Crypto Today: BTC taps $97K, DOGE and XRP in green as SEC sues Musk ahead of Trump Inauguration

- The cryptocurrency sector rose by 2.4% on January 14, with the aggregate market capitalization crossing $3.3 trillion .

- Bitcoin price reclaimed the $97,000 resistance level, with technicals signaling upside ahead.

- Trump-linked tokens, including DOGE, XRP, and MAGA raced up the top gainers list ahead of the January 20 inauguration.

Bitcoin Market Updates: BTC surges past $97K as trader place Trump bets

Bitcoin (BTC) price rose as high as $97,371 on Tuesday, as investors switched focus to Trump’s upcoming inauguration slated for January 20. By breaching the $97,000 resistance for the first time within the weekly time frame.

Bitcoin Price Action (BTCUSDT), January 13 | Source: Coinglass

Bitcoin price experienced a significant surge in market volumes as it breached the $97,000 support on Tuesday signaling that bull traders are firmly in control of the short-term market sentiment.

Altcoin market updates: Layer-2 demand drives ETH; Cardano recovers last week’s gains

The global cryptocurrency market remained steady on Monday, with Bitcoin (BTC) holding near $96,600.

However, altcoins displayed a mix of trends, with some posting notable gains while others struggled under selling pressure. Here’s a closer look at 24-hour price movements.

Crypto Market Performance Overview, January 14 2025 | Source: CoinmarketCap

Key Altcoin Price Movements

Ethereum (ETH)

Ethereum price saw a 3% rise over the past 24 hours, trading at $3,224. With a 24-hour volume of $22.5 billion, ETH remains a strong performer among top altcoins. The recent surge comes as institutional demand for Ethereum staking and Layer 2 solutions continues to grow, providing bullish momentum despite its 4.6% weekly decline.

Binance Coin (BNB)

BNB, Binance’s native token, edged up 1.7% in the past 24 hours to trade at $699.60. Positive sentiment surrounding Binance's ecosystem developments and its push for regulatory clarity in major markets have helped stabilize BNB, even as broader altcoin sentiment remains cautious.

Dogecoin (DOGE)

Dogecoin recorded a 5.7% gain over the last 24 hours, climbing to $0.3558.

This price action follows a $570 million surge in open interest, signaling increased speculative activity. DOGE remains a focus for traders anticipating a breakout above $0.40 ahead of Trump’s inauguration.

Solana (SOL)

Solana saw a modest 2.9% increase over the past 24 hours, trading at $187.55.

While SOL’s weekly performance remains negative, the 24-hour gain suggests renewed confidence, likely driven by increasing user adoption driven by the rising popularity of AI Agent memecoins like Pudgy Penguins and Ai6z both of which also scored double digit gains within the daily timeframe.

Cardano (ADA)

Cardano outperformed expectations, rising 6.3% in 24 hours to trade at $0.9991.

Notably Cardano had emerged the best performing top 20 ranked assets last week. ADA’s remarkable performance on Tuesday gains reflect renewed interest as market sentiment flipped positive.

The 24-hour analysis highlights a clear divergence among altcoins, with selective gains driven by ecosystem-specific catalyst

Chart of the Day: Trump-linked PolitiFi Tokens Attracting Investor Attention

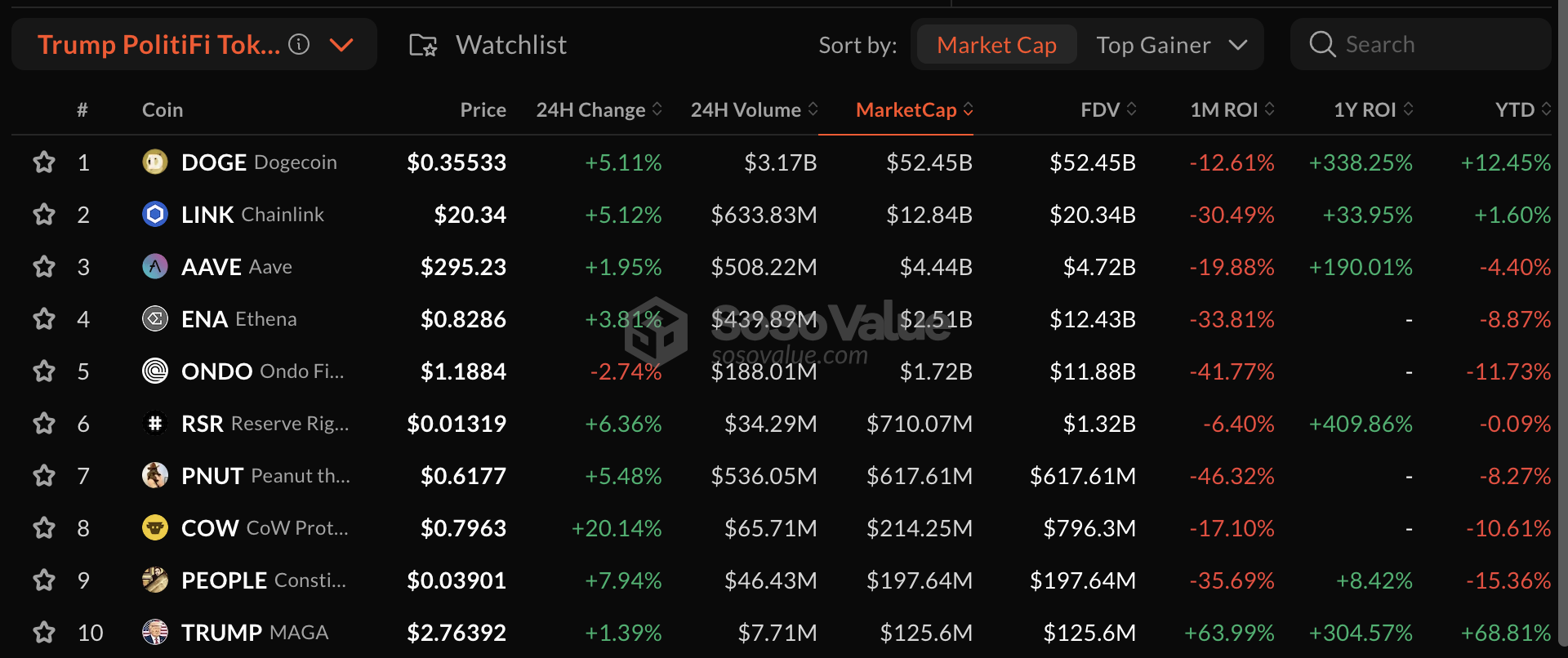

PolitiFi tokens, a niche category representing politically affiliated cryptocurrencies, are sparking interest among investors, giving Donald Trump’sl heavy engagement with the crypto sector during his presidential campaigns.

With the inauguration now only a week away, investors are closely monitoring PolitiFi tokens. These assets include prominent names like Trump MAGA ($TRUMP), which gained 1.39% in the past 24 hours, and ConstitutionDAO’s PEOPLE token, up 7.94%. While not exclusively tied to Trump, they benefit from the broader speculative rally within the sector.

Trump Politifi Sector Performance, January 14 2025 | Source: SosoValue

Trump Politifi Sector Performance, January 14 2025 | Source: SosoValue

DOGE led PolitiFi-related mega-cap assets, rising 5.11% to $0.35533, likely driven by its historical association with Elon Musk, billed to learn the aptly named D.O.G.E department. Chainlink (LINK) also surged 5.12% to $20.34, reflecting its foundational role in decentralized infrastructure. However, Ondo Finance (ONDO) bucked the trend, slipping 2.74%, signaling selective investor interest

Crypto News Updates:

- SEC Sues Elon Musk Over Alleged Securities Law Violations

The U.S. Securities and Exchange Commission (SEC) has filed a lawsuit against Elon Musk, alleging that he failed to disclose his purchase of more than 5% of Twitter (now X) shares within the legally required timeframe.

The SEC claims Musk’s delayed disclosure allowed him to purchase additional shares at artificially low prices, potentially underpaying by at least $150 million. The agency is seeking disgorgement of ill-gotten gains, a civil penalty, and a permanent injunction against future securities law violations.

“This is an admission that the SEC cannot bring an actual case because Musk has done nothing wrong and everyone sees this sham for what it is.”

- Elon Musk’s Lawyer, Alex Spiro.

Musk completed his $44 billion acquisition of Twitter in October 2022, and the SEC alleges his failure to disclose his stake harmed investors who sold shares at undervalued prices between March 25 and April 1, 2022.

- CFTC Investigates Crypto.com’s Super Bowl Derivatives Trading

The Commodity Futures Trading Commission (CFTC) is investigating Crypto.com’s derivatives contracts tied to the Super Bowl and other sporting events to ensure compliance with federal regulations.

The contracts, launched on December 23, may potentially violate gaming laws, prompting the CFTC to request a trading suspension while the review is underway.

Crypto.com has declined to halt trading, citing federal court precedents and maintaining that its operations adhere to legal standards.

The company has pledged to cooperate with the CFTC while continuing to support derivatives trading across all U.S. states.

- Metaplanet Debuts Bitcoin Magazine Japan to Drive Adoption

Metaplanet Inc. has launched Bitcoin Magazine Japan, a dedicated platform to promote Bitcoin awareness and adoption among Japanese citizens. The initiative aims to onboard one million individuals by offering educational resources and fostering discussions on Bitcoin's potential benefits, particularly in addressing Japan’s economic challenges like deflation and low-yield investments.