Kin price prediction 2025-2031: Will KIN recover?

Key takeaways

- Our KIN predictions anticipate a high of $0.000024 by the end of 2025.

- In 2028, it will range between $0.000060 and $0.000074, with an average price of $0.000062.

- In 2031, it will range between $0.000190 and $0.000228, with an average price of $0.000197.

Kin is a decentralized cryptocurrency designed to facilitate global transactions without intermediaries. Launched in 2017 by Kik Interactive and originally hosted on the Ethereum blockchain, Kin migrated to the Solana blockchain in 2020 to leverage its high scalability and low transaction costs. This migration has positioned Kin (KIN) as a viable medium for micropayments across various platforms, supporting a burgeoning economy of apps, games, and online services.

Currently, KIN is significantly below its ATH, raising questions among investors such as: Can KIN reach $0.001? Will KIN recapture its ATH? How high can KIN go in 2025?

Let’s get into the KIN technical analysis and price predictions.

Overview

| Cryptocurrency | Kin |

| Ticker | KIN |

| Current price | $0.00001083 |

| Market cap | $29.86M |

| Trading volume | $213.6K |

| Circulating supply | 2.75T KIN |

| All-time high | $0.001493 (Jan 06, 2018) |

| All-time low | $0.000002355 (Jan 09, 2020) |

| 24-hour low | $0.0000108 |

| 24-hour high | $0.00001163 |

KIN price prediction: Technical analysis

| Metric | Value |

| Volatility (30-day variation) | 6.18% |

| 50-day SMA | $0.0000132 |

| 14-Day RSI | 40.99 |

| 200-day SMA | $0.00001364 |

| Sentiment | Bearish |

| Fear and Greed Index | 61 (Greed) |

| Green days | 14/30 (47%) |

Kin price analysis: Kin price tumbles at $0.0000111

TL;DR Breakdown

- KIN resistance is present at $0.0000112.

- KIN’s immediate support is present at $0.0000107.

- The token has decreased by nearly 1.53% in the last 24 hours.

Kin’s price, reflecting a significant decline from its earlier level of $0.00001128, is currently trading at $0.0000111 as of 14 January. The price faced sharp selling pressure, dipping as low as $0.0000107 before showing signs of recovery. The $0.0000107 level acted as a crucial support zone, providing stability and preventing further drops.

On the upside, the price struggles to break through the $0.0000112 resistance level, indicating limited upward momentum. The narrow trading range between these levels suggests a period of consolidation as the market assesses the next direction for Kin’s price.

KIN/USD 1-day chart: Declining trend with bearish sentiment

The daily chart for Kin shows a gradual decline in its price, currently trading around $0.00001105. The price seems to have encountered resistance around $0.00001200 and support around $0.00001090. The declining trend indicates selling pressure in recent sessions, with relatively low price fluctuations.

The Relative Strength Index (RSI) is at 39.57, showing that Kin is near the oversold zone, which indicates weaker buying interest. The Chaikin Money Flow (CMF) is at -0.18, indicating significant capital outflows. These indicators reflect bearish sentiment and limited momentum in the current market trend.

KIN/USD 4-hour chart: Consolidation within a narrow range

Looking at the 4-hour chart of Kin, the price fluctuates within a narrow range, maintaining a slight upward momentum but remaining near the $0.00001105 mark. The trading volume appears relatively low, indicating muted market activity. The market has shown small increments, reflecting cautious sentiment among participants.

The RSI (14) stands at approximately 43, showing neutral momentum, neither indicating oversold nor overbought conditions. This suggests a balance between buying and selling pressures. The CMF (20) is at -0.25, highlighting negative money flow and reduced capital inflow, pointing to subdued buyer interest. Combined, these indicators suggest consolidation with limited volatility.

Kin technical indicators: Levels and action

Daily simple moving average (SMA)

| Period | Value ($) | Action |

| SMA 3 | 0.00001165 | SELL |

| SMA 5 | 0.00001213 | SELL |

| SMA 10 | 0.00001296 | SELL |

| SMA 21 | 0.00001277 | SELL |

| SMA 50 | 0.00001329 | SELL |

| SMA 100 | 0.00001266 | SELL |

| SMA 200 | 0.00001364 | SELL |

Daily exponential moving average (EMA)

| Period | Value ($) | Action |

| EMA 3 | 0.00001260 | SELL |

| EMA 5 | 0.00001278 | SELL |

| EMA 10 | 0.00001323 | SELL |

| EMA 21 | 0.00001346 | SELL |

| EMA 50 | 0.00001318 | SELL |

| EMA 100 | 0.00001327 | SELL |

| EMA 200 | 0.00001387 | SELL |

What to expect from Kin?

Kin’s price movement shows a period of consolidation with limited volatility, indicating uncertainty in the market direction. The daily chart highlights a gradual decline from previous highs, with prices testing lower support levels. The hourly chart reflects a narrow trading range, suggesting a lack of momentum from buyers or sellers. This overall stagnation points to a cautious market sentiment as Kin struggles to establish a clear trend amidst subdued trading activity.

Is KIN a good investment?

Kin’s transition to the Solana blockchain enhances transaction efficiency and scalability, positioning it well for broader adoption in the digital economy. The settlement with the SEC over a 2017 ICO confirmed Kin’s status as a non-security, providing regulatory clarity and potentially reducing investment risk.

Additionally, Kin’s growing use in various applications and services underscores its practical utility and potential demand. These factors suggest that Kin could be a viable option for investors looking to invest in crypto. However, like all digital assets, KIN is volatile and subject to significant price fluctuations. Investors should consider these risks alongside potential advantages.

Will Kin reach $1?

Predicting whether Kin will reach $1 is highly speculative and depends on numerous factors. Given its current price, achieving $1 would require an astronomical increase, approximately 69,444 times its current value, which is quite doubtful

Will Kin reach $10?

Reaching $10 for Kin is extremely unlikely, requiring an unprecedented increase in market cap.

Will Kin reach $100?

Reaching $100 from its current value would require an astronomical increase, which is highly unlikely given the current trend and typical market dynamics of cryptocurrencies.

Does Kin have a good long-term future?

Kin could potentially have a promising future if it continues to attract users and integrate into various platforms. Analysts forecast its price could reach between $0.000031 by 2025 and $0.000218 by 2030. However, like many similar digital currencies, Kin’s trajectory is unpredictable and will likely be influenced by various factors, such as broader market dynamics and community engagement.

Recent news/opinion on KIN

- CoinGecko adds new categories for the Kin Ecosystem, including Payments and SocialFi

KIN price prediction January 2025

In January 2025, Kin’s price may drop to a minimum of $0.000014. The expected average value might be $0.000015 with a maximum price of $0.000016.

| Month | Potential low ($) | Potential average ($) | Potential high ($) |

| January | 0.000014 | 0.000015 | 0.000016 |

KIN price prediction 2025

The price of KIN could reach a maximum value of $0.000024, an average trading price of $0.000021, and a minimum price of $0.000020.

| Year | Potential low ($) | Potential average ($) | Potential high ($) |

| 2025 | $0.000020 | $0.000021 | $0.000024 |

Kin price predictions 2026-2031

| Year | Minimum ($) | Average ($) | Maximum ($) |

| 2026 | 0.000029 | 0.000031 | 0.000037 |

| 2027 | 0.000040 | 0.000043 | 0.000050 |

| 2028 | 0.000060 | 0.000062 | 0.000074 |

| 2029 | 0.000090 | 0.000092 | 0.000106 |

| 2030 | 0.000131 | 0.000134 | 0.000156 |

| 2031 | 0.000190 | 0.000197 | 0.000228 |

Kin price prediction 2026

The KIN price prediction for 2026 estimates a minimum price of $0.000029. Expert analysis suggests a maximum price of $0.000037 and an average price of $0.000031.

Kin price prediction 2027

In 2026, the price of Kin is predicted to reach a minimum price of $0.000040. Investors can anticipate a maximum price of $0.000050 and an average trading price of $0.000043.

Kin price prediction 2028

Kin token is forecast to reach a minimum price of $0.000060 in 2027. Analysis shows a maximum price of $0.000074 and an average forecast price of $0.000062.

Kin price prediction 2029

In 2029, the price of Kin is predicted to trade at a minimum level of $0.000090, a maximum price of $0.000106, and an average trading price of $0.000092.

Kin price prediction 2030

In 2030, the price of Kin is expected to reach a minimum of $0.000131, a maximum of $0.000156, and an average of $0.000134.

Kin price prediction 2031

The KIN price prediction for 2031 suggests a minimum price of $0.000190 and an average price of $0.000197. The maximum forecasted KIN price is set at $0.000228.

Kin market price prediction: Analyst’s KIN price forecast

| Firm | 2025 | 2026 |

| Digitalcoinprice | $0.0000235 | $0.0000276 |

| Changelly | $0.0000231 | $0.0000294 |

| Gate.io | $0.0000143 | $0.0000147 |

Cryptopolitan’s Kin price prediction

Cryptopolitan’s KIN price predictions propose a somewhat positive outlook for the token’s future price should the market recover soon. According to our expert analysis, if the bulls back the token, KIN might record a maximum price of $0.000024 by the end of 2025 and an average price of $0.000021 in 2025. This is not investment advice. Always do your own research and understand the risks involved before making investment decisions in the cryptocurrency market.

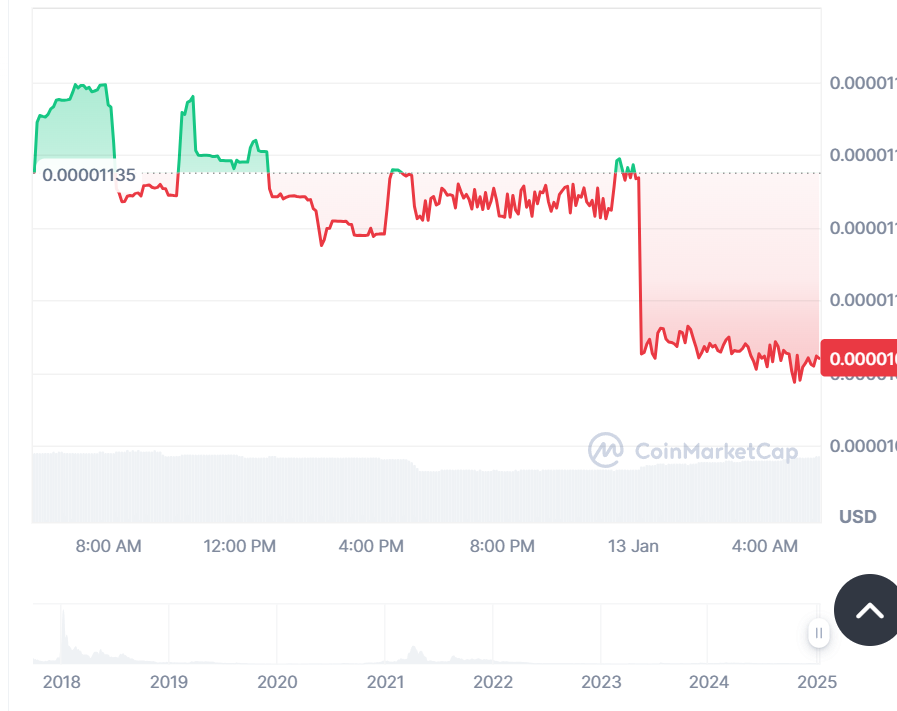

KIN historic price sentiment

- On January 6, 2018, KIN achieved a price rise to its all-time high of $0.001493.

- In early 2018, there was a significant spike, showing the price at approximately $0.0001163

- After the initial spike, the price drops sharply and declines gradually over the next two years. By late 2018, the price had fallen below $0.00005 and continued this downward trend into 2019.

- From 2020 onwards, the price stabilizes at much lower levels, fluctuating slightly but mostly remaining in the range of $0.000001 to $0.00002 on Jan 9. This indicates a period of relative stability, although at a significantly lower value than its initial spike.

- In the bull market of 2021, it managed to reach a high of $0.0004498 before reversing again.

- In 2022, the price started around $0.00001163. Kin experienced minor volatility throughout the year but generally maintained a low and flat price trajectory.

- In 2023, there was a visible continuation of this stability, with the price remaining below $0.000025 for the most part. Towards the end of 2023, KIN dipped to as low as $0.000008 but gained momentum in December, closing the year around $0.000015.

- KIN price movements show a bull run at the start of 2024, touching $0.000028 in February. Subsequently, price reversals followed, and KIN dipped to an average price of $0.00014 on April 30. KIN started the month of July at $0.00001394; currently bearish, the token is trading within the $0.00001288 – $0.00001481 range.

- The price remained largely unchanged, still trading near 0.00001135 USD, reflecting low activity or interest in the market in August 2024.

- A significant drop occurred during December 2024, with the price falling sharply to around $0.000001, indicating heightened selling pressure and lack of demand.

- In January 2025, the price stabilized near $0.000001, maintaining a low value with minimal fluctuations, signaling a weak recovery or continued bearish dominance.