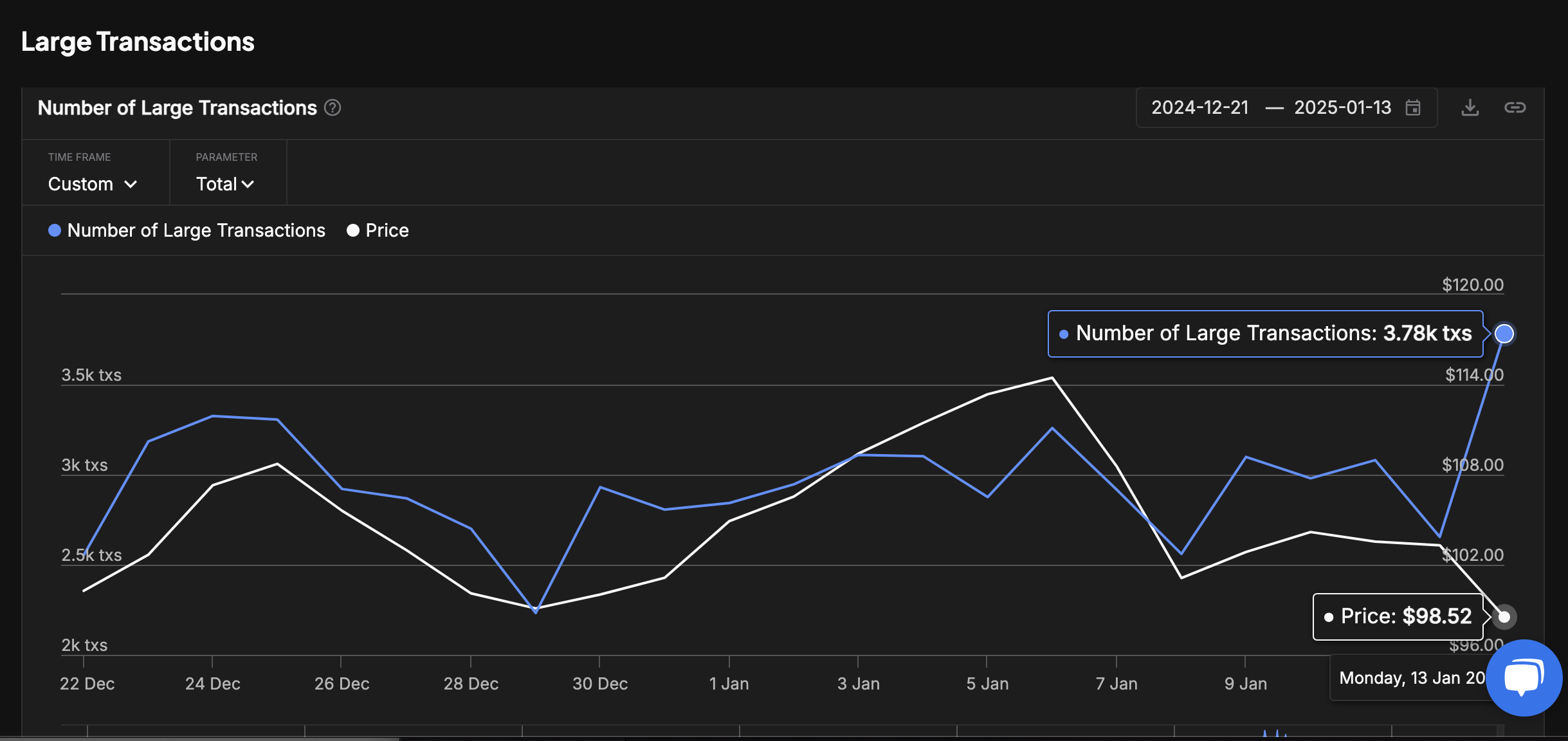

Confirming this narrative, IntoTheblock’s Whale Transactions count tracks the daily number of transactions exceeding $100,000 in value.

This helps provide real-time insights into swings in whale investors' current trading sentiment.

Litecoin Whale Transactions vs LTC price

Litecoin Whale Transactions vs LTC price

On-chain data from IntoTheBlock reveals that transactions exceeding $100,000 rose from 2,660 on Sunday to 3,780 on Tuesday.

This 42% increase in whales demand coincides with LTC’s breakout above the critical $100 level as broader market sentiment turned bullish on Monday.

The spike in whale transactions highlights strategic accumulation by large investors, absorbing excess market supply and bolstering overall market sentiment.

This pattern strengthens the bullish outlook for LTC, with whale-driven demand often serving as a precursor to sustained price growth.

Litecoin Price Forecast: Buyer indecision could trigger a $95 reversal

Litecoin's daily chart reveals a precarious balance between bullish and bearish pressures as market participants exhibit caution.

The Bollinger Bands are narrowing, with the upper band at $114.25 and the lower band at $94.40, signaling reduced volatility.

Litecoin’s price is consolidating around $102.06, below the midline of the Bollinger Bands at $104.32, indicating bearish dominance in the short term.

Declining trading volumes further suggest buyers are hesitant to commit to large positions, increasing the risk of prolonged sideways movement.

Litecoin Price Forecast | LTCUSDT

Litecoin Price Forecast | LTCUSDT

The Relative Strength Index (RSI) at 46.19 underscores weak bullish momentum, with its failure to cross the 50-neutral line reinforcing the narrative of market indecision.

Despite a $90 million surge in open interest, the volume data from the chart points to a lack of conviction among buyers to sustain upward momentum.

If market sentiment remains subdued, Litecoin risks retracing toward the $95 support level, as buyers remain sidelined.

Conversely, a surge in buying pressure could drive Litecoin above the Bollinger Band midline at $104.32, targeting the $114.25 resistance.

However, without a significant volume surge, such a breakout attempt would likely face rejection.